Capital News

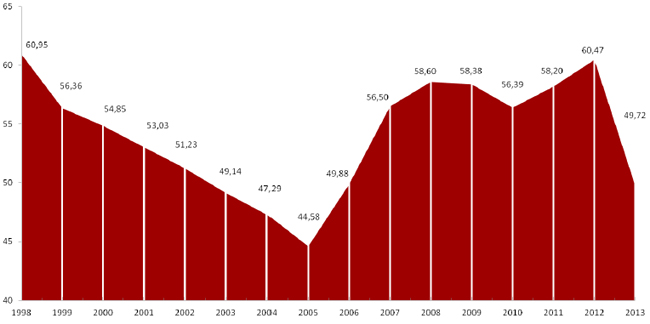

Entwicklung der Kapitalpräsenzen

Durchschnittliche Präsenz DAX®30 (1998-2013)

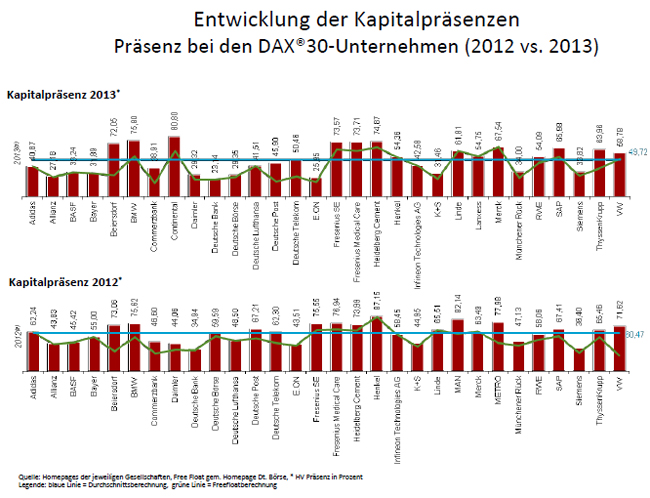

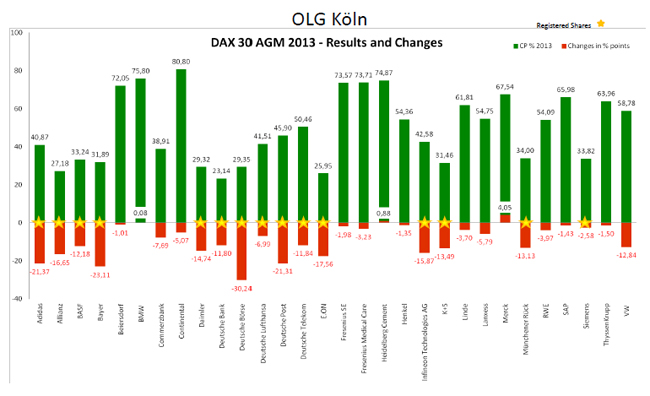

| Company | CP % 2012 | CP % 2013 | Changes in % points |

| Adidas ** | 62,24 | 40,87 | -21,37 |

| Allianz ** | 43,83 | 27,18 | -16,65 |

| BASF ** | 45,42 | 33,24 | -12,18 |

| Bayer ** | 55 | 31,89 | -23,11 |

| Beiersdorf | 73,06 | 72,05 | -1,01 |

| BMW | 75,72 | 75,8 | 0,08 |

| Commerzbank | 46,6 | 38,91 | -7,69 |

| Continental | 85,87 | 80,8 | -5,07 |

| Daimler ** | 44,06 | 29,32 | -14,74 |

| Deutsche Bank ** | 34,94 | 23,14 | -11,8 |

| Deutsche Börse ** | 59,59 | 29,35 | -30,24 |

| Deutsche Lufthansa ** | 48,5 | 41,51 | -6,99 |

| Deutsche Post ** | 67,21 | 45,9 | -21,31 |

| Deutsche Telekom ** | 62,3 | 50,46 | -11,84 |

| E.ON ** | 43,51 | 25,95 | -17,56 |

| Fresenius SE | 75,55 | 73,57 | -1,98 |

| Fresenius Medical Care | 76,94 | 73,71 | -3,23 |

| Heidelberg Cement | 73,99 | 74,87 | 0,88 |

| Henkel | 55,71 | 54,36 | -1,35 |

| Infineon Technologies AG ** | 58,45 | 42,58 | -15,87 |

| K+S ** | 44,95 | 31,46 | -13,49 |

| Linde | 65,51 | 61,81 | -3,7 |

| Lanxess | 60,54 | 54,75 | -5,79 |

| Merck | 63,49 | 67,54 | 4,05 |

| Münchener Rück ** | 47,13 | 34 | -13,13 |

| RWE | 58,06 | 54,09 | -3,97 |

| SAP | 67,41 | 65,98 | -1,43 |

| Siemens ** | 36,4 | 33,82 | -2,58 |

| ThyssenKrupp | 65,46 | 63,96 | -1,5 |

| VW | 71,62 | 58,78 | -12,84 |

| Ø Präsenz DAX30 | 58,97 | 49,72 | -9,25 |

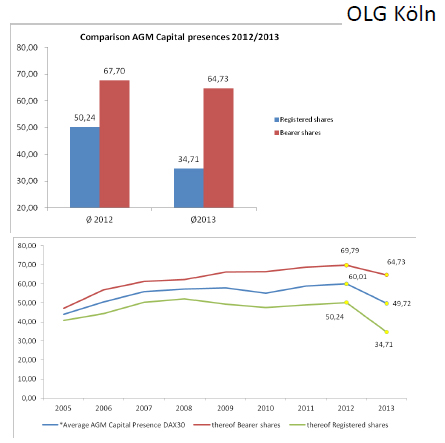

| DAX 30 Class of stocks | Ø 2012 | Ø2013 | Ø Changes in % points |

| Registered shares ** | 50,24 | 34,71 | -15,53 |

| Bearer shares | 67,7 | 64,73 | -2,97 |

<click here> complete version (PDF)

Commerzbank collects 2.5 billion

The Commerzbank has completed its capital increase and is thus gradually buying out the state influence. As planned, the new capital increase flushed 2.5 billion euros into the Frankfurt bank's coffers. Shareholder interest in the new paper was great, despite some significant criticism of the measure, the bank announced. 99.7 percent of the subscription rights were exercised.

The Commerzbank has completed its capital increase and is thus gradually buying out the state influence. As planned, the new capital increase flushed 2.5 billion euros into the Frankfurt bank's coffers. Shareholder interest in the new paper was great, despite some significant criticism of the measure, the bank announced. 99.7 percent of the subscription rights were exercised.

It was a so-called mixed cash/kind capital increase. That had to do with the fact that SoFFin, who owned 25 percent plus one share in Commerzbank, could not or would not put in more money. Accordingly, it placed a portion of its stake on the exchange through a syndicate of banks, without subscription rights. Consequently, the federal share dropped to 15 percent in the first step. But in a second step SoFFin did exercise these subscription rights, by conversion of the silent contribution. Thus, the rescue fund came to a 17 per cent share in Commerzbank again, but gave up the blocking minority whereby decisions can be blocked. But all the other shareholders had to carry out the capital increase in cash. The hard-core capital ratio, i.e. Commerzbank's crisis buffer, improved from 7.5 percent to 8.4 percent, taking into account all the new rules. The successful completion of the capital increase was “the federal government's entry into the phase-out from Commerzbank,” affirmed the bank. To attract investors, the Institute offered the new securities at a discount of about 50 percent to the current share price. Yet to come to the projected proceeds of 2.5 billion euros, the bank announced on 14 May it would nearly double the number of shares. Thus, the shares of the existing shareholders were diluted even more than expected. To avoid the risk of drifting into a penny stock-existence, Commerzbank had, finally, merged the shares at a ratio of ten to one. The rate heavily diluted by various capital increases was thus made ten times higher. The shareholders had until midnight on 15 May to decide whether to go along or not. With the fresh money Commerzbank wipes out the remaining direct government assistance from the financial crisis (€1.6 billion) and the Allianz silent participation (€750 million).

The finance committee of the Bundestag had already on 15 May held unscheduled discussions of the DAX Group's capital increase. The federal government should, it was said, take a stance on the question of short-selling of Commerzbank shares in the context of the capital increase and the role of hedge funds. The stock had “become a playground for hedge funds”, which was why the share price could fluctuate more in the short term. A portion of the hedge funds allegedly bet on rising prices. A second group was betting on falling prices, through short-selling. They had borrowed Commerzbank shares in advance, immediately sold them again and wanted to stock up on them again cheaper now in the capital increase.

Wallenborn: New wind bond

Wallenborn Adria Wind is to issue a corporate bond of 80 million euros to refinance a Croatian wind farm. The bond is according to the Dresden-based company to be secured with wind turbines in the park, through an independent trustee. The paper is to be traded after issue on the Munich Stock Exchange, but the release date is not yet known.

The wind farm, which has already been on the grid for two years, is located on the Adriatic coast near the town of Senj and has a capacity of 42 megawatts. Its location is so favourable that it gets many more full-load hours than German parks.