VIPsight - December 2011

COMPANIES

Greek bonds put a damper on quarterly balance-sheets

Chancellor Angela Merkel and French President Nicolas Sarkozy managed at the G20 summit to wring an average 50 percent haircut on Greek government bonds out of the European banks. The bill for the banks’ consent fell due in November; Germany’s number two, Commerzbank, alone had to write 798 million euros off its Greek government bonds in the third quarter, bringing quarterly earnings down to minus 687 million euros. Having written off 760 million euros in the second quarter, the bank has written off a total of 52 percent of the nominal value of its Greek positions in the year 2011 to date. Despite the losses, the Frankfurt bank’s management will not claim State aid again, even if new business has to be temporarily stopped to minimize balance-sheet risks and release capital. The industry leader Deutsche Bank estimates the value depreciation of its Greek bonds in the third quarter at 228 million euros. Deutsche Postbank had in the entire year to date to make adjustments to its Greek papers in the amount of 527 million euros, 341 million in the third quarter alone, meaning they have been written down to 42 percent of their nominal value. Insurers are also affected by the haircut: while Hanover Re got rid of Greek government bonds early and thus avoided losses, even there, as at Munich Re, investment results suffered as a result of declining prices. Allianz had to write off €198 million on Greek bonds, putting them now at 39 percent of nominal value on the Munich firm’s books. The analysis group Open Europe estimates the value of outstanding Greek government bonds in circulation at 355 billion euros. €127 billion of this are held by the European Union, the International Monetary Fund and the ECB. European banks have around €80 billion on their books. The Bundesbank estimates outstanding debt owed German banks in Greece at 28 billion euros. After the haircut, the EU banking authority EBA expects the 70 largest European banks to have a capital requirement of €106 billion, to reach the core-capital ratio of nine percent set by resolution. Four German banks alone are five billion euros short.

Chancellor Angela Merkel and French President Nicolas Sarkozy managed at the G20 summit to wring an average 50 percent haircut on Greek government bonds out of the European banks. The bill for the banks’ consent fell due in November; Germany’s number two, Commerzbank, alone had to write 798 million euros off its Greek government bonds in the third quarter, bringing quarterly earnings down to minus 687 million euros. Having written off 760 million euros in the second quarter, the bank has written off a total of 52 percent of the nominal value of its Greek positions in the year 2011 to date. Despite the losses, the Frankfurt bank’s management will not claim State aid again, even if new business has to be temporarily stopped to minimize balance-sheet risks and release capital. The industry leader Deutsche Bank estimates the value depreciation of its Greek bonds in the third quarter at 228 million euros. Deutsche Postbank had in the entire year to date to make adjustments to its Greek papers in the amount of 527 million euros, 341 million in the third quarter alone, meaning they have been written down to 42 percent of their nominal value. Insurers are also affected by the haircut: while Hanover Re got rid of Greek government bonds early and thus avoided losses, even there, as at Munich Re, investment results suffered as a result of declining prices. Allianz had to write off €198 million on Greek bonds, putting them now at 39 percent of nominal value on the Munich firm’s books. The analysis group Open Europe estimates the value of outstanding Greek government bonds in circulation at 355 billion euros. €127 billion of this are held by the European Union, the International Monetary Fund and the ECB. European banks have around €80 billion on their books. The Bundesbank estimates outstanding debt owed German banks in Greece at 28 billion euros. After the haircut, the EU banking authority EBA expects the 70 largest European banks to have a capital requirement of €106 billion, to reach the core-capital ratio of nine percent set by resolution. Four German banks alone are five billion euros short.

Commerzbank bank swallows Schiffsbank

Commerzbank will now take over HypoVereinsbank subsidiary Deutsche Schiffsbank fully and integrate it into the corporate group, meaning the bank will lose its traditional name. For the remaining 7.9 percent of the Schiffsbank shares, the Frankfurt bank will according to Financial Times Deutschland pay slightly less than the book value of €70 million. The Schiffsbank equity is 930 million euros. Commerzbank expects savings in the tens of millions.

Commerzbank will now take over HypoVereinsbank subsidiary Deutsche Schiffsbank fully and integrate it into the corporate group, meaning the bank will lose its traditional name. For the remaining 7.9 percent of the Schiffsbank shares, the Frankfurt bank will according to Financial Times Deutschland pay slightly less than the book value of €70 million. The Schiffsbank equity is 930 million euros. Commerzbank expects savings in the tens of millions.

Permira gets rid of Hugo Boss preference shares

Permira subsidiary Red & Black Holding sold around 4.5 million preference shares in fashion group Hugo Boss to institutional investors in mid-November as part of an accelerated bookbuilding process. Financial Times Deutschland speaks of a sales volume of 307 million euros, with which private-equity firm Permira wants to pay off debt. Permira still holds about 88 percent of the voting rights in the suit tailor, and has denied to Financial Times Deutschland that it is trying to cut its involvement in the fashion group Hugo Boss entirely. The total of 66 percent of the shares Permira holds even after the sale have however a lock-up period of only six months. Permira still has some 14.6 million preference shares and 31.6 million common shares. The sale raised the free float of the preference shares to around 57 percent, which will increase both the attractiveness of the stock and its weighting in the MDAX.

Lufthansa subsidiary BMI flies off

Lufthansa German Airlines is getting rid of its problem subsidiary British Midland Ltd. (BMI). In early November, Germany’s largest airline signed an agreement in principle with British Airways’ and Iberia’s parent International Consolidated Airlines Group SA (IAG) on a takeover of BMI. The partners want to sign the purchase agreement in the coming weeks. The requirements for the transaction to be completed by the first quarter of 2012 are a due-diligence review and antitrust clearance. BMI is active particularly in the UK market and has made a loss of €154 million between January and September on a turnover of €658 million.

Lufthansa German Airlines is getting rid of its problem subsidiary British Midland Ltd. (BMI). In early November, Germany’s largest airline signed an agreement in principle with British Airways’ and Iberia’s parent International Consolidated Airlines Group SA (IAG) on a takeover of BMI. The partners want to sign the purchase agreement in the coming weeks. The requirements for the transaction to be completed by the first quarter of 2012 are a due-diligence review and antitrust clearance. BMI is active particularly in the UK market and has made a loss of €154 million between January and September on a turnover of €658 million.

Corruption watchdog Waigel to go in 2012

It is now five years since the Siemens Munich headquarters was raided on suspicion of corruption. The system of corruption has so far cost the conglomerate more than two billion euros in fines, tax payments and refurbishment costs. Because Siemens was then also listed in the U.S. and had violated exchange rules, the U.S. Securities and Exchange Commission and the U.S. Treasury three years ago called in ex Finance Minister Theo Waigel to monitor corruption at Siemens. As long arm of the U.S. regulatory authorities, Waigel there monitors compliance with relevant rules, initially listing for the U.S. authorities around 200 points in need of improvement. This list eventually shrank to nine points. Waigel has now announced in mid-November to business journalists in Munich that he would resign from his job as compliance monitor in mid 2012 - provided the U.S. gives its approval.

ThyssenKrupp takes a dive

After news magazine Der Spiegel exposed steel group ThyssenKrupp’s connections to a South Korean trade representative as questionable, the Essen steel giant said it would terminate cooperation with industrial service provider Ferrostaal on the sale of submarines. Financial Times Deutschland reports that negotiations to that effect are currently under way. ThyssenKrupp and Ferrostaal had sold submarines through joint venture Marine Force International (MFI), including to South Korea.

After news magazine Der Spiegel exposed steel group ThyssenKrupp’s connections to a South Korean trade representative as questionable, the Essen steel giant said it would terminate cooperation with industrial service provider Ferrostaal on the sale of submarines. Financial Times Deutschland reports that negotiations to that effect are currently under way. ThyssenKrupp and Ferrostaal had sold submarines through joint venture Marine Force International (MFI), including to South Korea.

Cevian is the new anchor shareholder at Bilfinger Berger

A few months after the change of CEO, Bilfinger Berger has after many years a new major shareholder again. Cevian is taking over 12.6 percent of the shares, becoming the largest shareholder in the Mannheim-based services and construction group. The financial investor said an increase in the holding is not currently excluded, but they plan no takeover. The share of the fund, specialized in acquisitions of minority interests in listed companies, will not exceed 30 percent. Cevian in summer got out of Demag Cranes, now after a takeover bid majority owned by competitor Terex.

A few months after the change of CEO, Bilfinger Berger has after many years a new major shareholder again. Cevian is taking over 12.6 percent of the shares, becoming the largest shareholder in the Mannheim-based services and construction group. The financial investor said an increase in the holding is not currently excluded, but they plan no takeover. The share of the fund, specialized in acquisitions of minority interests in listed companies, will not exceed 30 percent. Cevian in summer got out of Demag Cranes, now after a takeover bid majority owned by competitor Terex.

Exchange merger slows innovation

The EU Commission’s concerns about the planned merger of Deutsche Börse and NYSE Euronext are according to a Börsenzeitung press report more serious than previously known. The Commission has therefore sent a new questionnaire on the stock-exchange merger. Both exchange operators are to take a stand on the 75 questions contained in the document. About two thirds of the questionnaire relate to the access offered to Eurex Clearing. The authority fears that after the merger competition would be eliminated just here, likely leading to higher fees and less innovation. In the so-called “Statement of Objections,” which was not previously published, the EU Commission compiled its concerns. The deadline for completion of the procedure was lengthened by a further 15 working days. The decision on the approval of the merger will therefore not be taken this year. The last date for the completion of the procedure is 23 January 2012.

KfW acquires 7.5 percent stake in EADS

The government’s entry to the European Aeronautic Defence and Space Company (EADS) is sealed. Daimler intends to conclude a memorandum of understanding on the transaction with the Kreditantalt für Wiederaufbau (KfW) before the end of the year, the carmaker announced on 10 November in Stuttgart. In July 2012, the State development bank is to acquire a 7.5 percent stake in the European aerospace and defence group from the Stuttgart carmaker. The Federal Economics Ministry also confirmed the reports. Daimler holds a total fifteen percent stake in EADS. Germany’s Economics Minister Philipp Rösler based the purchase on the “strategic importance” of the Franco-German joint venture.

MAN, VW subsidiary

The last of the relevant international antitrust authorities, the Chinese competition watchdogs, have now cleared the way for Volkswagen to increase its share in MAN. The transaction was completed on 9 November. The Wolfsburgers now hold 55.9 percent of the truck maker. Closer cooperation between MAN, Scania and Volkswagen should bring about substantial cost savings in purchasing and in development and production. The decision by the Chinese authorities had been widely expected. Brussels in September also had no concerns, and waved the merger through without conditions.

METRO is sticking to REAL

METRO has stopped the sale of REAL for now. A spokesman told Financial Times Deutschland the company had indeed had talks in recent months with several interested parties for the supermarket chain, and tested options for sales and partnerships. Because of the imminent replacement of Eckhard Cordes, however, the plans would currently not be pursued further. The last remaining bid, from British firm Apax Partners, had also not been attractive enough. Nor was METRO under time pressure in the sale of department-store chain Kaufhof.

METRO has stopped the sale of REAL for now. A spokesman told Financial Times Deutschland the company had indeed had talks in recent months with several interested parties for the supermarket chain, and tested options for sales and partnerships. Because of the imminent replacement of Eckhard Cordes, however, the plans would currently not be pursued further. The last remaining bid, from British firm Apax Partners, had also not been attractive enough. Nor was METRO under time pressure in the sale of department-store chain Kaufhof.

Buhlmann's Corner

One year like that is enough!

It’s a a very strange 2011 we are about to leave. Just a few weeks or months come between gilt-edged and a 50-percent haircut; legislative, executive and judiciary, provided with questionable expertise and under stressful time pressure, huddle together at a European banking-supervision desk. That most sacred sword of democratic parliaments, budgetary sovereignty, is defended nationally with blood, and no one wants to admit it has long been undermined: either the executive assents, without power of attorney, or the judiciary buys papers for euros until the same end is finally reached. In practice, the numbers are rising, and life on the periphery of the continent can continue as it has since the eurosummits in Maastricht and Lisbon. In America, the whole Greeks-versus-France-and-Merkel game takes place within the parliament. Don’t we trust anyone at all any more: no bank, no government, no justice, not even rationality?

It’s a a very strange 2011 we are about to leave. Just a few weeks or months come between gilt-edged and a 50-percent haircut; legislative, executive and judiciary, provided with questionable expertise and under stressful time pressure, huddle together at a European banking-supervision desk. That most sacred sword of democratic parliaments, budgetary sovereignty, is defended nationally with blood, and no one wants to admit it has long been undermined: either the executive assents, without power of attorney, or the judiciary buys papers for euros until the same end is finally reached. In practice, the numbers are rising, and life on the periphery of the continent can continue as it has since the eurosummits in Maastricht and Lisbon. In America, the whole Greeks-versus-France-and-Merkel game takes place within the parliament. Don’t we trust anyone at all any more: no bank, no government, no justice, not even rationality?

We at VIP have not (yet) reached that point. We like proxy advisors – even if there are only two of nationwide significance. We “compete” with them only in the eyes of the blinkered. Trust cannot be sustainably generated if shareholder voting happens on a screen. At VIP, the shareholders get a voting receipt, and on request a report – after the AGM. More and more sustainability-minded funds and shareholders want it that way, and so very slowly economies of scale are starting, with a volume of assets under voting reaching 9.9 billion euros. It’s fun to watch VIPsight.EU grow. It’s encouraging that we could now go global with AGMagenda.com – though it’s not all rounded off yet. It is interesting how the different national cultures react to this step. 30,000 hits per month is an incentive for the whole team. I thank you all for your support in 2011, and trust that we will remain friends for this good cause in 2012 too. For confidence in healthy checks and balances and owners acting responsibly is the basis, and not just when driving a car at night.

Gabi Trillhaas - Analysis

Understandable management reports*

*Translator’s note: The article deals with German texts. However, while some features like word length differ, the gist applies mutatis mutandis to English writing too.

“Unintelligible management reports lead capital markets astray!”

According to the Commercial Code and Securities Trading Act annual reports – and thus risk reports – have to be self-explanatory and represent the economic situation of the company independently and understandably. in its 2010 annual report BaFin complained that many companies need to catch up here. It points to the risk that the capital markets might draw the wrong conclusions from ambiguous or unclear formulations. How can this be remedied?

According to the Commercial Code and Securities Trading Act annual reports – and thus risk reports – have to be self-explanatory and represent the economic situation of the company independently and understandably. in its 2010 annual report BaFin complained that many companies need to catch up here. It points to the risk that the capital markets might draw the wrong conclusions from ambiguous or unclear formulations. How can this be remedied?

What if ambiguous situation or risk reports tempt capital-market participants into misjudgements? Just think of the risks that lie dormant in the balance sheets of banks and insurance companies. The author of management reports should, then, go to work with care and sensitivity. When it comes to the clear presentation of a company’s risk, it is very easy to get many things right, but also many things wrong.

What factors contribute to (un-)intelligibility?

Why are some texts more difficult to understand as compared to others? Why as a reader do you sometimes feel in the right place, but other times not even addressed? For reading comprehension and reading pleasure, it is especially important for the writer of the text to have an idea whom he is writing for, and how much time, prior knowledge and interest the reader will have. For an attractive writing style, among others the following rules must be considered:

- Technical terms should be explained at an appropriate place or be avoided altogether.

- Foreign-language expressions may be familiar to the company's employees, but not to readers of annual reports.

- Long sentences are generally harder to understand than short ones.

- Complicated sentences with references or inserted explanations are worse than bullet points and clear, concise statements.

- Passive sentences are harder to understand than active sentences.

- Excessively converting verbs into nouns gives the impression of an impersonal nominal style, also called officialese or legalese.

- The eye wants to be led, and likes pictures and graphics.

- Acres of print are simply not inviting!

- A clear structure makes it easier to find information.

- When several authors have collaborated on a text, the different writing styles should be harmonized.

Other factors should not be underestimated: for example typography, grammar, spelling, logical structure, consistency.

Intelligibility can be measured

In November 2011, the German Share Institute organized a seminar to present the results of the financial reporting competition. Here, exameo GmbH, the European Institute for understandable information, presented results from a study on the comprehensibility of the risk reports of 10 DAX companies. The companies’ reports were compared in the following categories: word and sentence length, proportion of difficult words, quality of explanations of technical terms and effect of different writing styles.

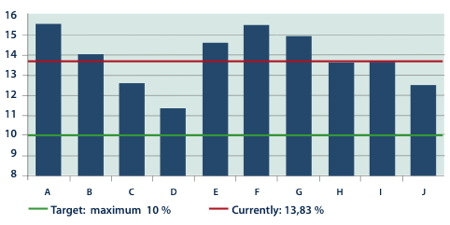

During the investigation, it was a question less of absolute test results than how much the individual texts differ. In measuring long words (> 12 letters), it was striking that the share of the individual DAX companies varies greatly (Figure 1). If, on average, nearly 14 percent of the words of a text have more than 12 letters, then this means that every seventh word is too long!

Figure 1: Proportion of long words (> 12 letters)

Source: exameo GmbH

Taking a look at these long words, it quickly becomes clear why the average word length is so high (Figure 2). It is a matter of central technical terms that are necessary for the understanding of the facts:

Figure 2: Examples of complicated words

Source: exameo GmbH

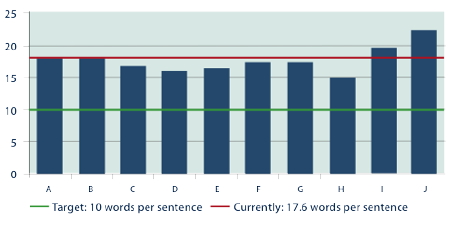

Looking at the average sentence length, the picture is uniform, but unsightly (Figure 3). Too many long sentences spoil the (reading) broth. If each sentence contains on average 17 words, then the reader has a lot to digest, and needs to concentrate hard. The longest sentence, with no less than 73 words, really showed some nerve!

Figure 3: Average sentence length

Source: exameo GmbH

Passive or Active?

In a good text, active and passive formulations should be judiciously mixed. Especially in risk reports, however, passive sentences often predominate. The German term “suffering form” expresses what this style is about: responsibility is unclear. Hazards “arise”, plans “are created”, tests “simulated”. “It” is defined, considered, explained – but by whom? Anonymity and powerlessness rule. The reader is left with uncertainty about who has the say here in the company, who recognizes the danger and takes precautions to control risks. The members of the Board, who on the first pages of the annual report have everything under control, like anonymous forces to be at work in the risk report.

Nowhere else is it so clear what possibilities open up here: the passive springs to mind when we want to show how helpless the company is in the face of the storms of the markets. Conversely, the author can use active formulations if he wants to to point out how farseeingly and risk-aware the leaders act: “We” examine, define, deploy instruments, plan, explain ...

Implement findings specifically

What has been objectively measured can be systematically improved. In other words, objective measurement results are an important prerequisite in order to identify weak points and improve texts. Difficulty of understanding is curable.

Gabi Trillhaas is the managing director of exameo GmbH, the European Institute for understandable information. exameo checks the comprehensibility of texts and helps companies see the need for optimization.

Gabi Trillhaas

exameo GmbH

24.11.2011

ACTIONS CORNER

Because of the failure of MF Global two pension funds have sued, among others, the Deutsche Bank. The funds accuse six banks of having concealed in prospectuses problems which eventually led to the broker’s collapse. The complaints were received on 18 November. MF Global had speculated with risky bets on European government bonds, and sought bankruptcy protection in late October. Because of the presumed recourse to customer accounts – apparently up to $1.2 billion is missing, twice as much as was initially reported – the regulatory authorities and the FBI are looking into the case.

Because of the failure of MF Global two pension funds have sued, among others, the Deutsche Bank. The funds accuse six banks of having concealed in prospectuses problems which eventually led to the broker’s collapse. The complaints were received on 18 November. MF Global had speculated with risky bets on European government bonds, and sought bankruptcy protection in late October. Because of the presumed recourse to customer accounts – apparently up to $1.2 billion is missing, twice as much as was initially reported – the regulatory authorities and the FBI are looking into the case.

The Deutsche Bank has been able to avert a dispute about the sale of mortgage-backed securities to five U.S. credit unions by paying 145 million dollars. The German industry leader did not have to admit guilt for the settlement. The bank was satisfied that it had solved the issue without having had to go to court, a spokesman said on 14 November in New York. The National Credit Union Administration had accused the financial institution of having given incorrect or incomplete information in connection with the sale of so-called mortgage-backed securities.

On 14 November it was revealed that Munich public prosecutors are investigating Josef Ackermann. They accuse the 63-year-old Swiss and former board colleagues Rolf Breuer, Clemens Börsig and Tessen von Heydebreck of attempted deceit of court and unsworn false testimony in the litigation with Leo Kirch. A raid was made on Ackermann’s executive office in the Deutsche Bank in the first week of November, according to a spokeswoman for the authorities. The villa of his predecessor Breuer in Frankfurt and his holiday apartment in Kitzbühel were also searched. The Deutsche Bank has now described Kirch’s lawyers’ access to the files as inappropriate, and suspects illicit collusion between individual judges and prosecutors that could have led to the raid in Frankfurt. After rejection of Breuer’s lawyers’ challenge on grounds of bias, the indictment was read on 24 November. Proceedings are to continue on 2 December.

On 14 November it was revealed that Munich public prosecutors are investigating Josef Ackermann. They accuse the 63-year-old Swiss and former board colleagues Rolf Breuer, Clemens Börsig and Tessen von Heydebreck of attempted deceit of court and unsworn false testimony in the litigation with Leo Kirch. A raid was made on Ackermann’s executive office in the Deutsche Bank in the first week of November, according to a spokeswoman for the authorities. The villa of his predecessor Breuer in Frankfurt and his holiday apartment in Kitzbühel were also searched. The Deutsche Bank has now described Kirch’s lawyers’ access to the files as inappropriate, and suspects illicit collusion between individual judges and prosecutors that could have led to the raid in Frankfurt. After rejection of Breuer’s lawyers’ challenge on grounds of bias, the indictment was read on 24 November. Proceedings are to continue on 2 December.

In the dispute over speculative interest bets, the Deutsche Bank is to pay €945,000 compensation to four Baden-Württemberg utilities. This out-of-court settlement had been determined by the Federal Court of Justice, said the plaintiffs’ attorneys. Thus the Oberlandesgericht Stuttgart verdict of a year ago in this swap case is now final. It is the first delivered in full favour of the plaintiffs. For years, the bank has been fighting with local authorities and businesses over so-called CMS spread collector swaps and CMS spread ladder swaps (CMS: Constant Maturity Swap), with which customers had suffered heavy losses, sometimes in the millions. In CMSs the interest payments of a swap partner are adjusted at regular intervals to a reference interest rate.

Deutsche Telekom has terminated its contracts with Drillisch without notice and levelled criminal charges on suspicion of commission fraud at a subsidiary (Simply) of its long-term business partner. The mobile-service provider dismissed the allegations of the Bonn group, according to a release, “decidedly”. In particular, Telekom’s allegation that Drillisch had activated tens of thousands of wireless connections without appropriate underlying customer relations did not correspond with the facts.

Deutsche Telekom has terminated its contracts with Drillisch without notice and levelled criminal charges on suspicion of commission fraud at a subsidiary (Simply) of its long-term business partner. The mobile-service provider dismissed the allegations of the Bonn group, according to a release, “decidedly”. In particular, Telekom’s allegation that Drillisch had activated tens of thousands of wireless connections without appropriate underlying customer relations did not correspond with the facts.

E.on is the first German energy company to complain to the Federal Constitutional Court against the nuclear phase-out. The 276-page constitutional complaint against the Federal Republic of Germany was filed in Karlsruhe, said a company spokesman. Without compensation, E.on thinks, the phase-out act is unconstitutional for the companies concerned. A spokesman for the utility said that it was intervention in the property right protected by the Basic Law and meant a financial loss in the high single-digit billions. The German government decided the phase-out by 2022 after the Fukushima nuclear disaster at the end of June.

Suzuki has as announced filed a case against Volkswagen at the Court of Arbitration of the International Chamber of Commerce in London. The Wolfsburgers are to be forced to dispose of the shares held in Japan’s fourth-largest carmaker to Suzuki or a third party. Volkswagen wants to keep the 19.9 percent share, however. Suzuki currently holds 1.5 percent of the German carmaker. The International Court of Arbitration is now to decide, after the cooperation agreed in December between the deeply divided partners failed. VW again rejected all accusations of noncooperation.

Suzuki has as announced filed a case against Volkswagen at the Court of Arbitration of the International Chamber of Commerce in London. The Wolfsburgers are to be forced to dispose of the shares held in Japan’s fourth-largest carmaker to Suzuki or a third party. Volkswagen wants to keep the 19.9 percent share, however. Suzuki currently holds 1.5 percent of the German carmaker. The International Court of Arbitration is now to decide, after the cooperation agreed in December between the deeply divided partners failed. VW again rejected all accusations of noncooperation.

The EU Commission has, as expected, decided to re-open an infringement procedure against Germany before the European Court of Justice because of the VW law. In the Commission’s view, the German authorities had implemented the court decision of 2007 only inadequately, and it urged the court to impose a fine. At Volkswagen , the 20-percent blocking minority guaranteeing the State of Lower Saxony veto power at general meetings is controversial. This practice is contrary to the spirit of the European internal market, said EU Internal Market Commissioner Michel Barnier.

AGM Dates

Politics

Latest bank stress test reveals gaps

The European Banking Authority EBA in a lightning test has expanded its summer stress-test data to the months of July, August and September. The final results are expected in late November. It emerged as early as mid-November, however, that in view of the Greek sovereign debt crisis the European banks’ need for a stable equity-capital ratio of nine percent at end June 2012 will be far greater than anyone had imagined. At German banks alone the capital shortfall of 5.2 billion euros is likely to increase to around ten billion euros, according to the experts’ first estimates. Between July and late September, Europe’s banks sold bonds worth tens of billions, wrote their value off, and brought on losses that severely reduced their equity capital. While in the stress test at the end of June the capital need of the 70 largest banks was already at 109 billion euros, this figure will increase dramatically once the escalation is taken into account. What is certain is that four German financial houses must drive up their capital ratio to nine percent, including the Deutsche Bank, which needs 1.2 billion euros, Commerzbank, which needs 2.9 billion euros, as well as the Landesbank Baden-Württemberg (€364 million) and Nord/LB (€660 million). It is becoming apparent that an additional nine German banks will show shortfalls.

The European Banking Authority EBA in a lightning test has expanded its summer stress-test data to the months of July, August and September. The final results are expected in late November. It emerged as early as mid-November, however, that in view of the Greek sovereign debt crisis the European banks’ need for a stable equity-capital ratio of nine percent at end June 2012 will be far greater than anyone had imagined. At German banks alone the capital shortfall of 5.2 billion euros is likely to increase to around ten billion euros, according to the experts’ first estimates. Between July and late September, Europe’s banks sold bonds worth tens of billions, wrote their value off, and brought on losses that severely reduced their equity capital. While in the stress test at the end of June the capital need of the 70 largest banks was already at 109 billion euros, this figure will increase dramatically once the escalation is taken into account. What is certain is that four German financial houses must drive up their capital ratio to nine percent, including the Deutsche Bank, which needs 1.2 billion euros, Commerzbank, which needs 2.9 billion euros, as well as the Landesbank Baden-Württemberg (€364 million) and Nord/LB (€660 million). It is becoming apparent that an additional nine German banks will show shortfalls.

Eurobonds controversy

On 23 November the EU Commission presented its proposal for joint bonds of euro-area countries. According to the Federal Association of German Banks (BdB), German private banks reject José Manuel Barroso’s proposals on eurobonds: none of the models presented in the European Commission’s Green Paper were convincing. The black-yellow coalition has also reiterated its rejection. Chancellor Angela Merkel had repeatedly made clear her opposition to Community bonds to solve the debt crisis. For the eurozone bonds, there are three options. First, the full replacement of national issues, with collective responsibility of all euro countries. The second possibility is joint and several liability up to a certain level of debt, say 60 percent of gross domestic product. In the last option, liability would be limited as in the second variant, but here the individual States would be liable for the common debt raised in proportion to their economic power. Brussels also wants to strengthen control over the budgetary oversight of euro countries suffering from serious difficulties.

On 23 November the EU Commission presented its proposal for joint bonds of euro-area countries. According to the Federal Association of German Banks (BdB), German private banks reject José Manuel Barroso’s proposals on eurobonds: none of the models presented in the European Commission’s Green Paper were convincing. The black-yellow coalition has also reiterated its rejection. Chancellor Angela Merkel had repeatedly made clear her opposition to Community bonds to solve the debt crisis. For the eurozone bonds, there are three options. First, the full replacement of national issues, with collective responsibility of all euro countries. The second possibility is joint and several liability up to a certain level of debt, say 60 percent of gross domestic product. In the last option, liability would be limited as in the second variant, but here the individual States would be liable for the common debt raised in proportion to their economic power. Brussels also wants to strengthen control over the budgetary oversight of euro countries suffering from serious difficulties.

IFRS 9 to apply as from 2015

From 2015 new accounting rules for banks are to ensure more security and transparency. The core of the reform is the accounting of financial instruments. The International Accounting Standards Board (IASB), responsible for the accounting rules, decided in November that the standard for financial instruments (IFRS 9) would first apply in 2015. The decision means that banks have more time to adjust to the new rules, thus ending the dispute between the IASB and the EU Commission. IFRS 9 consists of three parts: 1. Classification and evaluation of financial assets, 2. Assesment of and provisions for loan losses, and 3. Accounting treatment of hedging transactions. In late 2009 the first part was decided, but not yet implemented. According to it, in future there should be only two categories of assets - fair value or amortized cost (at cost). The hybrid category "available for sale" will no longer exist.

People

Enrico Tommaso Cuchiani, responsible on the Allianz board for insurance business in Europe and South America, will in future preside at Intesa Sanpaolo as Chief Executive Officer. The 61-year-old manager has asked the German insurance company to be released from his contract at the year’s end. Allianz has already signaled readiness. Cucchiani is to start with the Italians on 22 December.

Enrico Tommaso Cuchiani, responsible on the Allianz board for insurance business in Europe and South America, will in future preside at Intesa Sanpaolo as Chief Executive Officer. The 61-year-old manager has asked the German insurance company to be released from his contract at the year’s end. Allianz has already signaled readiness. Cucchiani is to start with the Italians on 22 December.

Josef Ackermann has told the Supervisory Board of Deutsche Bank that he is no longer a candidate for a move to it after his retirement from the board following the 2012 Annual Meeting, said the bank in a statement. Instead, Allianz CFO Paul Achleitner is to be the new Deutsche Bank Supervisory Board chairman.

Edward Kozel has asked the Supervisory Board of Deutsche Telekom to terminate his current contract, up in 2015, early for personal reasons.The Chief Technology and Innovation Officer wants to leave the Bonn-based group at the year’s end, Handelsblatt reported, among other things. The Supervisory Board will decide on the American’s request on 15 December. A successor is reportedly not being sought.

Edward Kozel has asked the Supervisory Board of Deutsche Telekom to terminate his current contract, up in 2015, early for personal reasons.The Chief Technology and Innovation Officer wants to leave the Bonn-based group at the year’s end, Handelsblatt reported, among other things. The Supervisory Board will decide on the American’s request on 15 December. A successor is reportedly not being sought.

Drägerwerk is losing its Director of Sales and Marketing. Carla Kriwet is leaving the medical and safety technology specialist at the year’s end, after only twelve months, by mutual agreement. The Lübeck firm is silent about the reasons for the resignation. Marketing will therefore not be re-organized until 2013, otherwise than planned. The 40-year-old was the first and only woman on the five-member board.

Gigaset has appointed Charles Fränkl as the new chief executive. According to indications the 53-year-old is an accomplished and recognized expert in international business, telecommunications and information technology. So far Maik Brockmann and Alexander Blum had shared CEO tasks equally. Both remain on the board, according to the statement.

From 1 January 2012, Infineon Technologies will again be based on four operating segments. Arunjai Mittal will come onto the board then, and take on the newly created position of Head of Marketing, Sales and Strategy Development. Currently head of the industrial-chip division, he is mainly to take care of growth in the increasingly important Asian markets.

From among its members, the Supervisory Board has elected Franz Markus Haniel as its new Chairman, METRO announced. The representative of the major shareholder (34.2 percent), he succeeds Jürgen Kluge, who in October announced his intention to resign. Olaf Koch will take over from Eckhard Cordes as Chief Executive Officer on 1 January 2012. The CFO was elected by eleven votes to ten.

From among its members, the Supervisory Board has elected Franz Markus Haniel as its new Chairman, METRO announced. The representative of the major shareholder (34.2 percent), he succeeds Jürgen Kluge, who in October announced his intention to resign. Olaf Koch will take over from Eckhard Cordes as Chief Executive Officer on 1 January 2012. The CFO was elected by eleven votes to ten.

Jürgen Zeschky of Voith Turbo will succeed Thomas Richterich at the top of Nordex . The 51-year-old will take up the post by 1 April 2012, the Hamburg-based wind-turbine manufacturers announced on 4 November. The longtime CEO’s contract ends in June next year. Richterich would not renew his contract “for personal reasons,” it was said.

At Q-Cells, the CFO surprisingly jumped ship on 14 November. Marion Helmes is giving up her post in the group on her own volition, said Nedim Cen. The CEO is taking over the position of CFO until further notice. The Supervisory Board regretted Helmes’s resignation, it was stated.

Campus

Hocker is new DSW president

Shareholder association Deutsche Schutzvereinigung für Wertpapierbesitz (DSW) elected previous chief executive Ulrich Hocker president at its members’ meeting. In relevant medias that was named a "revolution", this event of missing cooling-off shows the best example ever of what is worst practice or cybernetic auto-governance. Ulrich Hocker is (still) member of the Corporate Governance Codex Commission in Germany. The new vice-presidents are both capital-market lawyers, Daniela Bergdolt and Klaus Nieding.

Shareholder association Deutsche Schutzvereinigung für Wertpapierbesitz (DSW) elected previous chief executive Ulrich Hocker president at its members’ meeting. In relevant medias that was named a "revolution", this event of missing cooling-off shows the best example ever of what is worst practice or cybernetic auto-governance. Ulrich Hocker is (still) member of the Corporate Governance Codex Commission in Germany. The new vice-presidents are both capital-market lawyers, Daniela Bergdolt and Klaus Nieding.

IR Officers against short selling

Global corporations have a growing interest in investments in the fast-growing developing countries, and nearly one in three of these companies is considering a secondary listing in China. This is shown by a survey by BNY Mellon of 3,700 companies from 53 countries as part of the seventh “Global Trends in Investor Relations” study. About 40 percent see investor marketing in emerging markets as a strategic objective. The most important financial centres here are New York, London, Boston and Hong Kong. The vast majority of both U.S. as well as non-American companies are calling for additional supervision regulations for high-frequency trading, ‘dark pools’ (anonymous trading platforms), short selling and hedge funds. Half of the respondents stated that short selling has a negative impact on trade worldwide in their view. 92 percent of investor-relations officers were agreed that the financial reporting of companies represents a seal of approval for corporate governance, and is therefore even more important than effective financial controls (79 percent), the independence of committees (78 percent) or the appropriate remuneration of directors (51 percent).

Capital-market risks of CEO transition

The consulting firm FTI Consulting, in its study “Communicating Critical Events - CEO Transition and Risk to Enterprise Value”, went into the question of how leadership changes are reflected in Value at Risk (VAR). In the first part of the analysis FTI interviewed 3587 portfolio managers and analysts from 37 countries. In the second part, in a three-year period from June 2007 it studied the effect of the departures of CEOs at companies with a market capitalization of more than ten billion U.S. dollars. Of 263 cases examined in 35 countries there was a change in top management at 31 percent of the companies, of which 43 percent were unscheduled. Of the new CEOs, 80 percent had no experience as corporate executives and 77 percent were recruited from their own company. Changes in top management were critical particularly since about a third of investment decisions are made subject to public perception of the CEO, and the business leader’s reputation is as important here as the company’s. For 39 percent of portfolio managers surveyed, personality was a reason to sell shares of the company. To convince investors of his strategy, a new corporate executive has according to FTI about six months’ time in the capital market.

PR Award for Winterkorn

The German Public Relations Association (DPRG) has, jointly with the FAZ-Institut, made an International German PR Prize award to 22 companies and institutions for their strategic communications. The highest award of the German PR industry in the category of change, conflict and crisis communications went to TUI. VW CEO Martin Winterkorn was given the German Image Award for straightness, success and solidity. Deutsche Telekom achieved the highest rating in the category of innovative and creative PR.

The German Public Relations Association (DPRG) has, jointly with the FAZ-Institut, made an International German PR Prize award to 22 companies and institutions for their strategic communications. The highest award of the German PR industry in the category of change, conflict and crisis communications went to TUI. VW CEO Martin Winterkorn was given the German Image Award for straightness, success and solidity. Deutsche Telekom achieved the highest rating in the category of innovative and creative PR.

Board members rarely move to their own Supervisory Boards

The German Stock Institute has found that only 5.5 percent of supervisory-board members in the DAX, MDAX and TECDAX between 2002 and 2011 were previously in the same company, 3.3 percent as CEO and 2.2 percent as ordinary board members. Since the enactment of the new law in 2009, only one percent of executives had moved to the Supervisory Board of the same group.

The German Stock Institute has found that only 5.5 percent of supervisory-board members in the DAX, MDAX and TECDAX between 2002 and 2011 were previously in the same company, 3.3 percent as CEO and 2.2 percent as ordinary board members. Since the enactment of the new law in 2009, only one percent of executives had moved to the Supervisory Board of the same group.

Number of CSR reports increasing

According to KPMG 95 percent of the 250 largest companies worldwide publish a sustainability report. This represents an increase of fourteen percent in the past three years. While in Britain and Japan virtually every large company publishes a CSR report, the percentage in Germany is still at 62 percent.

Capital News

The share capital of Deutsche Wohnen is to be increased from 15 to to 28 November against cash contributions by up to 20.5 million euros, to €102 million. With a subscription price of €9.10, €130 million of the up to €186 million gross is eamarked for reducing old lines of credit and for selective acquisitions in existing core areas and in German metropolitan regions. In a continuing positive market environment for acquisitions the second-largest publicly traded apartment company is expected to invest the entire net proceeds of the issue within the next 12 to 15 months.

The share capital of Deutsche Wohnen is to be increased from 15 to to 28 November against cash contributions by up to 20.5 million euros, to €102 million. With a subscription price of €9.10, €130 million of the up to €186 million gross is eamarked for reducing old lines of credit and for selective acquisitions in existing core areas and in German metropolitan regions. In a continuing positive market environment for acquisitions the second-largest publicly traded apartment company is expected to invest the entire net proceeds of the issue within the next 12 to 15 months.

Drillisch has announced it will buy back shares worth up to four percent of the subscribed capital on the stock exchange. The mobile service provider is thus taking advantage of the low share price, which temporarily fell by half in early November because of the criminal accusation made by Deutsche Telekom and the termination without notice of cooperation with Drillisch.

Director's Dealings

| Company | Person | Function | Buy / Sell | Total value in Euro | Number of shares | Datum |

| ADVA | Christian Unterberger | MB | B | 95.564 | 39.999 | 08.11.2011 |

| ADVA | Christian Unterberger | MB | S | 179.996 | 39.999 | 08.11.2011 |

| Axel Springer | TriAlpha Oceana | S | 17.855.215 | 540.330 | 07.11.- 15.11.2011 | |

| Brenntag | Jürgen Buchsteiner | MB | B | 392.407 | 5.763 | 16.11.- 17.11.2011 |

| Brenntag | Steven Edward Holland | MB-Head | B | 33.990 | 500 | 17.11.2011 |

| DEUTSCHE BANK | Pierre de Weck | S | 1.183.010 | 35.425 | 28.10.2011 | |

| Deutsche EuroShop | Henry Böge | B | 6.624 | 288 | 23.11.2011 | |

| Deutsche EuroShop | Carlotta Böge | B | 13.524 | 588 | 23.11.2011 | |

| Deutsche Lufthansa | Carsten Spohr | B | 29.726 | 3.500 | 23.11.2011 | |

| Deutsche Lufthansa | Dr. Roland Busch | B | 18.790 | 2.040 | 21.11.2011 | |

| Deutsche Lufthansa | Carsten Spohr | B | 24.097 | 2.584 | 17.11.2011 | |

| Deutsche Lufthansa | Thomas Klühr | MB | B | 59.904 | 5.760 | 28.10.2011 |

| Deutsche Lufthansa | Stefan Lauer | MB | B | 120.006 | 11.539 | 28.10.2011 |

| Deutsche Lufthansa | Dr. Christoph Franz | MB-Head | B | 38.511 | 3.703 | 28.10.2011 |

| Douglas Holding | Dr. August Oetker Finanzierungund Beteiligung | B | 283.225 | 10.252 | 09.11.- 22.11.2011 | |

| Douglas Holding | Kreke Immobilien KG | B | 538.182 | 19.631 | 25.11.- 26.10.2011 | |

| Drillisch | Marion Weindl | B | 17.670 | 3.000 | 24.11.2011 | |

| Drillisch | Paschalis Choulidis | MB | B | 310.000 | 50.000 | 09.11.2011 |

| Drillisch | Vlasios Choulidis | MB | B | 338.628 | 55.000 | 09.11.2011 |

| Evotec | ROI Verwaltungsgesellschaft | B | 22.330 | 10.000 | 24.11.2011 | |

| Fresenius | Dr. Gerd Krick | SB-Head | Exercising an Option | 676.394 | 12.900 | 11.11.2011 |

| Fresenius | Dr. Ulf M. Schneider | MB-Head | Exercising an Option | 645.087 | 14.620 | 08.11.2011 |

| GERRY WEBER | R + U Weber GmbH & Co. KG | B | 896.734 | 42.241 | 24.11.2011 | |

| HeidelbergCement | Merckle Service GmbH | B | 9.125.399 | 335.616 | 23.11.2011 | |

| HeidelbergCement | SC Investment GmbH | B | 16.437.252 | 604.533 | 23.11.2011 | |

| HeidelbergCement | VEM Vermögensverwaltung | S | 25.562.651 | 940.149 | 23.11.2011 | |

| Henkel | Christoph Henkel | SB | O | 0 | 155.509 | 18.11.2011 |

| HUGO BOSS | Dr. Hellmut Albrecht | SB-Head | B | 50.663 | 750 | 15.11.2011 |

| Kontron | Ulrich Gehrmann | MB-Head | B | 15.531 | 3.000 | 28.10.2011 |

| Kontron | Thomas Sparrvik | MB | B | 97.850 | 19.000 | 27.10.2011 |

| KRONES | Schawei GmbH | B | 491.190 | 14.000 | 10.11.2011 | |

| MorphoSys | Dr. Simon Moroney | MB-Head | S | 435.682 | 26.500 | 18.11.- 23.11.2011 |

| MorphoSys | Dr. Simon Moroney | MB-Head | B | 44.835 | 3.500 | 23.11.2011 |

| MorphoSys | Dr. Marlies Sproll | MB | B | 51.240 | 4.000 | 10.11.2011 |

| MorphoSys | Dr. Marlies Sproll | MB | S | 443.553 | 26.000 | 09.11.- 10.11.2011 |

| MTU | Udo Stark Vermögensverwaltung | S | 101.160 | 2.000 | 27.10.2011 | |

| MTU | Udo Stark | SB | S | 101.160 | 2.000 | 27.10.2011 |

| PSI | Karsten Trippel | SB | B | 18.590 | 1.300 | 25.11.2011 |

| PSI | Dr. Harald Schrimpf | MB-Head | B | 14.800 | 1.000 | 18.11.2011 |

| SAP | Dr. Gerhard Maier | SB | S | 552.250 | 12.600 | 15.11.2011 |

| SGL CARBON | Robert J. Koehler | MB-Head | S | 1.007.690 | 22.000 | 04.11- 18.11.2011 |

| SGL CARBON | Jürgen Otto Walter Muth | MB | S | 83.785 | 1.808 | 08.11.- 14.11.2011 |

| SGL CARBON | Armin Horst Bruch | MB | S | 178.713 | 3.843 | 08.11.- 09.11.2011 |

| SGL CARBON | Gerd Wingefeld | MB | S | 509.325 | 10.919 | 04.11.- 08.11.2011 |

| Siemens | Dr. Roland Emil Busch | MB | S | 112.317 | 1.530 | 14.11.2011 |

| Siemens | Klaus Helmrich | MB | S | 161.575 | 2.201 | 14.11.2011 |

| Siemens | Siegfried Russwurm | MB | S | 1.007.993 | 13.731 | 14.11.2011 |

| Siemens | Joe Kaeser | MB | S | 1.007.993 | 13.731 | 14.11.2011 |

| Siemens | Peter Y. Solmssen | MB | S | 936.932 | 12.763 | 14.11.2011 |

| Siemens | Prof. Dr. Hermann Requardt | MB | S | 936.932 | 12.763 | 14.11.2011 |

| Siemens | Peter Löscher | MB-Head | S | 4.874.571 | 66.402 | 14.11.2011 |

| TUI | Poalim Worldwide Ltd. | B | 2.023.879 | 500.000 | 09.12.- 12-09.2011 | |

| Wacker Chemie | Dr. Karl-Heinz Weiss | B | 159.840 | 2.000 | 28.10.2011 |

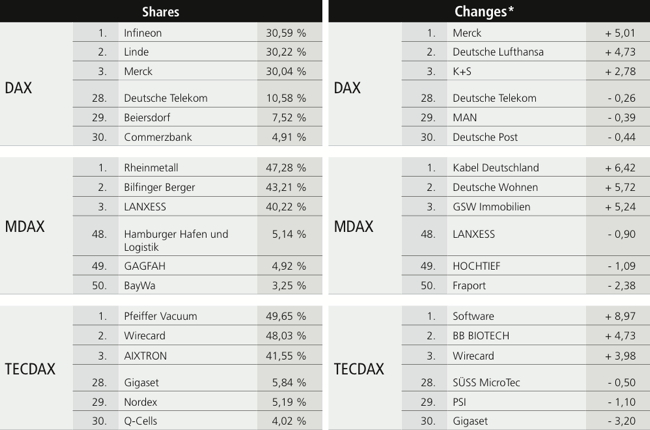

VIPsight Shareholders

in November

Shares held by capital investment companies:

*Changes from previous month, percent

VIPsight Shareholder ID <click here>

Event Diary

13 December 2011 Vergütungsstrategien für Mitarbeiter und Führungskräfte im Wandel [compensation strategies for employees and managers in change]

Organizer: Deutsches Aktien-Institut; Venue: DVFA-Center, Mainzer Landstraße 37-39, Frankfurt am Main; cost: €900; info: +49 69 929150

13 December 2011 Professor Otmar Issing, Die europäische Währungsunion auf dem Wege zur Fiskalunion [the European monetary union on the road to fiscal union]

CFS Colloquium, Organizer: CFS; Venue: Frankfurter Innenstadt; registration:

www.ifk-cfs.de/index.php?id=192&L=1

Reading suggestions

Quentmeier, Helma, Praxishandbuch Compliance [Practical Compliance Handbook]

Gabler-Verlag, 105 pp, €29.95, ISBN 978-3-8349-3379-9

The book covers the fundamentals, knowledge and practical work, as well as dealing with compliance in daily work life, with legal principles. Despite the difficult issues it is practically written and easy to understand, and contains many practical hints and examples from work.

Theiselmann, Rüdiger (ed.), Governance International

Schaeffer-Poeschel Verlag, 841 pp, €129.95, ISBN 978-3-7910-3109-5

To avoid liability risks, managers operating internationally should know the relevant regulations in foreign countries. The book gives guidance on legal issues in an international context. This volume provides basic legal knowledge for the following countries: Australia, Brazil, China, Denmark, Germany, Finland, France, India, Italy, Luxembourg, The Netherlands, Austria, Poland, Russia, Sweden, Switzerland, Spain, Czech Republic, Turkey, UK , USA, United Arab Emirates and Vietnam. Optimal for reference. The author is Head of the Corporate Center in Corporate Finance at Commerzbank AG and a lecturer in corporate finance law at the University of Cologne.

Wolf, Professor Birgit, Hill, Mark, and Pfaue, Michael, Strukturierte Finanzierungen [Structured Financing]

Schaeffer-Poeschel Verlag, 263 pp, €39.95, ISBN 978-3-7910-3048-7

Structured financing is perfect for the opening of new funding sources and increasing corporate value. At the same time they are also regarded as triggers and accelerators of the financial crisis. The new edition takes account of both aspects. In addition to a brief analysis of the financial crisis, the effects on three instruments, asset-backed structures, project financing and buy-out financing, are shown.