AGMagenda

|

Dec.21,2025 Seven West Media in (AU) |

|

Dec.21,2025 Jordan Ind Resources in (JO) |

|

Dec.21,2025 Jerusalem Insurance |

|

Dec.21,2025 Real Estate Trade Centers Co KSCC |

|

Dec.21,2025 KPF in (KR) |

|

Dec.21,2025 Ameen Al Iraq Bank for Islamic Investment and Finance |

|

Dec.21,2025 Supercom in (IL) |

|

Dec.21,2025 Patagonia Lithium |

|

Dec.21,2025 Balsm Alofoq Medical Company CJSC |

|

Dec.22,2025 CECEP Wind-Power |

|

Dec.22,2025 Sinotruk (Hong Kong) |

|

Dec.22,2025 Delta Insurance in (EG) |

|

Dec.22,2025 Emaar The Economic City in King Abdullah Economic City (KAEC) (SA) |

|

Dec.22,2025 Polski Koncern Naftowy Orlen in Plock (PL) |

|

Dec.22,2025 Aluminum of China in (CN) |

|

Dec.22,2025 Semen Gresik (Persero) Tbk in (ID) |

|

Dec.22,2025 Compass East Industry (Thailand) in Bangkok (TH) |

|

Dec.22,2025 TT Electronics in (UK) |

|

Dec.22,2025 Bank Polska Kasa Opieki in (PL) |

|

Dec.22,2025 Bank BRISyariah Tbk |

|

Dec.22,2025 Fidelity Special Values in (UK) |

|

Dec.22,2025 China Greatwallmputer Shenzhen in (CN) |

|

Dec.22,2025 Bewi |

|

Dec.22,2025 Punjab Communications |

|

Dec.22,2025 Orco Property Group in (FR) |

Search

VIPsight

|

Corporate Governance – portrayed in the individual cultural and legal framework, from the standpoint of equity capital. VIPsight is a dynamic photo archive, sorted by nations and dates, by and for those interested in CG from all over the world. VIPsight offers, every month:

|

VIPsight - 2nd Edition 2023 <click here>

VIPsight - News

April 2023

Allianz SE: Ignoring a Technical Dilemma

Since BaFin has taken its tasks seriously, even supposedly top names are no longer immune to criticism. The restrained communication about a current event shows the force with which this realization hit Allianz.

Since BaFin has taken its tasks seriously, even supposedly top names are no longer immune to criticism. The restrained communication about a current event shows the force with which this realization hit Allianz.

more - VIPsight - 2nd Edition 2023 <click here>

brave new world

ThyssenKrupp was not really an opponent; Cevian got into the ring - and soon realised that manual mistakes made the commitment turn blood red and stay that way. Siemens was beyond the reach of activists, as spin-offs came faster than concretely "demanded". Daimler's march back to Mercedes was completely in the interests of the managers. And the honourable as well as arrogant Bayer people (who are they? What are their names?) were just the logical target of all activists; they came, they went, they came back and even Thomas Henrik Shrager, Managing Director of Tweedy Browne demanded what is still demanded today: divide and spill. Who doesn't remember Shrager's appearance at THAT Bayer AGM where political (bee) activists climbed the balustrade behind the supervisory board....

ThyssenKrupp was not really an opponent; Cevian got into the ring - and soon realised that manual mistakes made the commitment turn blood red and stay that way. Siemens was beyond the reach of activists, as spin-offs came faster than concretely "demanded". Daimler's march back to Mercedes was completely in the interests of the managers. And the honourable as well as arrogant Bayer people (who are they? What are their names?) were just the logical target of all activists; they came, they went, they came back and even Thomas Henrik Shrager, Managing Director of Tweedy Browne demanded what is still demanded today: divide and spill. Who doesn't remember Shrager's appearance at THAT Bayer AGM where political (bee) activists climbed the balustrade behind the supervisory board....

more - VIPsight - 2nd Edition 2023 <click here>

Deutsche Börse AG: Sitting between the Chairs can be uncomfortable

Clearstream Banking S.A., Luxembourg, a subsidiary of Deutsche Börse AG, informed that a US court awarded judgment to creditors of Iran who had brought a lawsuit seeking turnover of approximately 1.7 billion USD that are attributed to the Iranian central bank (Bank Markazi) and held in custody at Clearstream in Luxembourg in a client account. Clearstream is considering appealing the decision.

Clearstream Banking S.A., Luxembourg, a subsidiary of Deutsche Börse AG, informed that a US court awarded judgment to creditors of Iran who had brought a lawsuit seeking turnover of approximately 1.7 billion USD that are attributed to the Iranian central bank (Bank Markazi) and held in custody at Clearstream in Luxembourg in a client account. Clearstream is considering appealing the decision.

more - VIPsight - 2nd Edition 2023 <click here>

TUI AG: Close, but just taken the Curve

In mid-April, the TUI share came under a little pressure. This was due to an unexpected oversupply of shares.

In mid-April, the TUI share came under a little pressure. This was due to an unexpected oversupply of shares.

In March 2023, the company announced the launch of a capital increase with subscription rights. The gross proceeds of the issue of approx. 1.8 billion EUR shall be used for repayment of WSF state aid and a significant reduction of the KfW credit lines to strengthen its balance sheet.

more - VIPsight - 2nd Edition 2023 <click here>

March 2023

BERKSHIRE HATHAWAY INC.

To the Shareholders of Berkshire Hathaway Inc.:

Charlie Munger, my long-time partner, and I have the job of managing the savings of a great number of individuals. We are grateful for their enduring trust, a relationship that often spans much of their adult lifetime. It is those dedicated savers that are forefront in my mind as I write this letter.

Charlie Munger, my long-time partner, and I have the job of managing the savings of a great number of individuals. We are grateful for their enduring trust, a relationship that often spans much of their adult lifetime. It is those dedicated savers that are forefront in my mind as I write this letter.

A common belief is that people choose to save when young, expecting thereby to maintain their living standards after retirement. Any assets that remain at death, this theory says, will usually be left to their families or, possibly, to friends and philanthropy.

Our experience has differed. We believe Berkshire’s individual holders largely to be of the once-a-saver, always-a-saver variety. Though these people live well, they eventually dispense most of their funds to philanthropic organizations. These, in turn, redistribute the funds by expenditures intended to improve the lives of a great many people who are unrelated to the original benefactor. Sometimes, the results have been spectacular.

The disposition of money unmasks humans. Charlie and I watch with pleasure the vast flow of Berkshire-generated funds to public needs and, alongside, the infrequency with which our shareholders opt for look-at-me assets and dynasty-building.

BERKSHIRE HATHAWAY INC. - 2022 ANNUAL REPORT (PDF) <click here>

The Power of Capitalism

Dear CEO,

Each year I make it a priority to write to you on behalf of BlackRock’s clients, who are shareholders in your company. The majority of our clients are investing to finance retirement. Their time horizons can span decades.

The financial security we seek to help our clients achieve is not created overnight. It is a long-term endeavor, and we take a long-term approach. That is why, for the past decade, I have written to you, as CEOs and Chairs of the companies our clients are invested in. I write these letters as a fiduciary for our clients who entrust us to manage their assets – to highlight the themes that I believe are vital to driving durable long-term returns and to helping them reach their goals.

When my partners and I founded BlackRock as a startup 34 years ago, I had no experience running a company. Over the past three decades, I’ve had the opportunity to talk with countless CEOs and to learn what distinguishes truly great companies. Time and again, what they all share is that they have a clear sense of purpose; consistent values; and, crucially, they recognize the importance of engaging with and delivering for their key stakeholders. This is the foundation of stakeholder capitalism.

more - https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter

January 2023

Deutsche Börse AG: Testing the Limits

Good relationships with the supervisory authorities are particularly important for financial institutions. After all, financial institutions cannot operate without official approval. What is more, good standing with the regulators is important for the customers´ trust in the solidity of their business?

Good relationships with the supervisory authorities are particularly important for financial institutions. After all, financial institutions cannot operate without official approval. What is more, good standing with the regulators is important for the customers´ trust in the solidity of their business?

more - VIPsight - 1st Edition 2023 <click here>

ADLER Group S.A.: Will this Bird ever fly again?

If you put it euphemistically, ADLER Group faces special challenges. Already the known corporate governance problems would be enough to overthrow the average market participant. However, the short-term securing of the company´s financing is much more important. Here, the bondholders are in the foreground.

If you put it euphemistically, ADLER Group faces special challenges. Already the known corporate governance problems would be enough to overthrow the average market participant. However, the short-term securing of the company´s financing is much more important. Here, the bondholders are in the foreground.

more - VIPsight - 1st Edition 2023 <click here>

BAYER AG: Advances in Damage Control open up new Perspectives for Shareholders

The takeover of Monsanto by BAYER can confidently be classified as one of the biggest money burns in the German capital market. With this acquisition, BAYER bought reputation and legal risks, a business model with an operationally weakening business, and limited strategic perspectives in the agricultural business.

The takeover of Monsanto by BAYER can confidently be classified as one of the biggest money burns in the German capital market. With this acquisition, BAYER bought reputation and legal risks, a business model with an operationally weakening business, and limited strategic perspectives in the agricultural business.

more - VIPsight - 1st Edition 2023 <click here>

August 2022

Dear CEO,

Each year I make it a priority to write to you on behalf of BlackRock’s clients, who are shareholders in your company. The majority of our clients are investing to finance retirement. Their time horizons can span decades.

The financial security we seek to help our clients achieve is not created overnight. It is a long-term endeavor, and we take a long-term approach. That is why ... - ... I know this firsthand. In this polarized world, CEOs will invariably have one set of stakeholders demanding that we do one thing, while another set of stakeholders demand that we do just the opposite.

That is why it is more important than ever that your company and its management be guided by its purpose. If you stay true to your company's purpose and focus on the long term, while adapting to this new world around us, you will deliver durable returns for shareholders and help realize the power of capitalism for all.

March 2021

WHO WAS ABLE TO LEND NON-ISSUED/ NOT EXISTING SHADOW SHARES ?

Custodian settlement is ... marvellous - may i vote my lended shares?

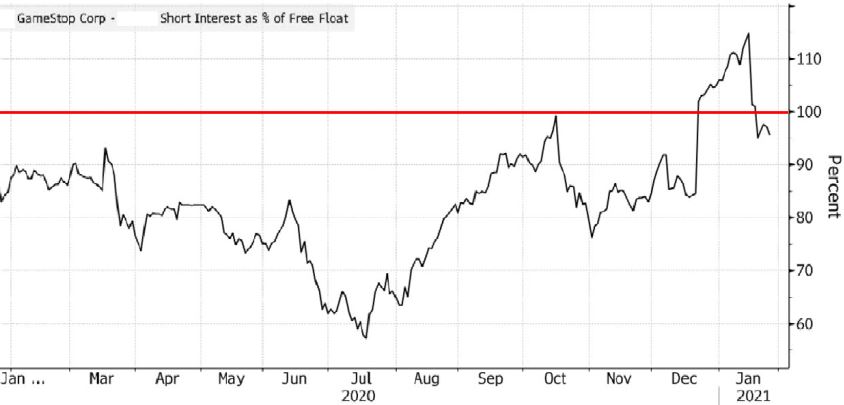

GameStop Corp. Short Interstest as % of Free Float

Volkswagen chart <ordinary> October 2008

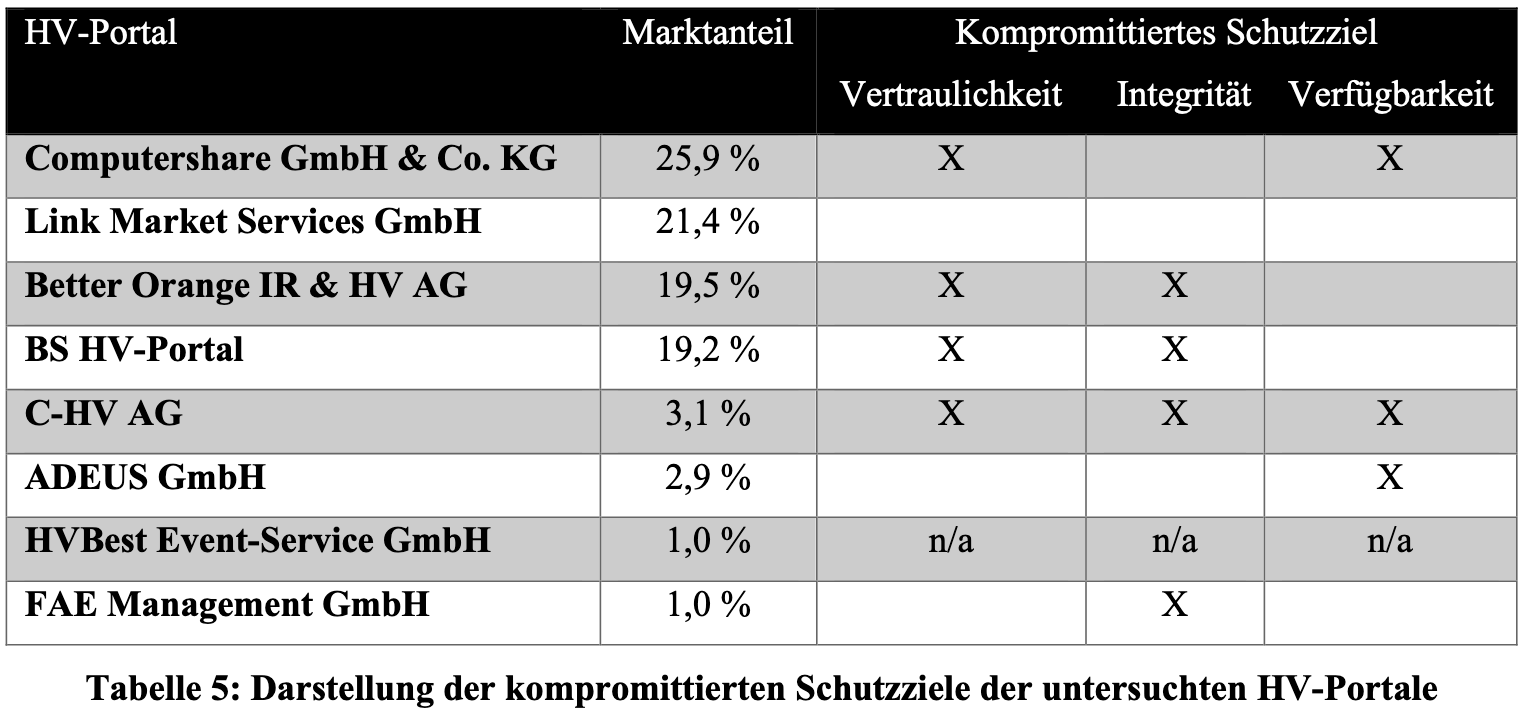

Virtuelle Hauptversammlungen (2020): Ein sicherer Ersatz für Präsenzveranstaltungen?

How to Break Virtual Shareholder Meetings

Prof. Dr.-Ing. Andreas Mayer, Hochschule Heilbronn

<click here> complete version (PDF) deutsch

<click here> complete version (PDF) english - page 98 (114) to 112 (128)

17. Deutscher IT-Sicherheitskongress des BSI

https://www.bsi.bund.de/EN/Home/

December 2019

Proxinvest publishes its twentieth third report: “Annual General Meetings and shareholder activism – 2019 season”

(Hans-Martin Buhlmann and Jose Ignacio Sanchez Galan after VIP remarks in 2019 Iberdrola AGM)

Restrained General meetings

While the “Place de Paris” (i.e stakeholders on the French listed market) wonders about the potential framework regarding shareholder activism, Proxinvest’s report on General Meetings displays that in fact General Meetings of French companies remain very controlled. In point of fact, 57.6% of voting rights exercised in the 315 General Meetings analyzed by Proxinvest were in the hands of reference shareholders (36% in the CAC 40), explaining why only 0.64% of resolutions were not adopted.

VIPsight - 2nd Edition 2023

COMPANIES

Allianz SE: Ignoring a Technical Dilemma

Since BaFin has taken its tasks seriously, even supposedly top names are no longer immune to criticism. The restrained communication about a current event shows the force with which this realization hit Allianz.

Since BaFin has taken its tasks seriously, even supposedly top names are no longer immune to criticism. The restrained communication about a current event shows the force with which this realization hit Allianz.

The problems are not even new and have been reported several times. What appears to be new, however, is that BaFin has evidently lost interest in troubleshooting and is now demanding solutions instead. Allianz will probably not get any further with excuses and needs to act. According to an article in the Handelsblatt, the main focus is on greater integration of the IT units within the parent company. The reinsurance business is particularly affected.

The measure is intended to contribute to reducing risks and increasing efficiency and is therefore welcome from a shareholder`s point of view. On the other hand, the continuous stream of negative news of this kind is unpleasant. Maybe Allianz could hire someone with the right communication skills who can give investors an overview of the problem areas in the IT units, the nature of the risks, as well as the costs and procedures for solving the problems. Combined with future proactive communication, this would be a step that would also benefit the group´s reputation. In times of volatile markets, this is a good investment.

BAUER AG: A Company goes dark

The balance of power has shifted at BAUER AG. The new positioning also affects the free shareholders. For example, the Executive Board of BAUER has decided to support the delisting of the shares from the Regulated Market of the Frankfurt Stock Exchange as sought by SD Thesaurus GmbH and the Supervisory Board of the company.

The balance of power has shifted at BAUER AG. The new positioning also affects the free shareholders. For example, the Executive Board of BAUER has decided to support the delisting of the shares from the Regulated Market of the Frankfurt Stock Exchange as sought by SD Thesaurus GmbH and the Supervisory Board of the company.

BAUER AG and SD Thesaurus GmbH plan to conclude a delisting agreement, and SD Thesaurus GmbH will structure a delisting offer to the shareholders following section 39 of the Stock Exchange Act. BAUER AG is committed to applying for the revocation of the admission of the company´s shares to trading on the Regulated Market of the Frankfurt Stock Exchange during the acceptance period of the Delisting Acquisition Offer so that delisting should become effective shortly after completion of the offer. The company added that it will not apply for the inclusion of its shares in the Open Market of a stock exchange.

According to BAUER AG, the economic benefit of including the shares in the Regulated Market no longer justified the associated expense. The regulatory framework is considered to be increasingly restricting the company and causing significant costs to comply with and implement the numerous legal requirements. The withdrawal, therefore, is considered to result in a reduction in the company´s future administrative and cost expenditure.

These arguments have been heard many times before. What is astonishing is that it is said primarily when a new major shareholder appeared. And to this day no one has been able to explain why it should apply to the inclusion of the shares in the Open Marke

Brenntag SE: Public Shareholder Correspondence

Critical shareholder voices are part of everyday management at Brenntag. This does not necessarily mean that the shareholders are correct in their criticism. But at least one can say that this management has learned how to deal with it. Brenntag could also use this experience when dealing with a recent letter from PrimeStone Capital LLP.

Critical shareholder voices are part of everyday management at Brenntag. This does not necessarily mean that the shareholders are correct in their criticism. But at least one can say that this management has learned how to deal with it. Brenntag could also use this experience when dealing with a recent letter from PrimeStone Capital LLP.

It looks like the investor and Brenntag have been in an intensive exchange of views for a long time, with a focus on corporate governance topics. In this context, the disposal of Brenntag Specialties is just one step requested. At the same time, the investor requests

- a stronger focus by the Supervisory Board on management´s performance and cost efficiency,

- the end of equivocal, misleading, or erroneous communications, and

- a sense of urgency in doing all of the above.

What at first glance looks like an action plan is at the same time a condemnation of the company´s previous approach and the quality of management decisions. If Brenntag wants to keep its strategic and operational course and deliver a compelling answer, strategic babble, plans, and intentions will not suffice. For a credible reaction, this management must also critically analyze and evaluate its own decisions to date.

Buhlmann's Corner

brave new world

ThyssenKrupp was not really an opponent; Cevian got into the ring - and soon realised that manual mistakes made the commitment turn blood red and stay that way. Siemens was beyond the reach of activists, as spin-offs came faster than concretely "demanded". Daimler's march back to Mercedes was completely in the interests of the managers. And the honourable as well as arrogant Bayer people (who are they? What are their names?) were just the logical target of all activists; they came, they went, they came back and even Thomas Henrik Shrager, Managing Director of Tweedy Browne demanded what is still demanded today: divide and spill. Who doesn't remember Shrager's appearance at THAT Bayer AGM where political (bee) activists climbed the balustrade behind the supervisory board....

ThyssenKrupp was not really an opponent; Cevian got into the ring - and soon realised that manual mistakes made the commitment turn blood red and stay that way. Siemens was beyond the reach of activists, as spin-offs came faster than concretely "demanded". Daimler's march back to Mercedes was completely in the interests of the managers. And the honourable as well as arrogant Bayer people (who are they? What are their names?) were just the logical target of all activists; they came, they went, they came back and even Thomas Henrik Shrager, Managing Director of Tweedy Browne demanded what is still demanded today: divide and spill. Who doesn't remember Shrager's appearance at THAT Bayer AGM where political (bee) activists climbed the balustrade behind the supervisory board....

Such acts are now virtually relegated to the living room of the critical activist - coupled with a censorship apparatus that would make any Chinese person's blood run cold. Shareholders are supposed to find 60 months of goodwill for this consolidation of managerial power? Of course there was criticism, also from the two voting advisors - the larger of which is owned by Deutsche Börse. The senior issuer advisors quickly agreed on a common language: not 5 but 2 years virtual and case-by-case review. So presumably all currently active board members can still survive until retirement with peace of mind. INFINEON, which was initially badly advised and only wanted what ¾ of the DAXes wanted, was given a lapel to sign: decide on 5 years and voluntarily limit it to 2 years - at any time a board can also become smarter tomorrow and ...

Siemens also purged itself of 5 to 2 years, to push through the 5 years par ordre du mufti for the 75% shareholding in Healthineers. Why have a Q&A at all? Let the AGM representatives get the classic right to "submit" 6 adjectives, from which the chat robot with GPT then compiles 3 questions, 2 comments and 1 photo through Microsoft BING. Why transport Ingo Speich, Hendrik Schmidt & Co from A to B? It's much easier to use artificial intelligence - which also solves the (coincidental?) problem of the coincidence of dates - by coincidence the AGMs of BASF and BAYER have been taking place on the same date for the last decade. Embarrassing mix-ups such as the Wirecard AGM 2019 are solved by the adaptive robots at the same time: in the (audited, now cancelled) financial statements for 2018, provisions and reserves were mixed up. Such mishaps do not happen to the ChatBot, or if they do, then only once.

For VIP, I promise you one thing: to avoid the danger of using the same adjectives as UNION, I will have my contributions set to music. Why should only Elliott put a Singer, I can do that too. Sure: with good results in major and with ... - that's how we do it, Google and also Baidu have already announced the bard. And whoever still wants to go to Ingo's "hall" will have to organise chrysanthemum and frankfurter sausages in sufficient quantities themselves - the police will only come for Mercedes.

ACTIONS CORNER

Deutsche Börse AG: Sitting between the Chairs can be uncomfortable

Clearstream Banking S.A., Luxembourg, a subsidiary of Deutsche Börse AG, informed that a US court awarded judgment to creditors of Iran who had brought a lawsuit seeking turnover of approximately 1.7 billion USD that are attributed to the Iranian central bank (Bank Markazi) and held in custody at Clearstream in Luxembourg in a client account. Clearstream is considering appealing the decision.

Clearstream Banking S.A., Luxembourg, a subsidiary of Deutsche Börse AG, informed that a US court awarded judgment to creditors of Iran who had brought a lawsuit seeking turnover of approximately 1.7 billion USD that are attributed to the Iranian central bank (Bank Markazi) and held in custody at Clearstream in Luxembourg in a client account. Clearstream is considering appealing the decision.

Since 2018, Bank Markazi – also as part of an action filed in Luxembourg against Clearstream – is asking for the restitution of considerable amounts of assets including the abovementioned amount of approximately 1.7 billion USD. This action is currently still being briefed in the first instance proceedings. After legal consultation, Clearstream believes the claims made against it in Luxembourg to be without merit.

Based on the legal assessment of these cases, the court decision does not cause any material change to the overall risk that would require Clearstream or Deutsche Börse AG to make provisions in this context.

Fine. Do we have a problem there, or don´t we? How to define this (non-?)risk, and could the same happen with Russian assets as a result of the sanctions?

Adler Group S.A.: Hanging on to Live

That much is certain now, Adler Group will keep us busy for quite a while. While many observers wrote off Adler some time ago, the ailing real estate group continues to be combative. This is also due to the High Court of Justice of England and Wales, which approved the current restructuring plan under Part 26A of the Companies Act 2006 of AGPS BondCo PLC, a 100% subsidiary of Adler Group S.A.

That much is certain now, Adler Group will keep us busy for quite a while. While many observers wrote off Adler some time ago, the ailing real estate group continues to be combative. This is also due to the High Court of Justice of England and Wales, which approved the current restructuring plan under Part 26A of the Companies Act 2006 of AGPS BondCo PLC, a 100% subsidiary of Adler Group S.A.

Several bondholders objected to the plan proposed by ADLER. In particular, the holders of the bond maturing later saw themselves disadvantaged by the plan. Economically, these fears are obvious. But they are just a part of a decision that must take into account all positions affected.

With the sanctioning of the plan, material requirements for the implementation of the amendments of the terms and conditions of the notes of AGPS BondCo PLC are being met and new money shall be provided by a group of bondholders to the Adler group of companies, subject to the fulfillment of further closing conditions.

SYNLAB AG: Just a Pit Stop at the Stock Exchange?

SYNLAB went public just two years ago. This short time is not enough to leave a lasting impression. And yet the stock market listing could soon be a thing of the past.

In March, funds advised by Cinven Limited submitted a legally non-binding expression of interest to acquire up to 100% of the company´s shares at an indicative offer price of 10.00 EUR per SYNLAB share. Cinven already holds approximately 43% of the company´s share capital. SYNLAB is now examining the expression of interest and its options for action. This expression of interest was not coordinated with the company and it is currently not foreseeable whether there will be a public acquisition offer on the part of CINVEN to all shareholders of SYNLAB.

As a reminder: around 20 EUR were paid for the share on its first day of trading. For an essentially successful company, this is an unusual share price performance. So who is to blame?

Capital News

TUI AG: Close, but just taken the Curve

In mid-April, the TUI share came under a little pressure. This was due to an unexpected oversupply of shares.

In mid-April, the TUI share came under a little pressure. This was due to an unexpected oversupply of shares.

In March 2023, the company announced the launch of a capital increase with subscription rights. The gross proceeds of the issue of approx. 1.8 billion EUR shall be used for repayment of WSF state aid and a significant reduction of the KfW credit lines to strengthen its balance sheet.

The issue comprised 328,910,448 new shares. Shareholders could subscribe to the new shares at a ratio of 8 new shares for 3 existing shares at the issue price of 5.55 EUR per new share. All shareholders? No, there was one noteworthy exception. Alexey A. Mordashov held 30.91% of the shares outstanding before the capital increase. This indirect holding via Uniform Limited and Servergroup LLC is subject to a loss of rights as a result of sanctions and under German securities law.

So Mr. Mordashov and persons or entities connected to him could therefore not participate in the rights issue and did not receive subscription rights. Hence, the rights issue excluded new shares attributable to Mr. Mordashov and persons or entities connected to him, and it was not secured through an underwriting commitment by a syndicate of banks.

In the end, not all plans worked out. But with a subscription quote of 90.884%, everyone involved in Hanover should have breathed a sigh of relief. What is more, a syndicate of banks successfully procured subscribers for all the 29.982.311 new shares not subscribed for in the subscription offer.

Hello TUI, welcome back as a normal capital-market-ready company!

LEONI AG: Gone with the Wind

When companies are overwhelmed by an almost unbelievable number of extraordinary problems, this can also be due to inadequate corporate governance or corporate culture. After all, this has already brought down former giants such as AEG, and since then there has been a steady stream of other examples, including more recently LEONI AG.

When companies are overwhelmed by an almost unbelievable number of extraordinary problems, this can also be due to inadequate corporate governance or corporate culture. After all, this has already brought down former giants such as AEG, and since then there has been a steady stream of other examples, including more recently LEONI AG.

LEONIE had its fair share of corporate problems for executives and advisors to tinker with. Successful problem-solving looks different. However, this also means that investors could recognize the risks involved. The full extent of the disaster only became clear towards the end. After the failure of a half-baked spin-off plan for a business unit, the existence of the company was in jeopardy and an emergency solution had to be found. The end of the gambling period had also to be reflected on the balance sheet. In April the company announced that the ongoing preparation of the 2022 annual financial statements indicated that, due to significant impairments, a loss that consumes the capital stock will have definitively occurred for fiscal 2022. At the time, the company expected impairments in the high three-digit million EUR range.

The Executive Board of LEONIE will therefore convene an extraordinary shareholders´ meeting soon. Shareholders can already mark June 2nd in their diary when this meeting shall be held. This meeting has a special meaning because it will probably be the last one as a public company.

Due to the ongoing extraordinary challenges, LEONI entered into negotiations with its financing parties and Leoni´s main shareholder, Dipl.-Ing. Stefan Pierer, on a financial restructuring concept. The measures aim at a substantial reduction in the company´s debt and the provision of fresh liquidity, to be implemented based on the German Corporate Stabilization and Restructuring Act (Unternehmensstabilisierungs- und restrukturierungsgesetz).

According to the plan, a company indirectly held by Mr. Pierer would, after a simplified capital reduction of LEONI AG to 0 EUR, contribute 150 million EUR by way of a cash capital increase with a subsequent contribution in kind in return for the issuance of new shares in Leoni AG. In addition, this company is to take over financial claims against LEONI for 708 million EUR from its financing parties in return for a recovery instrument corresponding to an economic interest of 45%. These claims will be contributed to LEONI AG in the course of the capital increase by way of a contribution in kind. In the course of this capital increase, to which only the company indirectly held by Mr. Pierer is to be admitted, this company will become the new sole shareholder of LEONI AG.

The news caught many investors off guard. What is more, Leoni did announce the beginning of the implementation of this plan shortly afterward. So what is clear as of today is that the shareholder´s meeting on June 2nd is a zombie event. Yes, it´ll be an occasion to express frustration over what happened, but it´ll be meaningless for the company's future. Instead, the story sounds like a paradise for lawyers.

VARTA AG: Back to the Start

Experienced management does not even need much time to put a listed company on course for restructuring. After a failure in 2016, VARTA managed to go public in 2017. The share received strong advance praise and initially recorded a pleasing share price development. However, the joy didn´t last long, because soon there were the first signs of stress. This did not stop the share price from soaring to over 160 EUR per share until the rose-colored glasses of investors were cleaned with bad news. The information on the restructuring concept published in March almost reads like a list of deficiencies for the management.

Experienced management does not even need much time to put a listed company on course for restructuring. After a failure in 2016, VARTA managed to go public in 2017. The share received strong advance praise and initially recorded a pleasing share price development. However, the joy didn´t last long, because soon there were the first signs of stress. This did not stop the share price from soaring to over 160 EUR per share until the rose-colored glasses of investors were cleaned with bad news. The information on the restructuring concept published in March almost reads like a list of deficiencies for the management.

VARTA reached an agreement with the financing banks and the majority shareholder on far-reaching restructuring measures. The short-term financing needs of the company are covered by a capital increase with gross proceeds of approximately 51 million EUR for VARTA. This amount is deemed to be sufficient to secure the further development of the company and enable its restructuring. The agreement also provides for an extension of the financing of VARTA until the end of December 2026 and changes the loan conditions. The restructuring includes an adjustment of production and structural costs, as well as investments in growth areas such as energy transition and e-mobility. Supplemented by measures to strengthen operations, this will create prerequisites for stabilizing the company. The measures also include cost savings in the personnel area.

At first glance, this sounds good. But wouldn´t it also make sense to strengthen controlling and corporate communication so that future problems can be identified earlier?

In any case, the restructuring did not dampen the optimism of shareholders. The share price is currently still almost at the level of the issue price at the IPO.

Pfeiffer Vacuum Technology AG: Major Shareholder Strengthens its Position

Pfeiffer Vacuum Technology AG concluded a domination and profit and loss transfer agreement between the company as the controlled entity and Pangea GmbH as the controlling company, with the consent of the Supervisory Board of Pfeiffer. Pangea is a wholly-owned subsidiary of Busch SE, which currently owns about 62.7% of the shares in Pfeiffer, while Busch SE owns an additional 0.96% of the shares in Pfeiffer.

Pfeiffer Vacuum Technology AG concluded a domination and profit and loss transfer agreement between the company as the controlled entity and Pangea GmbH as the controlling company, with the consent of the Supervisory Board of Pfeiffer. Pangea is a wholly-owned subsidiary of Busch SE, which currently owns about 62.7% of the shares in Pfeiffer, while Busch SE owns an additional 0.96% of the shares in Pfeiffer.

The domination and profit and loss transfer agreement requires the consent of the AGM of Pfeiffer, which is planned for May 2, 2023, and the consent of the shareholders of Pangea. In the agreement, Pangea is offering to acquire the shares of the outside Pfeiffer shareholders in return for a cash compensation of 133.07 EUR per share. The cash compensation corresponds to the volume-weighted average stock market price of 133.07 per share calculated by BaFin in the relevant three-month period up to and including November 5, 2022. In addition, the domination and profit and loss agreement provides for an annual recurring compensation payment for the outsid.

VIPsight - 1st Edition 2023

COMPANIES

Deutsche Börse AG: Testing the Limits

Good relationships with the supervisory authorities are particularly important for financial institutions. After all, financial institutions cannot operate without official approval. What is more, good standing with the regulators is important for the customers´ trust in the solidity of their business?

Good relationships with the supervisory authorities are particularly important for financial institutions. After all, financial institutions cannot operate without official approval. What is more, good standing with the regulators is important for the customers´ trust in the solidity of their business?

These considerations are probably not new for Deutsche Börse either. The current exchange of blows between the Clearstream subsidiary and BaFin is therefore all the more surprising. As early as April 2022, an increase in the underlying equity and the implementation of organizational changes were ordered. This was done following a special audit which revealed that the correctness of the business organization within the meaning of Section 25a (1) KWG in conjunction with Section 25h KWG at Clearstream was not given in all audited areas.

Something like this can happen. Correct mistakes, and move on? Not so much at Clearstream. Here, it looks like they place more value on a sustained stream of bad news. In January 2023, BaFin had to announce that it ordered Clearstream to ensure proper business organization under Section 25a (2) sentence 2 of the KWG and Section 45b (1) KWG. BaFin has also ordered Clearstream to report regularly to BaFin and the Deutsche Bundesbank on the progress made in remedying the deficiencies.

Perhaps the time has come to involve shareholders in this conversation and to explain what is (not?) happening here.

Hamburger Hafen und Logistik AG: Translation Help at the Terminal

COSCO Shipping Ports Ltd. (COSCO) is a major customer of Hamburger Hafen und Logistik AG (HHLA). Hence, it did not come as a surprise when the companies announced plans to intensify this partnership, including a minority stake in HHLA Container Terminal Tollerort. Given the strategic importance of port facilities, the German Ministry for Economic Affairs and Climate Action was also interested in this process. After all, the relevant question is why was such participation necessary at all if the parties only wanted to deepen the cooperation.

COSCO Shipping Ports Ltd. (COSCO) is a major customer of Hamburger Hafen und Logistik AG (HHLA). Hence, it did not come as a surprise when the companies announced plans to intensify this partnership, including a minority stake in HHLA Container Terminal Tollerort. Given the strategic importance of port facilities, the German Ministry for Economic Affairs and Climate Action was also interested in this process. After all, the relevant question is why was such participation necessary at all if the parties only wanted to deepen the cooperation.

The outcome of this discussion was concrete requirements for COSCO and HHLA if they wanted to proceed with the planned stake in the Terminal. The volume of the maximum investment was limited to 25%, and all strategic decisions shall continue to be made by HHLA. COSCO will not receive any exclusive rights at the Terminal, which is to remain open to container volumes from all customers. COSCO also will not get access to strategic know-how, while IT and sales data remain solely at HHLA´s responsibility.

This looks like a resilient foundation for the terms of the planned minority stake. However, it raises the original question again, this time from COSCO´s point of view. Leaving aside potential dividend income, what other benefits does the investment offer to COSCO? Perhaps this question has also been asked in CHINA. Hence, it didn´t come as a surprise when in early January COSCO made a mandatory announcement in Hong Kong that as of January 6th, 2023 the parties are still considering and discussing the with the Ministry to the conditions, and the non-objection certificate to be issued by the Ministry has not been issued yet.

Does this sound like an easy task to solve? At least HHLA still seems to think so. Given this optimism, one can only wish for speedy success.

SYNLAB AG: In Case of Doubt, send the Message out

Many companies wait until they can no longer avoid publishing bad news. Sometimes the problems solve themselves without any action on your part. And if this doesn´t happen, one at least had a little peace to prepare oneself very carefully for questions from the media and investor audience. Holding back the news is convenient, but it comes at a price. Investors learn quickly when the news comes very late. That leads to mistrust of the investor relations department, but also of the company and its business practice as a whole.

Fortunately, there are good examples of how to do it better, too. A recent SYNLAB release fits that bill. The company the Portuguese Competition Authority has initiated proceedings against, inter alia, two Portuguese entities of SYNLAB Group and has associated SYNLAB AG with the proceedings regarding potential violations of competition law in Portugal. The Authority has formally notified the respective objections. These concern the operations in the Portuguese market for laboratory diagnostics between 2016 and March 2022. SYNLAB will review the objections carefully and decide upon the next steps afterward. The estimated outcome of the proceedings, including the risk of a potential penalty being imposed on SYNLAB, cannot be determined before the completion of this review and progress in the proceedings.

Indeed, this is bad news for the shareholders. But it should be noted that the company decided to inform about the proceedings although it is not yet clear what the consequences of the process will be. Someone did their homework here.

Uniper SE: Time to say Goodbye

If there was one company in Germany that benefited massively from political windfall profits, then it must be Uniper. But political windfall profits also come at a price. This also includes the risk of a change in the political situation that the company cannot control.

If there was one company in Germany that benefited massively from political windfall profits, then it must be Uniper. But political windfall profits also come at a price. This also includes the risk of a change in the political situation that the company cannot control.

Putin´s hope of buying consent to wipe Ukraine off the map with cheap gas was dashed, as was Uniper´s business model. As a consequence, the company and its shareholders were suffering losses that could no longer be sustained. This resulted in a call for help to the state which could not resist this request given the company´s economic importance.

The result is a short message informing the shareholders that the company´s boards resolved on a capital increase using the Authorized Capital 2022 created by the general meeting on December 19th, 2022. The share capital shall be increased via the issue of new shares. Only the Federal Republic of Germany or a person specified in Section 29 (6) EnSiG is permitted to subscribe for the new shares. Time to say goodbye for the ordinary shareholder!

Rheinmetall AG: Supplied with 100% unreliability Guarantee

The Russian attack on Ukraine caused a remarkable change of mood in Germany in favor of armaments companies. Rheinmetall also benefited from this. No wonder, that the share price has soared since. As a result, many shareholders sat back and relaxed in the expectation of a pleasant Christmas.

The Russian attack on Ukraine caused a remarkable change of mood in Germany in favor of armaments companies. Rheinmetall also benefited from this. No wonder, that the share price has soared since. As a result, many shareholders sat back and relaxed in the expectation of a pleasant Christmas.

This pleasant situation was severely disturbed from November 18th. On that day, a drastic fall in the share price began, which deepened the following day. On December 19, shareholders also learned the reason for the share price disaster. The Ministry of Defense had presented a briefing on hardware and software problems with the Rheinmetall´s Puma tanks to the German parliament.

Doesn´t that look like a tough pre-Christmas work program for the German financial regulator BaFin?

Linde plc: Are European Standards too high for Linde?

Linde plc proposed an intercompany reorganization that would result in the delisting of Linde plc shares from the Frankfurt Stock Exchange. In this context, a new holding company would be created through an Irish scheme of arrangement and domestic Irish merger. Shareholders would receive one share of the new holding company to be listed on the New York Stock Exchange.

Linde plc proposed an intercompany reorganization that would result in the delisting of Linde plc shares from the Frankfurt Stock Exchange. In this context, a new holding company would be created through an Irish scheme of arrangement and domestic Irish merger. Shareholders would receive one share of the new holding company to be listed on the New York Stock Exchange.

The message addresses the background to this decision only indirectly. The management and board determined that shareholders of Linde plc have become negatively impacted by various factors associated with the stock being dual listed in the United States and Germany. The key clou can be found here:

“While the dual listing structure has served us well since interception, it has constrained our stock valuation through European restrictions in addition to incremental complexity.”

Some observers took this statement as a reference to the different multiples in major European and American Indices. But this idea is nonsense. The American indices enjoy a higher multiple due the large high-tech component. Linde is not set to become the next Apple, and one should not expect the Linde share to jump to a new level for this reason. What is different, though, are the corporate governance rules, and the regulations of the stock exchanges. Some of the European regulations are obviously more shareholder friendly. Some American regulations are more management friendly.

So it´s the fine print that count. Investors need to find out which essential cost-incurring regulations are no longer applicable when a stock market listing is abandoned and which investor rights are lost in the process. And finally, it is important to quantify the one-time cost of withdrawing from the American or European stock exchanges, and the risks of implementing a decision. Why is it that Linde has not yet announced these minimum information requirements for a decision on the proposal?

Leoni AG: A reliable Bad Luck Raven

There are some companies that seem to attract misfortune. Unfortunately, Leoni also belongs to this group. The qualification gives a sympathy bonus. But that doesn´t count on the capital market. But at least we can count the company among the regular guests in this category.

There are some companies that seem to attract misfortune. Unfortunately, Leoni also belongs to this group. The qualification gives a sympathy bonus. But that doesn´t count on the capital market. But at least we can count the company among the regular guests in this category.

In mid-December it was time for an update again. This time, Leoni informed that all closing conditions for the closing of the sale and purchase agreement entered on May 23rd, 2022 with STARK Corporation on the sale of the Business Group Automotive Cable Solutions have been timely fulfilled and that the closing was scheduled to occur shortly. However, STARK demanded on December 13th significant amendments to the purchase agreement. Despite willingness to compromise on the side of Leoni, STARK refuses to agree and will not perform the closing according to Leoni. From Leoni`s perspective, no grounds for non-performance of the closing exist, meaning that STARK is in breach of the contract.

From the outsider view, this looks like a typical poker game. The transaction is linked to the refinancing plan, which is the basis for the financing of the Leoni Group until the end of 2025. For this purpose, Leoni has already signed a comprehensive contractual documentation of the refinancing plan with its syndicate banks and borrower´s note holders on the basis of the agreement in principle reached in July 2022. An essential prerequisite for its implementation, however, is a partial repayment of financial liabilities with proceeds from the sale of the Automotive Cable Solutions Group. As a result of the non-performance of the contract by STARK, the refinancing plan cannot be implemented for the time being.

The syndicate banks have already declared (subject to customary approval processes) that they will temporarily extend the credit facilities maturing on December 31st, and Leonie indicated that it will take all measures to enforce its rights against STARK.

Voilá, the classic legal question: Who has more to lose if it takes longer?

flatexDEGIRO AG: Do they understand what they are doing there?

The general definition of a mistake is doing what you wouldn’t have done if you had realized what you were doing. flatexDEGIRO showed its shareholders how this works in its corporate announcement on December 3rd. At some point in November, the company learned of the results of a BaFin audit. Apparently, the importance of this information was only understood sometime later. The obtuseness is surprising.

The general definition of a mistake is doing what you wouldn’t have done if you had realized what you were doing. flatexDEGIRO showed its shareholders how this works in its corporate announcement on December 3rd. At some point in November, the company learned of the results of a BaFin audit. Apparently, the importance of this information was only understood sometime later. The obtuseness is surprising.

Earlier in the year, BaFin has conducted a special audit at flatexDEGIRO in accordance with section 44 of the KWG (Kreditwesengesetz), identifying shortcomings in business practices and corporate governance. As a result of the audit, BaFin will, among other things, impose flatexDEGIRO to ensure an appropriate business organization, and has issued temporary capital surcharges.

flatexDEGIRO claims that it has immediately initiated various measures to comply with the regulatory requirements, within a specified timeframe. The corporate news dated December 3rd seems to be the first outcome of these initiatives. As an outsider, one can only speculate about the status of the corporate governance at the company. Investors are warned to not take the processing time for the report on the BaFin examination as a proxy in this respect. Although probably ad hoc relevant, the publication of the audit results came a bit late, and the focus was not really on the content of the findings from the audit. However, the message also explained changes to the executive board. Let´s hope that these will help to improve the corporate governance, including a corporate communication suitable for the capital market.

ACTIONS CORNER

ADLER Group S.A.: Will this Bird ever fly again?

If you put it euphemistically, ADLER Group faces special challenges. Already the known corporate governance problems would be enough to overthrow the average market participant. However, the short-term securing of the company´s financing is much more important. Here, the bondholders are in the foreground.

If you put it euphemistically, ADLER Group faces special challenges. Already the known corporate governance problems would be enough to overthrow the average market participant. However, the short-term securing of the company´s financing is much more important. Here, the bondholders are in the foreground.

On November 25th, 2022, ADLER agreed with certain bondholders to effect changes to its notes. According to the agreement, ADLER would commence a consent solicitation process in respect of each series of its notes to implement the proposed changes. Under German law, a quorum for the bondholders representing at least 50% of the outstanding notes in terms of value and the approval by a majority of at least 75% of the voting bondholders to each series of notes is required for the implementation of the proposed changes. Due to the cross-conditionality of the proposed changes through a consent solicitation, if one series of notes fails to reach the 75% threshold, the proposed changes will not be effective for any other series.

The outcome of the voting was overwhelming support in favor of the consent solicitation with all series of notes but one. In other words, the first attempt failed. Accordingly, ADLER now has to go other ways to possibly reach the goal. A successful outcome is still achievable. But this requires a show running on the very edge of what is possible.

Brenntag SE: Nice that we talked to each other

Brenntag´s shareholders are probably not satisfied with the course of the share price in 2022. It was only in November that the share price recovered for a short time. But on the 25th this was over. On this day, Brenntag confirmed preliminary discussions with Univar Solutions regarding a potential acquisition.

This news was not well received by Brenntag´s shareholders. While the share price came under pressure, shareholders also publicly expressed their critical attitude towards these talks, including a request for the immediate cessation of this project. It is therefore not surprising that Brenntag gave in to this pressure. After all, a takeover also costs money. The redeeming message followed at the beginning of January. The company decided that it is no longer proceeding with these discussions.

It is always gratifying to see that companies listen to their owners. However, corporate communication that is comprehensible to the shareholders is occasionally just as important. After all, the acquisition could have been advantageous for the company´s development and shareholders. It´s a shame we didn´t find out.

GRENKE AG: With kind Regards to Fraser Perring

Activist investors perform an important task in the German market. Nevertheless, their effects are often underestimated. In fact, one can compare their role most closely with vultures in the field of corporate governance. Their main function is to identify problems, thus contributing to a cleaner capital market.

In the recent past, GRENKE AG was one of Fraser Perrings targets. But see where these attacks led. GRENKE decided to undergo substantial changes in its corporate governance, addressing a multitude of issues uncovered on this occasion. Two years later, the company achieved a top ranking in DVFA´s Corporate Governance Scorecard. Achieving 74.14% (2020: just under 52%) of the maximal number of points, GRENKE advanced to third place among a total of 64 assessed SDAX companies.

So as not to be misunderstood here: The price for this success was high. But the effort was essential for the company´s success.

People

CEWE Stiftung & Co. KGaA: Reverse Corporate Governance

Companies with a limited partnership structure also have corporate governance. The owners of the share-like limited partnership shares mostly have nothing to do with it, though. Instead, other people or companies are in control of these ventures. Sometimes, there can be surprising developments with these complicated constructions.

Companies with a limited partnership structure also have corporate governance. The owners of the share-like limited partnership shares mostly have nothing to do with it, though. Instead, other people or companies are in control of these ventures. Sometimes, there can be surprising developments with these complicated constructions.

If you withhold the corporate governance rights from the shareholders, they ultimately have to stay somewhere else. The result can look like this. CEWE Stiftung is a company with a limited partnership structure. The business of the company is managed by the Neumüller CEWE COLOR Stiftung.

The Board of Trustees of this entity decided on November 29th, 2022 to extend Dr. Rolf Hollander´s term of office as a member and in his function as Chairman of the Board of Trustees. This news was expected by many observers. But the same cannot be said of the further information published a few days later. The Board of Management of the Neumüller CEWE COLOR Stiftung had legal concerns about the conformity of the Board of Trustees' decision.

On January 1st, investors learned the result of this dispute. Following the examination of the vote on Dr. Hollander´s membership of the Board of Trustees, it became clear that the appointment was void according to too legal opinions. Thus, Dr. Hollander´s term of office at CEWE ended by the end of 2022, while the Management Board asked the state foundation supervisory authority to ensure that the Board of Trustees is properly reappointed to remain able to act.

The company was hit by an unexpected power struggle. So, it only remains to wish that the Management Board´s hopes will come true and that unity at CEWE could be restored through a new start in the Board of Trustees and the start of the new CEO, Ms. Yvonne Rostock in 2023.

Fresenius Medical Care AG & Co. KGaA: Wash my Fur, but don´t wet me

In May, it all sounded like a beautiful dream. The Supervisory Board of Fresenius Medical Care unanimously appointed Dr. Carla Kriwet to succeed Rice Powell as the new CEO of the company. Mr. Powell left the company after 25 years, including a full decade as CEO.

In May, it all sounded like a beautiful dream. The Supervisory Board of Fresenius Medical Care unanimously appointed Dr. Carla Kriwet to succeed Rice Powell as the new CEO of the company. Mr. Powell left the company after 25 years, including a full decade as CEO.

Just a few weeks after taking office on October 1st, Dr. Kriwet had to announce a revision of the earnings outlook. However, the press release was opened with the statement “I am excited having started to work for this great company.” That may have been the case at the time. But such statements are rarely found in a profit warning. Therefore, the announcement regarding Helen Giza to take over as CEO of Fresenius Medical Care was not entirely unexpected. After all, a lot can happen over the course of a month. Here, for example, significant strategic differences seem to have emerged within just a few weeks. Consequently, Dr. Kriwet decided to leave the company at her own request and by mutual agreement due to strategic differences.

Unfortunately, the press release did not explain the meaning of mutual agreement in this case.

Capital News

BAYER AG: Advances in Damage Control open up new Perspectives for Shareholders

The takeover of Monsanto by BAYER can confidently be classified as one of the biggest money burns in the German capital market. With this acquisition, BAYER bought reputation and legal risks, a business model with an operationally weakening business, and limited strategic perspectives in the agricultural business.

The takeover of Monsanto by BAYER can confidently be classified as one of the biggest money burns in the German capital market. With this acquisition, BAYER bought reputation and legal risks, a business model with an operationally weakening business, and limited strategic perspectives in the agricultural business.

But this is only a snapshot. What is more, one can just as well state that BAYER has managed to get at least a part of the purchased problems under control. While the operative business of the Group is still suffering from the consequences of the Monsanto acquisition, there has been positive news from the legal front for the first time in the past few months. For example, BASF´s claim against BAYER in connection with the sale of parts of BAYER´s agricultural business in 2018 was dismissed by the arbitrator. According to rumors at the time, BASF is said to have demanded 1.7 billion EURO plus interest. Even in times when losses for shareholders are inflated by the Monsanto acquisition, this is a considerable amount. In addition, management capacities are relieved by the elimination of this construction site.

All in all, it can be said that the legal risks for BAYER have become clearer. The transparency gained in this way draws more attention to the potential of the operative business. Manageable risks and unused strategic potential in the operative business arouse the interest of active investors. This brings us back to the well-known question: Does it make more sense to break up the conglomerate to raise values in the short term than to wait for a higher level of earnings from the operating business in the medium term? If the current group structure is to be defended, management must at least provide comprehensible evidence that the operative business will be able to produce stronger results in the future, with fewer risks and improved social acceptance.

So, the race has only just begun.

Drägerwerk AG & Co. KGaA: An Era comes to an End

For many years, German issuers used profit-sharing certificates to raise equity without corporate governance rights. Profit-sharing certificates securitize borrowed capital with equity-like features and can be traded like stocks. In the meantime, they have been largely superseded by a new legal construction, the share-like limited partnership shares (KGaA). These constructions are more interesting for issuers because they are considered “real” equity instruments despite severely restricted corporate governance rights.

For many years, German issuers used profit-sharing certificates to raise equity without corporate governance rights. Profit-sharing certificates securitize borrowed capital with equity-like features and can be traded like stocks. In the meantime, they have been largely superseded by a new legal construction, the share-like limited partnership shares (KGaA). These constructions are more interesting for issuers because they are considered “real” equity instruments despite severely restricted corporate governance rights.

Drägerwerk was the main remaining issuer of profit-sharing certificates was the main remaining German issuer of profit-sharing certificates outside the financial and media sector. The first issue dates back to 1983. In 2020, the company terminated all outstanding certificates under the terms and conditions. The last tranche was repaid at the beginning of 2023 (nominal), while the dividend-related final payment on these certificates will be made after the AGM 2023.

HELLA GmbH & Co. GmbH KGaA: This is what Vibrations sound like

When you hit a bell, there is a sound. When you hit a company, there is a flow of unexpected news. You can see how this looks like at HELLA.

When you hit a bell, there is a sound. When you hit a company, there is a flow of unexpected news. You can see how this looks like at HELLA.

In mid-December, the owners of the share-like limited partnership shares learned that the Management Board and the Shareholders` Committee of HELLA GmbH & Co. KGaA decided to propose to the AGM 2023, in addition to the distribution of a regular dividend a special dividend in the amount of 2.61 EUR per share. The company intends to distribute to its shareholders, including the holders of the limited partnership shares, the proceeds from the sale of its holding in HBPO Beteiligungsgesellschaft mbH.

This looks like a shareholder friendly initiative, thank you. Unfortunately, just a few days later the company also had to announce that the Shareholders´ Committee has agreed with two members of the Management Board to terminate the management contracts by mutual agreement. This is not the first top level change since the new major shareholder came on board. Are there any other material changes in the pipeline?

Bauer AG: Christmas Capital Increase cancelled at Short Notice

Everything looked so beautiful and the preparations were already well advanced. Probably even the Christmas party was planned down to the last cookie. But as we all know, the devil is in the details.

On November 18th, the Extraordinary General Meeting of BAUER voted to approve a capital increase, paving the way for an increase in the company´s share capital from 26.1 million no-nominal-value bearer shares, by up to 17.4 million new shares, against cash contribution.

The announcement of the capital increase added some reassuring information for shareholders. The main shareholder Doblinger Beteiligung GmbH, which at the time held 30% of shares and voting rights according to the last voting right communication, had declared its willingness in participating in the capital increase to a significant extent. Also, SD Thesaurus GmbH, a company in which Ms. Sabine Doblinger has significant holdings, committed under a subscription and purchase agreement to acquire all new shares that are not subscribed for by other shareholders up to a maximum total of 70 million EUR.

This positive news was accompanied by the additional information that the Executive Board had no information as to whether and to what extent the Bauer family, which at the time held 36.03% of the shares in BAUER AG, would exercise its subscription rights as shareholder in the course of the capital increase.

So far, so good. But on December 19th the unpleasant mess followed. The Executive Board decided to suspend the planned capital increase for the time being. To the company´s knowledge a legal action has been filed with the Munich Regional Court I by a shareholder against the resolution of the Extraordinary General Meeting to increase the company´s share capital against cash contributions. Consequently, the subscription period for the rights issue could not begin as planned on December 22nd and had to be postponed for an as yet indefinite period.

TUI AG: Making a clean Sweep

For a while it looked as if TUI would also perish in the COVID maelstrom. However, these voices underestimated the industriousness of TUI and the depth of the government´s coffers. Meanwhile the worst is over and it is time to come to terms with the past. For TUI this means above all the repatriation of the aid money.

For a while it looked as if TUI would also perish in the COVID maelstrom. However, these voices underestimated the industriousness of TUI and the depth of the government´s coffers. Meanwhile the worst is over and it is time to come to terms with the past. For TUI this means above all the repatriation of the aid money.

Mid-December, TUI announced that it has concluded an agreement with the German Economic Stabilization Fund (“WSF”) on the repayment of stabilization measures. This agreement regulates the intended termination of the stabilization measures by means of a right of the company to

- Repayment of the contribution made by the WSF as a silent partner in January 2021 (€420 million), and

- Repurchase the warrant-linked bond 2020/2026 issued by the company to WSF (€57.7 million as well as 58,674,899 option rights),

until December 31st, 2023, at a repayment price of €730,113,240, plus interest accruing until repayment under the stabilization measures.

Under the repayment agreement, TUI is also obliged, to the extent permitted by law, to propose to a General Meeting of Shareholders a reduction in the company´s share capital from currently approx. € 1.785 billion to approx. € 179 million by consolidating shares at a ratio of ten to one.

The amount of the reduction of approx. € 1.606 billion will be allocated to the capital reserves and will not be distributed to shareholders. Furthermore, the company is obligated under the repayment agreement, to the extent permitted by law, to use its best efforts to implement a rights issue capital increase from the authorized capital, the proceeds of which shall be used to finance the repayment of the WSF.

The invitation to the Annual General Meeting, including the full agenda and the corresponding resolution proposals, is expected to be published in the German Federal Gazette (Bundesanzeiger) and on the company´s website at the beginning of January 2023.

The measures come much faster than expected. We will therefore keep our fingers crossed that all shareholders already have the funds required available to participate in the capital increase.

VIPsight - 2nd Edition 2022

COMPANIES

Uniper SE: Like a wounded Dinosaur

Maybe everything would have turned out differently if Putin´s Blitzkrieg Strategy had been successful. The resistance of the people in Kiew not only saved them from this fate but also emphasized the particular risk in dealings with totalitarian systems.

Maybe everything would have turned out differently if Putin´s Blitzkrieg Strategy had been successful. The resistance of the people in Kiew not only saved them from this fate but also emphasized the particular risk in dealings with totalitarian systems.

At least Uniper now has a better idea of what kind of material the good profits in its gas business were made of. In June this year, the company withdrew its outlook for the financial year 2022 regarding the adjusted EBIT and adjusted net income. In addition, the company expected EBIT and adjusted net income for the first six months of 2022 to be significantly below the respective last year´s figures.

Uniper blames Gazprom for this misery. Since June 16th, 2022, Uniper has received only 40% of the contractually committed gas volumes from Gazprom. Consequently, Uniper had to procure substitution volumes at significantly higher prices. Since the company cannot yet pass on the resulting additional costs, it has to carry significant financial burdens. At the same time, Uniper warned of risks from the “geopolitical situation”, as well as the duration and scope of Russian gas supply restrictions. In particular, Uniper mentioned that gas price developments are difficult to assess at present. Amidst this background, Uniper entered into discussions with the German government on possible stabilization measures, including equity investments.

Political risks are always difficult to assess for outsiders. But the fact that Russia is at war with Ukraine should have been noticed in Essen by 2014 at the latest. The supply of gas from Russia has depended on the political goodwill of the Kremlin and its mastermind Putin. Two questions follow from this. What has Uniper´s management done to regionally diversify the gas supply and reduce the risk factor Russia, and how was this political risk presented to shareholders in the company´s reports? So that might become expensive, once the dust settled.

Allianz SE: “Hoffentlich Allianz-versichert!“

Allianz SE informed that its indirect subsidiary Allianz Global Investors U.S. LLC (AGI) has entered into settlements with the U.S. Department of Justice and the SEC in connection with the Structured Alpha “matter”. According to the resolution with the Department of Justice, AGI will plead guilty to one count of criminal securities fraud, and the SEC resolution establishes that AGI violated U.S. securities laws. These settlements fully resolve the U.S. governmental investigations of the Structured Alpha “matter” for Allianz.

Allianz SE informed that its indirect subsidiary Allianz Global Investors U.S. LLC (AGI) has entered into settlements with the U.S. Department of Justice and the SEC in connection with the Structured Alpha “matter”. According to the resolution with the Department of Justice, AGI will plead guilty to one count of criminal securities fraud, and the SEC resolution establishes that AGI violated U.S. securities laws. These settlements fully resolve the U.S. governmental investigations of the Structured Alpha “matter” for Allianz.

The Statement of Facts accompanying the resolution states that the criminal misconduct was limited to a handful of individuals in the Structured Products Group of AGI who are no longer employed by the company and that the Department of Justice´s investigation did not otherwise find any knowledge of, or participation in, the misconduct at Allianz SE or any other entity of the Allianz Group.

Allianz SE also informed that it has signed a Memorandum of Understanding to enter into a long-term strategic partnership including a transition of AGI´s investment management activities with currently approx.. USD 120 billion in assets under management in scope to a new partner in the US. The transferred activities do not include any part of the Structured Products Group, which has previously been dissolved. As consideration for the transfer, Allianz Global Investors would receive a stake in the enlarged entity and long-term, global, cross-distribution agreements.

In connection with the settlements, AGI will pay a forfeiture of USD 174.3 million to the Department of Justice, and USD 675 million as a penalty to the SEC that may be used in some part as compensation for investors. Other monetary obligations addressed by the Department of Justice and the SEC have been or will be satisfied by the approximately USD 5 billion in compensation paid to Structured Alpha investors.

ADLER Real Estate AG: Another Opportunity missed

We have heard a lot from ADLER Real Estate in recent months. Even the last doubter should have understood by now: this company is still alive, and it is defending itself against the allegations made.

We have heard a lot from ADLER Real Estate in recent months. Even the last doubter should have understood by now: this company is still alive, and it is defending itself against the allegations made.

When assessing the effectiveness of measures implemented, one has to keep in mind that the governance structure of the group offers an ideal breeding ground for short sellers. The structure is complicated, intransparent, and full of unfinished corners. On the other hand, this is at least partly due to the company´s rapid growth, in which the optimization of parts was perhaps more important than the efficiency of the whole. Measures to improve the corporate structure, such as the planned squeeze out of the shareholders of ADLER Real Estate AG, are therefore particularly interesting for investors.

Adler Group S.A. submitted a formal request that an extraordinary general meeting of ADLER Real Estate shall resolve to transfer the shares of the minority shareholders to Adler Group for an appropriate cash settlement. Adler Group currently holds approximately 96.72% of ADLER Real Estate´s share capital. The extraordinary EGM is expected to be held towards the end of 2022.

Buhlmann's Corner

Stories - that life wrote.

"If history repeats itself, and the unexpected always happens, how incapable must Man be of learning from experience."

George Bernard Shaw

When Ruhrgas was still ruled by Burckhard Bergmann and headquartered in Essen, the energy world was still in order - the business model was cutthroat then as now, though it was in line with the political credo of those years. Blessed by a ministerial permit and showered with purchase price/money. Ruhrgas was the pride of a whole nation, ended up with the people's share VEBA in E.on and was integrated into UNIPER at its 2nd rebirth to make it prettier.

The Finnish Fortum wanted to take over UNIPER also because of the gas wholesale and was still arguing with the relevant activist shareholders of the so-called special situation: there came Putin, the gas tap and the end of an era with Russian gas wholesale. Not only ex-Chancellor Schröder sat in soft Russian manager chairs - but it was Schröder who, without cooling-off in the Chancellery, took out a billion-euro guarantee for North-Stream, only to end up in an executive position with the borrower the next day. At that time hardly anyone was bothered, today no one really wants to know. According to its own understanding and its abbreviated name, Ver.di is a "service" trade union - I have not yet found out for whom it provides services apart from the respective chairperson. A Frank Bsirske was elected in November 2000 in Hanover as an "accident" and led a strike of fire brigade workers at Frankfurt airport in winter 2002. With little use of strike funds, he paralysed the airport. As he was at the same time vice-chairman of the supervisory board of Deutsche Lufthansa - which lost many millions in shareholder assets in the strike - VIP ... called on the AGM 2003 not to discharge this supervisory board member Bsirske: he is one of the rare examples of DAX supervisory board members who have not been discharged. Christine Behle has taken this story to heart. With a 6-figure salary, she is deputy chairperson of the Lufthansa supervisory board, without having previously pursued a job to earn a living other than in the union hall. In her role as vice-boss of ver.di, she unleashes a 27-hour so-called warning strike on the peak of Lufthansa operations in Frankfurt and Munich. She ruins a large part of Lufthansa's reputation, destroys trust, 1,000 cancelled flights and 134,000 (or more - who counted them?) stranded Lufthansa customers. So far she has not resigned, she is not fulfilling her legal duty to avert damage to the company and, presumably as a child of the 1968s, she is dreaming of a re-election at the Annual General Meeting on 10 May 2023. That's the arrogance of self-serving functionaries who mistake conflicts of interest as an award.

Instead of castigating the operational executive management for mistakes of the past years, such functionaries should first present their constructive criticism in hard times. And if they cannot do the one but do the other - then they should at least have the decency to resign. One can only hope that Klaus-Michael Kühne will be man enough to reproach Christine Behle for this and give her a fair chance to mend her ways by not discharging and not re-electing her.

Hegel remarked somewhere that all great world-historical facts and persons happen twice, so to speak.[1] He forgot to add: one time as a tragedy, the other time as a farce.

|

= deutsche Text-Version weiter unten =

2003 AGM Deutsche Lufthansa AG Agenda Item 4: counter-motions

Ladies and Gentlemen,