Welcome to VIPsight Asia - China

|

|

| Christine Chow |

1 February 2022

SPAC backed by Chinese brokerage CMB International becomes first to file for Hong Kong listing, under new regime for blank-cheque companies

The South China Morning Post reports that SPAC backed by Chinese brokerage CMB International becomes first to file for Hong Kong listing, under new regime for blank-cheque companies: https://www.scmp.com/business/banking-finance/article/3163778/spac-backed-chinese-brokerage-cmb-international-becomes. “A special purpose acquisition company (SPAC) sponsored by the asset management arm of Chinese brokerage CMB International has applied to float its shares in Hong Kong, becoming the first to test a new listing regime which became effective this month. Acquila Acquisition Corp will offer shares at HK$10 each (US$1.28), it said in a heavily-redacted draft prospectus filed with the stock exchange on Monday. […] The city will only allow large SPACs that raise at least HK$1 billion (US$128 million) to list on its main board, the highest requirement among all exchanges.

24 August 2020

Corporate Governance in Mandarin: shareholders are welcome ... to pay for entrance:

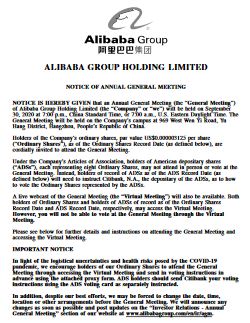

To log into the Virtual Meeting, you will need a unique 16-digit control code, which the holders of ADSs received in the mail and holders of Ordinary Shares can obtain by calling the international toll number mailed to you together with this Notice of Annual General Meeting. With your 16-digit control code, you will be able to submit questions through theVirtual Meeting prior to the meeting and in real-time during the meeting. Due to the timelimit, only selected questions submitted through the Virtual Meeting will be answered at the General Meeting.

find here downside on page 3 <click here>

20 August 2016

Alibaba Group Announces June Edition 2016

“We delivered excellent results this quarter. The 59% revenue growth for the company overall and the 49% revenue growth of our China retail marketplaces represent the highest growth rates we’ve achieved since our IPO,” said Maggie Wu, Chief Financial Officer of Alibaba Group. “We passed an important milestone this quarter in achieving higher monetization of mobile users than non-mobile users for the first time, reflecting the success of our strategy to stay ahead of the curve by embracing mobile.

Total revenue YoY growth of 59% was driven by accelerated revenue growth of China commerce retail, robust growth of Cloud Computing, strong monetization of UCWeb users and acquisition of Youku.

Core commerce earnings before interest, tax and amortization was RMB16,624 million (US$2,501 million), an increase of 38% year-over-year, representing an adjusted EBITA margin of 61%. Non-GAAP diluted EPS was RMB4.90 (US$0.74), an increase of 33% year-over-year.

25 June 2015

The Principles of Responsible Ownership is Vital to the “Maturing” of Markets

On 2 March 2015, The Securities and Futures Commission (SFC) launched a three-month consultation on proposed Principles of Responsible Ownership which provide guidance for how investors should fulfil their ownership responsibilities in relation to their investment in a listed company.

The seven principles of responsible ownership ask investors:

- To establish and report to their stakeholders their policies for discharging their ownership responsibilities;

- To monitor and engage with their investee companies;

- To establish clear policies on when to escalate their engagement activities;

- To have clear policies on voting;

- To be willing to act collectively with other investors when appropriate;

- To report to their stakeholders on how they have discharged their ownership responsibilities; and

- When investing on behalf of clients, to have policies on managing conflicts of interests.

The following article was published in the Hong Kong Economic Journal on 2 June 2015.

HIGHLIGHTS:

- Institutional investors increasingly use index / passive funds as a low cost alternative for gaining beta exposure. Engagement with constituent companies is not a choice but a necessity .

- Engagement to reflect Responsible Ownership is a two-way process – the executive management team of companies is of course accountable for the decisions they make and the company’s performance; investors should also exercise stewardship; communicate realistic expectations and apply sanctions when necessary. There should be a channel for continuous dialogue to better understand the challenges and opportunities of the business, and how and why management make certain strategic and tactical decisions.

- The Principles of Responsible Ownership have a practical function in stablising a turbulent market through better disclosure, enhanced transparency and therefore positive stakeholder communications – which lead to a better understanding of the different perspectives of companies and shareholders.

- There have been discussions on the “A-sharisation” of the Hong Kong market, reflecting a short term oriented investment culture where majority of market participants are retail oriented and/or less sophisticated, who tend to act on rumours. Unexpected company events may lead to a downward spiral of irrational buy/sell actions. In the worst case, the market loses its function in adequately pricing securities.

- Enhancing investor confidence through responsible ownership initiatives reduces unnecessary transaction costs induced by market sentiment.

by

This email address is being protected from spambots. You need JavaScript enabled to view it.

11 December 2014

Shanghai-Hong Kong Stock Connect – a new beginning or a false dawn for corporate governance in China?

Studies

Two recent studies, one by the Asian Corporate Governance Association (ACGA) and broker CLSA (September 2014) and another by Institutional Shareholder Services (ISS) (November 2014), suggest that for the Stock Connect to live up to its expectations corporate transparency and disclosures need to be improved in China and – more fundamentally – the way state-owned enterprises (SOE) are run needs to be reformed.

The ACGA study scored 11 Asian markets based on their corporate governance framework and practices. China, with a score of 45 out of a possible 100, was ranked ninth followed only by the Philippines and Indonesia. In spite of slight improvements, China’s score slipped in some categories relative to other markets, highlighting that it remains a market with weak corporate governance. In comparison, Hong Kong and Singapore ranked joint first in the study, scoring 65 and 64 respectively.

The ISS study, which included a survey of institutional investors, confirmed the results of the ACGA study and demonstrated the practical impact of China’s poor corporate governance. Indeed, one of its key findings is that concerns about corporate governance are the main reason for not investing in China. While corporate governance may have been widely interpreted in the study, according to the research, investors are clearly worried about the lack of transparency, related-party transactions (RPTs) and share issuances without pre-emption rights.

Need for reforms

What needs to happen? First and foremost, there needs to be a push for more corporate transparency and better disclosures as well as improved communications between companies and investors. This is particularly important with regard to RPTs and capital measures.

Secondly, the government has to push on with reforms of SOEs. The high-level announcements following the third plenum of the 18th National Congress of the Communist Party of China in November 2013 were encouraging. The overall ambition seems to be to reduce the role of the government in listed entities. The role of the State-owned Assets Supervision and Administration Commission is expected to change from one of a close supervisor of SOEs to more of a manager of capital. However, progress on the reforms appears slow. The sluggish start of the Stock Connect may send a powerful message to the government that more momentum is required.

It will take more than a trading link between Shanghai and Hong Kong to boost the attraction of the mainland’s A-share market and improve corporate governance practices. However, the new link presents a crucial part of the infrastructure required to facilitate change over time.

VIPsight Archives Asia - China

2 August 2012

Insider Trading in China: Tackling Structural Problems through Governance in Function

Given all the hype around insider trading scandals, it is difficult to imagine that it was not illegal in most countries until the mid-1990s (Bhattacharya and Daouk 2002). It is now a common challenge facing regulators worldwide. Whilst China established its main exchanges (Shanghai and Shenzhen) in 1990, with insider trading laws introduced in 1993, enforcement, defined as the first prosecution in the country, did not take place until 2003 (Huang 2006: 50). In comparison, Germany introduced insider trading laws in 1994, one year later than China, but the first prosecution took place in 1995.

In July 2012, we witnessed some high profile insider trading scandals involving Chinese firms – on 27 July 2012, the Securities and Exchange Commission (SEC) of the United States froze US$38 million of assets owned by individuals who may have profited from the purchases of Nexen’s shares, an acquisition target of China National Offshore Oil Corporation (CNOOC), one of the largest oil and gas companies in China 1).

Three days later, the SEC announced that charges had been made against a New York based fund manager who had illegally profited from a Chinese reverse merger 2). This followed the prosecution of six individuals who made more than US$9 million on a company being taken private in April 2012 3). It looks like the US regulator is keeping a keen eye on Chinarelated deals.

This does not mean that the China regulator has been idle. Since 2010, the China Securities Regulatory Commission (CSRC) has investigated a total of 122 insider trading cases (as of May 2012), in which administrative sanctions have been imposed in 21 cases, and 36 cases have been referred to judicial authorities.

I recently spoke with the chairman of the corporate governance committee of a Chinese state-owned enterprise with a market capitalisation of HK$100 billion (US$13 billion). He asked how the company could implement good governance. My first question was whether he wanted to achieve governance in form or in function.

To achieve governance in name, understanding the relevant corporate governance codes, disclosure requirements, reporting guidelines, and ensuring compliance with these is sufficient. After all, many governance rating companies assess the governance quality of a company through such structural compliance. However, to achieve governance in function is much more difficult. It involves getting the disclosure and compliance ‘ingredients’ to work, to yield results – using the right ingredients does not guarantee delicious gourmet cuisine – the flavour interactions between these ingredients makes all the difference. Not having the right ingredients would however certainly impede the making of a well-governed company. We then proceeded to discuss more specific engagement measures.

Achieving governance in function in China is more important than in many countries because most Chinese companies are state- or family-owned conglomerates, which explains why nearly half of the investigated and prosecuted cases in China are related to M&A and restructuring involving family groups and government officials 4).

This legacy shareholding structure is not conducive to good governance; insider trading thrives in a cosy, clubby atmosphere, with controlling shares highly concentrated in the hands of a few. In addition, the lack of a whistle blowing culture helps to form an incubator for insider trading and related party transactions, as witnessed in the aforementioned cases.

Structural issues are a bottleneck, but this does not mean that soft infrastructure cannot be put in place to reduce their negative impact. So where do we begin? In terms of getting the right ‘ingredients’ to address insider trading, the CSRC has released the Provisions for Establishing a Registration and Administration System for Persons with Insider Information in Listed Companies on 25 November 2011.

The Provisions cover the registration and verification of insiders, signing of confidential agreements, reporting procedures, disclosure responsibilities, self-assessment of transactions in company stock and related derivatives, and the rights of regulators to conduct administrative investigations. What appears to be lacking however, is the measures to induce ‘flavour interactions’, such as whistle blowing procedures and protection for the informer; a direct hotline to contact relevant authorities who could carry out investigations, prosecution within a clean and coordinated framework; and a website to which informers could upload sensitive information, including photos, audio and videos, before it is intentionally destroyed by others.

These measures are catalytic by nature as they send a clear signal that disclosure and reporting does not have to come from company management (which appears to be the case in the Provisions), but from company stakeholders who could provide correct and relevant information in a timely manner. By the time the company’s management file an official report, the authorities may have already lost critical time for independent investigation.

Some suggest that Confucian culture is one reason why there is no whistle-blowing culture in China (Hwang et al 2008), but the reasons given such as fear of retaliation and media coverage do not seem Chinesespecific; even guanxi is really just a Chinese translation for the word “connections”, which exist anywhere when people of different levels of closeness and connectedness are involved.

Looking on the bright side, we are beginning to see some evidence of effective enforcement and innovation in insider trading laws in China. Getting the right “ingredients” in place is a step in the right direction.

1) SEC public announcement 2012-145. Available at: http://www.sec.gov/news/press/2012/2012-145.htm. Accessed 31 July 2012.

2) SEC public announcement 2012-146. Available at: http://www.sec.gov/news/press/2012/2012-146.htm. Accessed 1 August 2012.

3) SEC public announcement 2012-54. Available at: http://www.sec.gov/news/press/2012/2012-54.htm. Accessed 1 August 2012.

4) Xu Z 2012 Insider Trading shakes the Foundation of China’s Securities Market People’s Daily 25 May 2012. Available at http://www.csrc.gov.cn/pub/csrc_en/newsfacts/release/201207/t20120718_212859.htm. Accessed 1 August 2012.

Reference

Bhattacharya, U. and Daouk, H. (2002) The World Price of Insider Trading Journal of Finance Vol. 57 (1) 75-108.

Huang, H. (2006) International Securities Markets: Insider Trading Law in China. Kluwer Law International: The Netherlands.

Hwang, D., Staley, B., Chen, Y. T. and Lan, J. S. (2008) Confucian Culture and Whistle-Blowing by Professional Accountants: An Exploratory Study Managerial Auditing Journal 23(5): 504-26.

Author: Christine Chow