VIPsight - April 2010

COMPANIES

Telekom adopts a female quota

By the end of 2015 30% of middle and senior management posts in Deutsche Telekom worldwide are to be occupied by women, the board of Germany’s biggest telecommunications group decided in March. Currently, the 60 top managers include only two women. There are none on the board, and on the supervisory board there are only three women, as representatives of the employee side. In middle and lower management, the female proportion is currently 16%, while 32% of employees are female. The firm’s boss René Obermann calls the voluntary female quota “not some dictate of misunderstood equalization, but a solid necessity.” The group was thus also responding to the failure of years of measures to date to promote women, which were honourable and well meant, but unfortunately remained unsuccessful, admitted personnel director Thomas Sattelberger. In order to reach the binding quota group-wide in future, for new appointments of graduates, in selection processes, talent pools and management development programs at least 30% of applicants will have to be female. The quota is flanked by programmes to make family and job compatible. The range of job accompaniments is to be extended to parental time models, part-time models for management, flexible-hours models and child-care possibilities. By the binding quota, the DAX firm is responding to the threatening fight for scarce talent in an ageing society and seeking to stop up the specialist gap. The German economic research institute (DIW) finds that the female proportion in the top storey in Germany currently reaches a bare 2.5%.

Qatar wants a second seat on the VW supervisory board

Last year the Emirate of Qatar came to the aid of Stuttgart luxury carmaker Porsche when it was threatened with collapse because of over-indebtedness in consequence of a failed attempt to take over Volkswagen. The Arabs took a share in Porsche Finance Holding and took over most of the options for VW shares. As a counterpart the investor was promised a second seat on the VW supervisory board. The business newspaper “Das Handelsblatt” reports from VW supervisory board circles that the Emirate is now demanding this second seat. The Lower Saxon state government confirmed this move to Handelsblatt. At VW’s AGM on 22 April, initially Hussain Ali Al-Abdulla, manager of the Qatar holding company, will replace Roland Oetker on the supervisory board. Behind the scenes, speculations are now about who will have to vacate a seat for the second Qatar appointee. In particular, the two owning families Porsche and Piёch each fear being in a weaker position than the other clan if one of their people has to step down. The two families are therefore pushing for one of the independent members such as RWE manager Jürgen Großmann, ex-E.On manager Hans Michael Gaul or TUI CEO Michael Frenzel to go. In the new set-up the two clans hold up to 35% of the shares. The VW Act gives Lower Saxony two supervisory board seats.

Bilfinger Berger becomes an SE

On the agenda for the annual general meeting of construction group Bilfinger Berger on 15 April, alongside such points as a share buyback is the conversion of the company into a Societas Europaea (SE). By autumn the MDAX firm will according to its timetable have taken this new form. At the same time the supervisory board is being reduced from its present 20 members to 12. Financial Times Deutschland (FTD) names Hans Bauer, Horst Dietz and Rudolf Rupprecht as possible candidates to vacate their places at the boardroom table.

In the meantime, the Mannheim construction giant has, against the background of accusations that the group had done shoddy work building the underground railways in Cologne and Düsseldorf and on other projects, set up two expert panels. The first group is to take a look at quality management within the group. The second will study current and completed specialized underground constructions with similar bearing structures to those used in the Cologne and Düsseldorf undergrounds. Both expert panels will report to technical director Prof. Hans Helmut Schetter. “Depending on the results, we will take measures to keep our quality guarantees in future above any doubt again,” says CEO Herbert Bodner. Even though the question of guilt for the collapse of the Cologne City Archives has not yet been fully cleared up, Bodner stressed that any financial repercussions were under control. The group was well insured, said the CEO of Germany’s second biggest construction group. Nor had the accusations affected the balance sheet for the past year. Even the final result for 2010 would not be lastingly affected by retroactive improvements and possible construction delays, Bodner promised.

EADS loses major order

European aerospace group EADS is being squeezed at several points at once. First, there are the disputes over the A400M cargo plane. While this military aircraft is to be built, the Airbus military division (AMSL) is currently in a clinch with the Europrop International (EPI) consortium, which is to build the Western world’s most powerful propeller propulsion unit. The two parties are accusing each other of delaying the project, and making damage claims: AMSL for €500 million and EPI for some €425 million. Complicating all this is the fact that EADS subsidiary Airbus was unable to succeed with the US military in the tender for the supply of tanker aircraft. Because of political pressure, the bidding period for the 35-billion-dollar order is being extended, but the documentation required for it under US competition law can hardly be produced in good time. Additionally, Italian tax authorities are currently looking into whether the EADS space subsidiary Astrium in Italy has to pay arrears of tax. Italian public prosecutors decided in late 2009 to start proceedings for attempted fraud and failure to submit a tax declaration. Neither the date nor the amount of the claim are known.

In the meantime, the loss position is also having its effect on shareholders. In 2009 EADS registered net losses of €763 million. Shareholders are to get no dividend this year.

Metro clears the decks

The wholesale and department-store group Metro is splitting up its core business, the wholesale division Cash & Carry. In future the segment will be divided between two business units: Europe/MENA (Middle East and North Africa) on the one hand, and Asia/New Markets on the other. Management and administrative functions of the group holding company Metro AG and of Metro Cash & Carry are also to be largely integrated, thus considerably simplifying management organization. This will probably mean lost administrative jobs. The new structure is intended in particular to take advantage of growth opportunities in Asia and Russia and improve the flagging German business. In the course of group restructuring, the DAX group could hive off its department store subsidiary Kaufhof and in the medium term also get rid of grocery division Real, say industry observers, according to Financial Times Germany (FTD). In the medium term the result before special factors is expected to grow by at least 10% a year.

Deutsche Post loses its tax privilege

On 5 March the Bundestag removed Deutsche Post’s turnover-tax privilege as from 1 July. In future the Post as universal service provider as a letter carrier for commercial customers will, like its competitors, be subject to VAT. Service to private customers can continue to be offered tax free. The former monopolist’s CEO Frank Appel objected to removing the privilege, saying the draft law was in contradiction with EU law, which says countrywide letter services for private and business customers are in general to be VAT exempt. He said nothing about possible legal steps.

Adidas in future to issue personal shares

Adidas is to resolve at the AGM on 6 May to convert shares in the sports goods producer from bearer to personal shares. “It will be easier to find out who our shareholders are and to keep in touch with them,” says Financial Times Deutschland (FTD), citing an Adidas spokeswoman. Currently the proportion of non-localized shareholdings at Adidas is around 29%. Around half the DAX firms now have personal shares. In 2009 Bayer and in 2008 E.On shifted to this type of share.

HeidelCement wants onto the DAX

At latest by autumn 2010, the Heidelberg building-materials giant wants to come into the DAX. This was announced by CFO Lorenz Näger while presenting the latest figures for 2009. Dispersed holdings in the MDAX company had grown, and with it the interest of investors and analysts, the company indicated. In terms of dispersed holdings and market capitalization, HeidelCement, he said, already met the criteria for being in the DAX. By the end of May the exchange-turnover hurdle should be passed.

New company has MDAX chances

Kabel Deutschland AG, hived off from Deutsche Telekom in 2003, was the biggest IPO of a company in Germany for two years. The firm, listed in Prime Standard for the first time on 22 March, runs cable networks and offers services in the areas of television and telecommunications. In its IPO, the selling shareholder, Cable Holding SA, started by offering 45 million units, with a further 6.75 million as an additional allotment. The offer was then cut to 30 million units with a further 4.5 million as a greenshoe (over-allotment option). The shares were offered in a price range of €21.50 – €25.50, and the issue price then set at €22.00. Kabel Deutschland is regarded as a candidate for the MDAX in the medium term.

Singulus joins the TECDAX

At the regular review of the indexes, bioanalytics group Rofin Sinar had to give way to optical storage medium maker Singulus Technologies in the technology index. The change is effective from 22 March 2010. There were no changes in the DAX or MDAX.

Salzgitter takes over Klöckner-Werke

In March 2007 Salzgitter came into Klöckner-Werke, taking 85%. This has since risen to 95.78%, enough to allow a squeeze-out at the filling and packaging technology group. The majority shareholder is offering the requisite minimum of €14.33 per share certificate. The general meeting, which still has to formally vote on the squeeze-out, is likely to be held in August.

Squeeze-out by Munich Re

In May, shareholders of the ERGO insurance group are to decide on the squeeze-out by Münchener Rückversicherungs-Gesellschaft (Munich Re). Munich Re set the cash payment at €97.72 on 2 March. The shareholder vote is scheduled for 12 May.

Wirecard like a yo-yo

Because of mysterious information, the Wirecard share collapsed for a while by over 30% and its exchange value fell, according to the FTD, “by some 240 million euros”. What started this off was a report by information service Gomopa on the convolutions on a money-laundering scandal in Florida. Additionally, according to a report in the Süddeutsche Zeitung, there is a criminal information before Munich public prosecutors saying that unlawful money transfers were processed through the Wirecard bank. The Handelsblatt then did some research and found that the report in a local Florida newspaper cited as a source by Gomopa did not exist; the on-line service had also, on request, deleted the reference to the local paper. Additionally, the reporter in Florida admitted on inquiry that Wirecard was not mentioned in the report. The anonymous denunciation received by Munich public prosecutors would certainly be looked into, but so far no investigations had been begun. Handelsblatt cites one analyst as saying that the Wirecard share had been “manipulated for weeks”. “Short-sellers were playing at yo-yo with the Wirecard share“. Wirecard itself rejects the accusations and has hired a law firm.

Buhlmann's Corner

Chance or Money Governance?

Stefan Ortseifen, till July 2008 CEO of IKB Industrie Kreditbank AG, Lehman Brothers’ German little brother, is being dragged through the streets and the media as a symbolic figure for the financial crisis. In fact, he was being pushed by the system, whose weaknesses were enthusiastically accepted and blown up as “German silly money” by the apparatchiks. In fact, all the controls in the system (government watchdogs, regulators, supervisory boards and shareholders) failed miserably. Is it, then, the Deutsche Bank’s “fault” if on 26 July 2007 it poured a glass of tea down the tenor’s throat and thus made the monetary whirlpool start to gargle and stutter – first at IKB and then in the rest of the world? ... or was it just by chance that it was the Deutsche Bank?

Stefan Ortseifen, till July 2008 CEO of IKB Industrie Kreditbank AG, Lehman Brothers’ German little brother, is being dragged through the streets and the media as a symbolic figure for the financial crisis. In fact, he was being pushed by the system, whose weaknesses were enthusiastically accepted and blown up as “German silly money” by the apparatchiks. In fact, all the controls in the system (government watchdogs, regulators, supervisory boards and shareholders) failed miserably. Is it, then, the Deutsche Bank’s “fault” if on 26 July 2007 it poured a glass of tea down the tenor’s throat and thus made the monetary whirlpool start to gargle and stutter – first at IKB and then in the rest of the world? ... or was it just by chance that it was the Deutsche Bank?

Siemens is the exemplary mega case, and MAN, Daimler, Ferrostaal & Co are only dominos – and there are still 27 to go until the end of the DAX. “Then it got too tight for them in the DAX, so the SEC moved into the stocks...” Ingo Insterburg might text and sing today. Didn’t the USA itself, having acted here as the teacher of corruption, wage an entire war on false documents with its friends’ money, and at the cost of many human lives? Of course corruption is bad, and most religions call it contemptible in their dogmas. Of course, from the economic viewpoint it is a misallocation of capital where there is corruption. But there are good reasons why the allocation of intelligence becomes better for it – though admittedly, and particularly regrettably, with an increase in features of contempt for people, even going as far as taking mafia-like forms. Ultimately, however, the American authorities give the worst example. An unholy coalition of advisers and officials randomly squeezes first the one and then the other. Is there anybody who reacts because he thinks he cannot be squeezed? Practice at any rate shows that there are no owners that defend themselves – not even the American beneficials. And certainly not the Champagne growers in Rheims.

ACTIONS CORNER

Frankfurt Regional Court has annulled the decisions giving discharge to senior managers Klaus-Peter Müller and Martin Blessing for the business year 2008. The judges objected that according to the charter the takeover of Dresdner Bank ought to have been decided by the AGM. Commerzbank has appealed against the decision.

Hanover Regional Court has ruled Rolf Koerfer’s election to the Continental supervisory board null and void. Continental and its major shareholder want to appeal. The court based its ruling on grounds for concern over conflicts of interest in the case of Koerfer, a lawyer. Additionally, Continental had not adequately informed its shareholders before the AGM in April 2009. Among others, corporate-governance expert and former head of DWS Christian Strenger had sued against the election of the Schaeffler advisor.

Following exhaustive investigations by US stock-exchange regulators, the US Justice Ministry has charged Daimler. On 1 April the bribery case over possible systematic impermissible payments of at least 56 million dollars to foreign government employees in 22 countries by the German carmaker between 1998 and 2008 will be heard before a US court. They are alleged to have let the Stuttgart firm secure lucrative orders and earn turnover totalling 1.9 billion dollars. While Daimler wants to pay some 185 million dollars to settle the case, it is nonetheless being placed under supervision. Former FBI head Louis Freeh is to monitor the group for the next three years to ensure its business is clean.

Stuttgart Higher Regional Court has condemned Deutsche Bank to pay €1.5 million damages to Teamtechnik, which it had offered interest-swap contracts. The judges agreed with the midsized plant installer from Freiburg am Neckar that this was “a sort of gamble” in which the plaintiff had been disadvantaged “vis-à-vis the bank with its highly developed simulation models”. The Ninth Civil Division further criticized the fact that the bankers had developed the contracts with their risk models in such a way that losses were likely. Such transactions ought not, however, to be offered by banks. Milan prosecutors too have after months of investigations in connection with derivatives transactions brought charges against four foreign banks, including Deutsche Bank. The first trial of this nature in Europe starts on 6 May. The institutions are alleged to have deliberately deceived the city of Milan in 2005 by selling it complex interest swaps, by which the municipality hoped to reduce its interest burden. The issues had brought the banks €100 million at the city’s expense, said Milan investigator Alfredo Robledo.

Stefan Ortseifen is blaming the near bankruptcy of IKB on Deutsche Bank. It had caused the collapse by capping its business relations with the small-business bank and closing its long-time credit lines on 27 July 2007, said the former IKB board spokesman. The resulting enormous damage to its reputation had ultimately sparked off the existential crisis. Deutsche Bank immediately rejected the accusations. Ortseifen has since 16 March been defending himself at Düsseldorf Regional Court on accusations of rate manipulation and breach of trust in connection with building operations on his service villa.

Investigation proceedings against Kai-Uwe Ricke and Klaus Zumwinkel in the Telekom spying scandal will probably be completed by Easter, according to public prosecutors. The magazine Focus had previously reported that senior prosecutor Fred Apostel had confirmed that there were indications that Telekom bosses had had trade unionist and journalists spied on in order to trace leaks. Focus further reported that Bonn prosecutors nonetheless wanted to stay the proceedings since ultimately the investigators were unable to refute the statements of the former Telekom CEO and Supervisory Board chair.

Heinrich von Pierer has been given an unappealable administrative fine in the bribery case. The former Siemens CEO and Supervisory Board chair has to pay a six-figure fine for the administrative offence. This is confirmed by public prosecutors and Pierer’s lawyers. No indications were given of the precise figure of the fine. Decisions of this nature can range up to half a million Euros. Investigators accused the 69-year-old of negligent breach of his supervisory duties for not having checks done when he received the relevant information.

In connection with the case of concealed funding of the dummy trade union AUB, accusations have now also been brought against Günter Wilhelm. The former Siemens board member, in Siemens central management between 1992 and 2000, is accused of incitement to breach of trust and tax evasion. Wilhelm is said to have incited his successor Johannes Feldmayer at the start of the decade to pay amounts in the millions to former AUB head Wilhelm Schelsky. The industrial conglomerate had promoted the organization of works councillors as an employer-friendly counterweight to IG Metall.

AGM Dates

| Company | Event | Date | Time | Place | Address | Published on |

| DAX | ||||||

| adidas | ord. AGM | 06.0 5.10 |

10:30:00 | 90762 Fürth | Rosenstraße 50, Fürther Stadthalle | 16.03.10 |

| The Agenda for the ordinary AGM of adidas AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. adidas AG earned balance-sheet profits of €284.56m last business year. Of the profits, €73.23m is to be paid out as dividend and €211,33m carried forward to a new account. A resolution approving the remuneration system for board members is to be taken. Additionally, several charter amendments are to be decided. The existing Authorized Capital is to be replaced by a new one of €20.0m. The existing Conditional Capital 1999/I is to be cancelled. The existing Conditional Capital 2003/II is also to be cancelled. The authorization to issue option and/or convertible bonds of 11 May 2006 with its associated Conditional Capital 2006 is also to be cancelled. The company is to be authorized to issue option and/or convertible bonds. For this, Conditional Capital 2010 of €36.0m is to be kept available. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. A resolution authorizing use of equity capital derivatives in connection with purchase of own shares is to be taken. A resolution on conversion from bearer shares to personal shares is to be taken. | ||||||

| Bayer | ord. AGM | 30.04.10 | 10:00:00 | 50679 Köln | Deutz-Mülheimer Str. 111, Congres-Centrum Koelnmesse, Eingang Nord, Halle 7 | 26.02.10 |

| The Agenda for the ordinary AGM of Bayer AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Bayer AG earned balance-sheet profits of €1157.73m last business year. The profits are to be fully paid out as dividend. A resolution approving the remuneration system for board members is to be taken. The existing Authorized Capital I is to be replaced by a new one of €530.0m. The existing Authorized Capital II is to be replaced by a new one of €211.7m. Additionally, the company is to be authorized to issue option and/or convertible bonds. For this, Conditional Capital of €211.7m is to be kept available. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. Additionally, several charter amendments are to be decided. | ||||||

| Beiersdorf | ord. AGM | 29.04.10 | 10:30:00 | 20355 Hamburg | Am Dammtor/Marseiller Straße, Congress Center Hamburg | 12.03.10 |

| The Agenda for the ordinary AGM of Beiersdorf AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Beiersdorf AG earned balance-sheet profits of €190.52m last business year. Of the profits, €158,77m is to be paid out as dividend and €31.74m allocated to reserves. The company is again to be authorized to purchase its own shares and use them. The existing Authorized Capital I is to be replaced by a new one of €42.0m. The existing Authorized Capital II is to be replaced by a new one of €25.0m. The existing Authorized Capital III is to be replaced by a new one of €25.0m. Additionally, the company is again to be authorized to issue option and/or convertible bonds. For this, Conditional Capital of €42.0m is to be kept available. Additionally, several charter amendments are to be decided. A resolution approving the remuneration system for board members is to be taken. | ||||||

| Deutsche Lufthansa | ord. AGM | 29.04.10 | 10:00:00 | 14057 Berlin | Neue Kantstraße/Ecke Messedamm, ICC | 16.03.10 |

| The Agenda for the ordinary AGM of Deutsche Lufthansa AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. A resolution approving the remuneration system for board members is to be taken. Elections to the Supervisory Board are to be held. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. The existing Authorized Capital is to be replaced by a new one of €561.16m. Additionally, several charter amendments are to be decided. | ||||||

| Deutsche Post | ord. AGM | 28.04.10 | 10:00:00 | 65929 Frankfurt | Pfaffenwiese, Jahrhunderthalle | 16.03.10 |

| The Agenda for the ordinary AGM of Deutsche Post AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Deutsche Post AG earned balance-sheet profits of €880.8m last business year. Of the profits, €725,41m is to be paid out as dividend and €155.39m carried forward to a new account. The company is to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. Use of derivatives in connection with purchase of own shares is to be possible. A resolution approving the remuneration system for board members is to be taken. Elections to the Supervisory Board are to be held. Supervisory Board pay is to be adjusted. | ||||||

| Münchener Rück | ord. AGM | 28.04.10 | 10:00:00 | 81829 München | Am Messesee 6, ICM-Internationales Congress Center München | 16.03.10 |

| The Agenda for the ordinary AGM of Munich Re starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Munich Re earned balance-sheet profits of €1,291.06m last business year. Of the profits, €1,087.78m is to be paid out as dividend, €156.0m allocated to reserves and €47.27m carried forward to a new account. A resolution approving the remuneration system for board members is to be taken. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. Use of derivatives in connection with purchase of own shares is to be possible. Additionally, the company is again to be authorized to issue option and convertible bonds. For this, Conditional Capital of €117.0m is to be kept available. Additionally, several charter amendments are to be decided. | ||||||

| RWE | ord. AGM | 22.04.10 | 10:00:00 | 45131 Essen | Norbertstr. 2 | 09.03.10 |

| The Agenda for the ordinary AGM of RWE AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. RWE AG earned balance-sheet profits of €1867.51m last business year. Except for a portion of €52,782, to be retained, the balance-sheet profits are to be paid out as dividend. A resolution approving the remuneration system for board members is to be taken. By-elections to the Supervisory Board are to be held. The company is to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. Additionally, several charter amendments are to be decided. A resolution on assent to amendment of a control and profit-transfer agreement with RWE Supply & Trading GmbH is to be taken. | ||||||

| VW | pref. sh.meeting | 22.04.10 | 15:00:00 | 20355 Hamburg | Marseiller Str. 2, congress Center Hamburg | 11.03.10 |

| The sole item on the agenda for the the preference shareholders' meeting of Volkswagen AG is assent to the resolution authorizing the board to issue option and/or convertible bonds. | ||||||

| VW | ord. AGM | 22.04.10 | 10:00:00 | 20355 Hamburg | Marseiller Str. 2, Congress Center Hamburg | |

| The Agenda for the ordinary AGM of Volkswagen AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Volkswagen AG earned balance-sheet profits of €884.19m last business year. Of the profits, €646.7m is to be paid out as dividend and €237.49m carried forward to a new account. Elections to the Supervisory Board are to be held. The existing Authorized Capital is to be replaced by a new one and used to issue option and/or convertible bonds. A resolution approving the remuneration system for board members is to be taken. Additionally,control and profit-transfer agreements between Volkswagen AG and Volkswagen Sachsen Immobilienverwaltungs GmbH, Zwickau, and between Volkswagen AG and Volkswagen Osnabrück GmbH, Wolfsburg, are to be concluded. | ||||||

| Daimler | ord. AGM | 14.04.10 | 10:00:00 | 14055 Berlin | Messe Berlin, Sondereingang Ecke Masurenallee/Messedamm | 03.03.10 |

| The Agenda for the ordinary AGM of Daimler AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. A resolution approving the remuneration system for board members is to be taken. The company is again to be authorized to purchase its own shares and use them, excluding shareholders’ subscription and tendering rights. Elections to the Supervisory Board are to be held. Additionally, several charter amendments are to be decided. Additionally, the company is again to be authorized to issue option and/or convertible bonds. For this, Conditional Capital of €500.0m is to be kept available. | ||||||

| MDAX | ||||||

| Deutsche Postbank | ord. AGM | 29.04.10 | 10:00:00 | 65929 Frankfurt am Main | Pfaffenwiese, Jahrhunderthalle | 15.03.10 |

| The Agenda for the ordinary AGM of Deutsche Postbank AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Elections to the Supervisory Board are to be held. The company is to be authorized to purchase its own shares and use them. | ||||||

| Sky Deutschland | ord. AGM | 23.04.10 | 10:00:00 | 80339 München | theresienhöhe 15, Alte Kongresshalle | 12.03.10 |

| The Agenda for the ordinary AGM of Sky Deutschland AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Additionally, several charter amendments are to be decided. The Supervisory Board is in future to consist of 9 members. Elections to the Supervisory Board are to be held. Supervisory Board pay is to be adjusted. The company is again to be authorized to purchase its own shares and use them. The existing Authorized Capital is to be replaced by a new one of €269.58m. Additionally, the company is again to be authorized to issue option and/or convertible bonds. For this, Conditional Capital of €53.92m is to be kept available. | ||||||

| MTU | ord. AGM | 22.04.10 | 10:00:00 | 81925 München | Arabellastr. 6, The Westin Grand München Arabellapark | 12.03.10 |

| The Agenda for the ordinary AGM of Sky Deutschland AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Additionally, several charter amendments are to be decided. The Supervisory Board is in future to consist of 9 members. Elections to the Supervisory Board are to be held. Supervisory Board pay is to be adjusted. The company is again to be authorized to purchase its own shares and use them. The existing Authorized Capital is to be replaced by a new one of €269.58m. Additionally, the company is again to be authorized to issue option and/or convertible bonds. For this, Conditional Capital of €53.92m is to be kept available. | ||||||

| GEA | ord. AGM | 21.04.10 | 10:00:00 | 44791 Bochum | Stadionring 20, RuhrCongress Bochum | 11.03.10 |

| The Agenda for the ordinary AGM of GEA Group AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. GEA Group AG earned balance-sheet profits of €55.83m last business year. Of the profits, €55.14m is to be paid out as dividend and €684,201 carried forward to a new account. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. A new Authorized Capital II of up to €72.0m is to be created. Additionally, the company is to be authorized to issue option and/or convertible bonds. For this, Conditional Capital of €48.66m is to be kept available. Additionally, several charter amendments are to be decided. | ||||||

| RATIONAL | Auf | 21.04.10 | 10:30:00 | 86159 Augsburg | Gögginger Str. 10 | 11.03.10 |

| The Agenda for the ordinary AGM of RATIONAL AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. RATIONAL AG earned balance-sheet profits of €134.18m last business year. Of the profits, €39.8m is to be paid out as dividend and €94.38m carried forward to a new account. A resolution approving the remuneration system for board members is to be taken. The existing Authorized Capitals I and II are to be cancelled. Additionally, several charter amendments are to be decided. | ||||||

| PUMA | ord. AGM | 20.04.10 | 14:00:00 | 91074 Herzogenaurach | PUMA-Way 1, PUMA Brand Center | 05.03.10 |

| The Agenda for the ordinary AGM of PUMA AG Rudolf Dassler Sport AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. PUMA AG Rudolf Dassler Sport AG earned balance-sheet profits of €50.0m last business year. Of the profits, €27.15m is to be paid out as dividend and €22.85m carried forward to a new account. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. Resolutions on assent to profit-transfer agreements with PUMA Sprint GmbH and PUMA Vertrieb GmbH are to be taken. Additionally, several charter amendments are to be decided. | ||||||

| Bilfinger | ord. AGM | 15.04.10 | 10:00:00 | 68161 Mannheim | Rosengartenplatz 2 | 08.03.10 |

| The Agenda for the ordinary AGM of Bilfinger Berger AG starts with the usual items, like presentation of annual accounts and discharge to the company bodies. Bilfinger Berger AG earned balance-sheet profits of €92.05m last business year. Of the profits, €88,28m is to be paid out as dividend and €3.77m carried forward to a new account. Elections to the Supervisory Board are to be held.. Additionally, several charter amendments are to be decided. The company is again to be authorized to purchase its own shares and use them, possibly excluding shareholders’ subscription and tendering rights. The existing Authorized Capital is to be replaced by a new one of €69.0m. Additionally, the company is to be authorized to issue option and/or convertible bonds. For this, Conditional Capital III of €13.81m is to be kept available.A resolution is to be taken on converting Bilfinger Berger AG into a European Company (Societas Europaea, SE). | ||||||

Politics

Schäuble to ban short-selling

Germany’s finance minister wants to ban naked short-selling by law, and regulate covered short-selling more tightly. Transparency measures are to be introduced applying to all shares traded on a regulated market. An electronic information and disclosure system is to guarantee that those under disclosure obligations are identified and sanctions threatened where disclosure obligations are infringed. To prevent investors “creeping up”, i.e. building up major voting-rights positions without disclosing this, disclosure obligations under securities trading law are to be expanded. Additionally, Schäuble wants investment consultancy on products on the grey capital market in future to meet the requirements of the Securities Trading Act, so that consultancy records must be kept and commissions disclosed. Financial services watchdog BaFin is to be able to impose fines for bad advice or failure to disclose commissions. Investment advisers must also be registered with BaFin and submit indications on consultants’ qualifications and experience. For repeated, sustained offenses, the Bonn authority is in future to be able to impose fines and order consultants no longer to be employed in an investment consultancy for a set period. Also, to prevent open real estate funds from not meeting their trading-session buyback obligation, a two-year minimum holding period is to apply to all investors. On top of this are periods of notice that may lie between six and 24 months. The shorter the notice, the more liquidity the funds have to set aside.

BaFin has to make disclosures

The Hessen Administrative Court (VGH) decided on appeal in March that financial services watchdog BaFin had to open the files on a bank it was monitoring in connection with a civil trial. In the specific case, a private person wanted to proceed against a credit institution that had mediated failed speculative transactions. The plaintiff accordingly asked BaFin to see the relevant documents, but the Bonn authority refused on grounds of business secrecy. The Hessian court’s unappealable ruling that has now been issued is based on the Freedom of Information Act of 2006 guaranteeing all citizens the right to see personally relevant documents of federal authorities. According to the ruling, the court now has to decide whether the BaFin documents contain information that requires secrecy to be kept. The plaintiff will not for the moment be allowed to see the documents. Even before the latest ruling, BaFin had several times refused to allow citizens to see documents, but then after several lost judgments in first instance ended by eventually giving them out. It would, however, itself decide which bits to black out or keep back from the plaintiff. In general, the Bonn financial watchdog fears institutions might suspend their voluntary collaboration with it if they could no longer be sure confidential data would not be given out.

New structure for oversight

The governing coalition wants to set up a holding company under the Bundesbank’s umbrella consisting of three pillars: financial services watchdog BaFin, the Bundesbank and the special financial-market stabilization fund SoFFin. On this model, BaFin is to take on all oversight of banks, insurers and securities trading, thus taking over the bank supervision that has hitherto been with the Bundesbank. The Bundesbank, minus its banking oversight, would then be the second pillar, with as its task the core business of a central bank. As the third pillar, SoFFin could be expanded into a permanent crisis fund for banks and insurers. The holding company is to be headed by a board, chaired by Bundesbank head Axel Weber and with the BaFin and SoFFin chairs also on it. The reform of oversight is to be brought before the Bundestag before the summer break.

New EU capital-market rules

At the end of this year, the EUs new internal market commissionaire Michel Barnier is to submit a draft law redefining bank regulation. On disputed points, like indebtedness limits or liquidity standards, individual governments and financial institutions must still be heard. By the end of 2012 the new regulations based on the Basel II proposals are to enter into force. The core of the new rules is a set of fixed liquidity buffers that banks must in future maintain in the form of easily saleable assets. Pfandbriefe and corporate bonds are to be included among these. Additionally, strict requirements are to be placed on the quality of equity capital. To put a limit on excessive indebtedness of banks, a maximum leverage ratio in relation to the balance-sheet total is to be provided for. Here it is not yet clear whether there will be a binding index or only one that will act as an alarm signal to monitors. Stricter core-capital provisions will according to the draft better secure the relevant counterparty’s default risk in relation to derivatives, pension transactions and security transactions. Derivatives traded off exchange are to be cleared through central counterparties to cushion counterparty default. Additionally, in good times banks are to build up capital buffers for poor times. By contrast with the US, the EU is not to set a size limit for banks. However, Europe-wide regulations are to set standards for credit provision.

A new levy on banks

The Federal Government wants the new special levy on banks to bring in around a billion Euros. Through this instrument, the government wishes to make the financial sector share part of the damage caused by the financial crisis. The money is to be administered by the special fund for financial market stabilization (SoFFin).

As well as the bank levy, the cabinet also decided that in future systemically relevant parts of a failing bank can be hived off and transferred to a “bridge bank”. To flank this, a reorganization procedure for credit institutions is provided for, to be able to restructure banks. To prevent a bank’s collapse, its restructuring is to be achieved by negotiation, and current insolvency law is to be extended for this purpose. Additionally, the existing five-year statute of limitations for misconduct by bankmanagers is to be doubled to ten years. The draft law is to be worked out by the Finance and Justice Ministries before the summer break.

Ackermann’s pay under fire

In August last year, the Act on Appropriateness of Executive Remuneration came into force. But if German trade union federation (DGB) board member Dietmar Hexel is to be believed, it has had little effect. Particular criticism goes to Josef Ackermann, who a year after his voluntary waiver of bonus in 2008 is to receive €9.6 million in pay for 2009, €8.2 million of it in bonus payments. Hexel, also a member of the Government Commission on Corporate Governance, lobbies the criticism that the sheer size of such pay can hardly be justified to citizens in an economic crisis probably caused by the banks. “Any pay over 2 million has nothing more to do with performance. It is a status symbol of a new managerial feudalism,” says the DGB expert.

Last year, with group losses of 4.8 billion, the Swiss Ackermann still received €1.4 million. The bank’s eight-member board took a total of just over 7 million euros in 2009, as against 4.5 million the previous year. As from this year, banks must have their executives’ pay reviewed by a remuneration committee on which there should be representatives of employees in every sector. While Ackermann is again the undisputed number one for pay in the German economy, RWE CEO Jürgen Großmann at 7.2 million and Siemens CEO Peter Löscher at 7.1 million are also receiving superlative pay. Daimler CEO Dieter Zetsche took pay of €4.2 million for last year, which ended with losses of €2.64 billion; in 2008 he got €4.8 million. In general, Supervisory Board responsibility in connection with executive remuneration has also increased. Deutsche Post is taking account of this by doubling annual remuneration for its Supervisory Board members in 2010, to €40.000.

EU regulates short-selling

The European Securities Regulators Committee (CESR) is to curb short-selling by uniform rules. In short-selling speculators borrow shares which they then sell and buy back at a lower price. They are thus betting on falling prices, and may accelerate this. To limit this practice, the CESR wants to insure that investors selling 0.2% of a firm’s share capital short must disclose this to oversight authorities. At 0.5% the public must be informed. Germany’s financial services watchdog BaFin has announced that rules to this effect also apply in Germany as from 25 March until 31 January 2011, though only for the shares of Aareal, Allianz, Generali Deutschland, Commerzbank, Deutsche Bank, Deutsche Börse, Postbank, Hannover Re, MLP and Munich Re. Since the start of the year, short-selling is in general allowed again in Germany.

People

The Conergy supervisory board has appointed Andreas Wilsdorf as board member for distribution and marketing. On 15 March this manager, last employed at Schüco in Bielefeld, replaced Philip von Schmeling. The former sales director had decided after five years at the solar firm and three years on its board to seek new challenges on the expiry of his contract.

Paul Achleitner has been nominated for election to the Daimler supervisory board. If the AGM on 14 April in Berlin agrees, he will replace Arnaud Lagardère, who has been on it since 2005 and is no longer standing for re-election. Achleitner is the Allianz CFO and is already on the supervisory boards of Dax groups Bayer, MAN and RWE, and a member of the Henkel partners committee.

John Allan has left the supervisory board of Deutsche Lufthansa. The former Deutsche Post CFO resigned with effect from 31 December 2009. To replace him, Martin Koehler joined the board until the AGM. Ulrich Hartmann and Herbert Walter have also resigned with effect from the end of the airline’s next AGM on 29 April. For their remaining period in office Robert Kimmitt and Adidas CEO Herbert Hainer are to be newly elected to the supervisory board as representatives of the capital side.

At the next HOCHTIEF AGM on 11 May, Martin Kohlhaussen will resign from the supervisory board chair. Detlev Bremkamp has been elected as successor. A former Allianz board member, he has like the departing chairman been on the supervisory board since 1996. Kohlhaussen, 74 years old, will however, remain as a supervisory board member. In January he left the ThyssenKrupp supervisory board.

IVG Immobilien is losing Georg Reul, currently in charge of the company’s funds division. The 42-year-old will not renew his contract, expiring in late July, in order to devote himself to “other international challenges in the real-estate sector”. In the last year and a half the leading European real-estate and fund-managing company has slimed its board down and made new appointments to all remaining posts.

The board and employees of Manz Automation are mourning supervisory board chair Jan Wittig, who died suddenly and unexpectedly at the age of 49 in the first weekend in March. Deputy chair Heiko Aurenz has provisionally taken over the chair of the supervisory board. Additionally, a third supervisory board member will soon be court appointed to a provisional seat.

MediGene has announced that CFO Thomas Klaue is leaving the biotech company by mutual agreement with the supervisory board because of differing strategic views, after the AGM on 11 May. The new CFO will be Arnd Christ, who MediGene says has several years experience in the biotech and pharma industry.

Jürgen Kluge is joining the METRO supervisory board and will take its chair. Franz Markus Haniel is resigning as the commercial group’s supervisory board chair after the end of the AGM on 5 May. Zygmunt Mierdorf (57), who has worked with the METRO group for almost two decades, left its board early (contract until 2013) in agreement with the supervisory board on 2 March.

ProSiebenSat.1 Media has found a new head for its New Media division, Dan Marks. A Briton, he is taking the sector over from Marcus Englert, who is leaving the Unterföhring firm, on 1 May. As Chief New Media Officer Marks will in future be responsible for further development and coordination of digital strategy. After 12 years with the broadcasting group, Englert is seeking new challenges.

CEO Anton Milner left the Q-Cells board with immediate effect on 11 March, but remains available to the firm as a consultant. CFO Nedim Cen will additionally take the CEO spot at the solar firm. Milner was among the firm’s founders who began producing solar cells in Bitterfeld-Wolfen in Sachsen-Anhalt in mid 2001.

Rupert Murdoch is sending Charles Carey to the supervisory board of Sky Deutschland. From headquarters in New York, “Chase Carey” is to run the pay TV’s foreign business. According to Sky, as well as Murdoch’s right-hand man, lawyer Michael Arnold and Katrin Wehr-Seiter, former manageress of holding company Permira, are to be new members of the supervisory board, expanded from six to nine.

Pierre-Pascal Urbon, CFO of SMA Solar Technology, has ended his leave. He had taken indeterminate leave in early February in connection with current investigations against him. The investigation proceedings for an alleged sexual offence are not yet completed. The photovoltaic firm’s board and supervisory board continue to presume his innocence.

Campus

CG shortcomings in the MDAX

Shareholder service provider Ivox, which in December 2009 for the first time produced a corporate-governance ranking of German firms, has now assessed the MDAX, using over 140 criteria. In general, transparency was found to be lacking here. Often there is no corporate governance report, remuneration is not always reported, and shareholders are seldom provided with information on background and activities of supervisory board members. But this was precisely what critical investors wanted. Only 14 out of 50 companies in the MDAX are therefore given a good corporate governance rating by Ivox. Chemicals group Lanxess takes first place here. The worst score was taken by real estate firm Gagfah of Luxembourg, almost everything about which was criticized. Hugo Boss and Südzucker (equal 48th) came second last, with criticisms of lack of independence on the supervisory board. While in the DAX five firms were accused of gross corporate governance flaws, 21 MDAX firms got a red card from Ivox.

AGM attendance up

The Deutsche Investor Relations Verband (DIRK) did its semi-annual survey of IR experts from Germany, Switzerland and Austria early this year. Over half the respondents in Germany rated the current situation as better than six months ago, and also expected improvements in the coming half year. While in DAX firms eleven people on average work in the Investor Relations division, in the MDAX the figure is three, and in the TECDAX and SDAX two each. Not much will change in this position: 92.3% indicated that the number of full-time posts would stay the same for the next six months. Respondents estimated the DAX would be between 4,500 and 7,500 points by the end of June 2010, the average being 6,150. As regards annual general meetings, AGM attendance in 2009 was between 60 and 80% at over 40% of firms. One in three of them had higher attendance, and another third was able to keep it steady. Shareholder attendance grew particularly strongly since 2005 in the DAX and TECDAX. So-called proxy solicitors play no part at all in Germany (63.4%). In the DAX, however, 38.5% of firms have contact. One in four firms puts the AGM in whole or in part onto the Internet; for DAX groups the figure is 77%. Around a fifth of firms stated they would in future also allow electronic voting.

Online ordering for printed business reports

The Cologne agency NetFederation asked DAX, TECDAX and MDAX firms about their service for ordering business reports. On the whole they stated that the service had increased over the year. Of 110 firms surveyed, only eight supplied no business report upon request. Only one third of firms confirmed receipt of an order. Only 30 packaged their prestige product in such a way that it would be sure to reach the recipient undamaged.

ISO 14001 standard on the DAX

The topic of sustainability is so important to the 30 DAX groups that 54% of them have made it a board responsibility, says a study by Union Investment, the asset manager for the Volks- and Raiffeisen banks. Family-led firms like Beiersdorf, BMW, Henkel and Merck take the topic particularly seriously. But sustainability means not just ecology, it also has economic, ethical and social aspects. The questionnaire put to participants covered such aspects as environment, the social sphere and corporate governance, covering, as well as annual energy consumption, also CO2 emission, product safety, labour standards and social commitment, plus compliance with the German Corporate Governance Code. The response rate was 93%. 86% of groups have their environment management system certified in accordance with DIN ISO 14001. ILO (International Labour Organisation) labour standards are complied with by only 64% of respondents, and reporting as per the Global Reporting Initiative (GRI) by 61% (but only with 11% is the report part of the business report and therefore cleared by auditors). Only 39% of DAX firms implement the German Corporate Governance Code recommendations without exceptions or restrictions.

More on-line reports

The geschäftsberichte-portal each month surveys facts that display trends in the production of business reports. In the most recent survey over half the respondents state that their business report for 2009 will be as exhaustive as the previous one. Just one fifth suggest the annual publication will be more elaborate. The picture is the same as regards length. For 54.8% of respondents the business report would remain the same length; only 26.2% said it would be longer. While 81.5% would continue to print their business report, 6.2% want to make it on-line only. The remaining 12.4% print the publication digitally on demand. However, only 46.8% will also print their 2010 quarterly reports in their entirety. 36.4% stated they would publish these interim reports only on-line.

Capital News

To finance a major order for over 12 million euros worth of traffic monitoring systems and installations outside Europe and further expected orders in this area of business as well as other growth, the board of the Jenoptik group has decided on an ex rights capital increase of €13,529,006.40. The 5,203,464 new bearer shares were successfully placed with institutional investors by Accelerated Bookbuilding procedure.

To finance the first tranche of its €16 billion takeover of Porsche, on 23 March Volkswagen started Germany’s biggest capital increase since 1999. After initial placement of up to 65 million preference shares with institutional investors, the remaining subscription rights of old shareholders can be traded and exercised between 31 March and 13 April. The subscription price was set at €65 per preference share on 26 March. The carmaker wants to take in some 4 billion euros this way. The capital increase has ended up lower than possible, following an announcement by VW management when presenting the final figures that as well as a capital increase it would also be using convertible bonds.

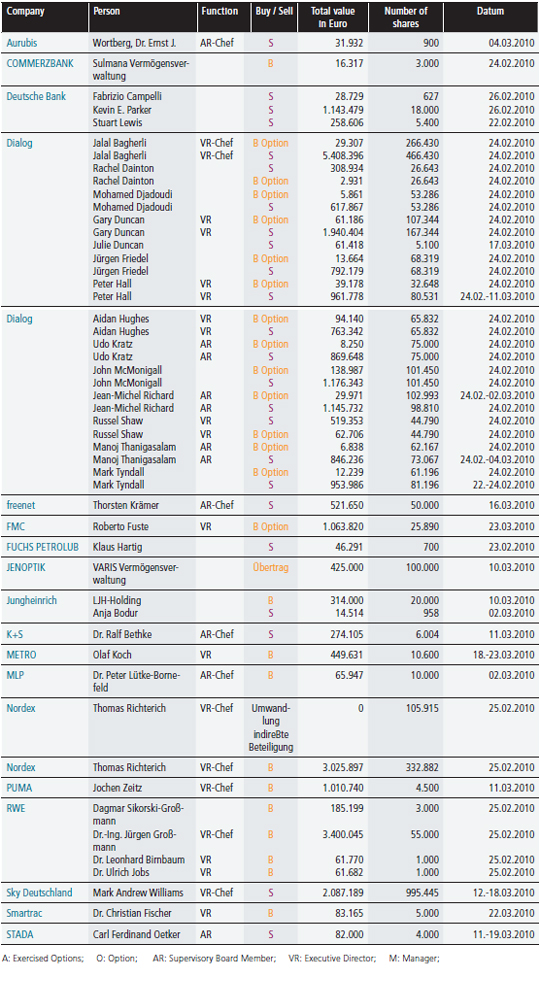

Director's Dealings

in March

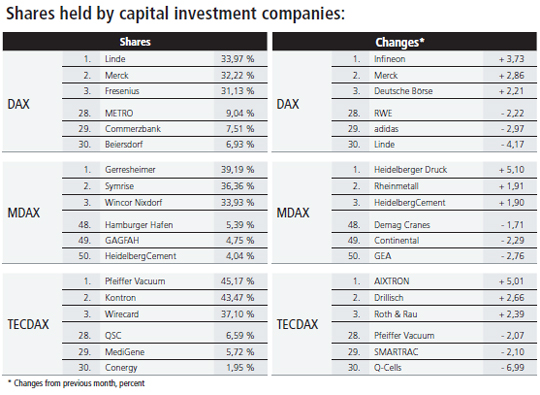

VIPsight Shareholder ID

in March

VIPsight Shareholder ID <click here>

Event Diary

14 April 2010 Finanzierung rechtlicher Rahmen von Übernahmen

organizer: Deutsches Aktien-Institut; place: DVFA Center im Signaris, Frankfurt am Main, Mainzer Landstraße 37-39; cost: €900 (non-members); info: 069 929 15-0

14 April 2010 Matthias Mitscherlich (CEO Ferrostaal), Key Factors for Success in Global Competition

organizer: Frankfurt School of Finance & Management; place: Frankfurt School, Frankfurt am Main, Sonnemannstr. 2; cost: none; info:.frankfurt-school.de/dialog

15 April 2010 Unternehmensbewertung und Kaufpreisformeln (Modul 4)

organizer: M&A-Lehrgang von Pöllath + Partner Training GmbH; place: Pöllath+Partner, Frankfurt am Main, Zeil 127; cost: €100; registration: Sonja Perzlmeier 089 24 240-131

27 April 2010 Professionalisierung der Aufsichtsräte

organizer: Deutsches Aktien-Institut; place: DVFA Center im Signaris, Frankfurt am Main, Mainzer Landstraße 37-39; cost: €900 (non-members); info: 069 929 15-0

28 April 2010 Platow InvestorenForum 2010-03-31

organizer: Forum Institut für Management GmbH; place: Villa Kennedy, Frankfurt am Main; cost: €990; info: Carmen Fürst-Grüner This email address is being protected from spambots. You need JavaScript enabled to view it.

Reading suggestions

Dahm, Joachim, Hamacher, Rolfjosef, Termingeschäfte im Steuerrecht - Optionsgeschäfte und Futures steuerrechtlich beraten und einordnen

Gabler Verlag, 149 pp, €3995, ISBN 978-3-8349-2153-6

In recent decades, derivatives have become increasingly significant in Germany, initially in the form of so-called “OTC transactions”. This was accelerated by the German Derivatives Exchange founded in the early 1990s, today’s EUREX, on which various types of financial transactions can be done. Other futures exchanges such as the commodity futures exchange WTB in Hanover and the power exchange EEX in Leipzig followed. The term “derivatives” covers a multitude of transactions of different types, often marked by high complexity. The associated uncertainty is also found in tax law, since the income-tax treatment for investors and the turnover-tax classification of the instruments had for long clearly not been resolved - and are partly still not today. The authors are partners in the Axer Partnerschaft in Cologne.

Meyer, Marco, Loitz, Rüdiger, Linder, Robert, Zerwas, Peter, Latente Steuern - Bewertung, Bilanzierung, Beratung

Gabler Verlag, 2nd ed. 311 pp, €59.95, ISBN 978-3-8349-1785-0

Deferred taxes arise from differences between the balance-sheet valuations according to commercial law and tax law. The work describes the recognition and measurement of deferred-tax assets and liabilities under IFRS and HGB and also goes into tax loss carryforwards, consolidation measures and special topics in this area. For a better understanding of the complex field, numerous examples and practical advice are there to help. The 2nd edition contains the changes to commercial accounting by the BilMoG. In addition, the expected changes in IFRS by the new IAS 12 (ED 2009/2) have been integrated fully. An accountant and tax consultant, Dr. Mark Meyer is a recognized practitioner in the field and, like all the other authors, works for PricewaterhouseCoopers.

Sander, Beate, Fath, Peter, Leiner, Anka, Nachhaltig investieren

FinanzBuch Verlag, 496 pp, €29.90, ISBN 978-3-89879-565-4

For anyone interested in investments in the field of environmental technologies, here is a comprehensive and interesting guide. The starting point of the analysis is a study of the German Association for Renewable Energies (Bundesverband Erneuerbare Energien), which has drawn up clear growth forecasts for the year 2020. Especially in wind energy, bioenergy, solar power and geothermal energy, the authors see a large and high-yield potential.