VIPsight - 2nd Edition 2017

COMPANIES

Ensuring stability to preserve a flexible corporate culture

On June 2nd, 2017 the Deutsche Wohnen AGM decided to change the legal status of the company from an AG into an SE. At the same time, the company confirmed that this will not result in a substantial change of governance rights. So why do it at all? The answer is easy, the new legal status means that the company can keep its flexibility and corporate culture, including the flexibility to ongoing adjustments to the business model.

On June 2nd, 2017 the Deutsche Wohnen AGM decided to change the legal status of the company from an AG into an SE. At the same time, the company confirmed that this will not result in a substantial change of governance rights. So why do it at all? The answer is easy, the new legal status means that the company can keep its flexibility and corporate culture, including the flexibility to ongoing adjustments to the business model.

At the AGM, it also became clear that the next move in this regard is already on the way. Deutsche Wohnen will pay more attention to the service and infrastructure elements surrounding its core rental business. Topics of interest range from catering the needs of special interest groups, via a careful selection of shop renters focused on the needs of the local population, up to security services and cable. The company made already some progress in this direction. For example, cable connections to 24.000 households living in homes rented by Deutsche Wohnen have been reacquired, with an amortization period for the investment of just 12 month. So in all, this upgrade to the business model serves several purposes at once. Renters get a better service, allowing for higher rents, while the rendering of the services creates an additional income stream. A noteworthy impact could also occur with regard to the reputation of the company, helping to improve its status as a good citizen.

Good corporate governance practice vers. good business?

The fight of the Hastor-family for a representation on the supervisory board of GRAMMER AG has many interesting features. The family currently controls more than 20 percent of the equity of the company. Several months prior to this year´s AGM they tried to obtain approval for an extraordinary AGM, which was denied by the court. The idea was to replace most of the members of the supervisory board by people proposed by the investor.

The fight of the Hastor-family for a representation on the supervisory board of GRAMMER AG has many interesting features. The family currently controls more than 20 percent of the equity of the company. Several months prior to this year´s AGM they tried to obtain approval for an extraordinary AGM, which was denied by the court. The idea was to replace most of the members of the supervisory board by people proposed by the investor.

While this already looked like a questionable “cold” takeover attempt (any thoughts about a bid for the shares not yet controlled by the Hastor family?), another important element involving a very unusual conflict of interest is even more interesting. The Hastor family made its reputation in Germany through a fierce battle with VW. Consequently bad memories turned up with car makers when they acquired a substantial holding in an important supplier to the automotive industry.

As is common with this kind of events, there are arguments pro and contra. However, one crucial element, which is probably not at the disposal of the parties involved, sticks out. Without doubt, a substantial shareholder should be represented on the supervisory board of a company in an appropriate way. This is nothing but good corporate governance practice. But it is also good corporate governance practice to provide detailed information about the business to the supervisory board members –which is currently probably the worst nightmare with some car manufacturers. So it was no surprise at all when GRAMMER informed about reactions by its customers on this situation, including a sharp decline in the order intake. Hence the question: what is your preference, a good corporate governance practice or a good business?

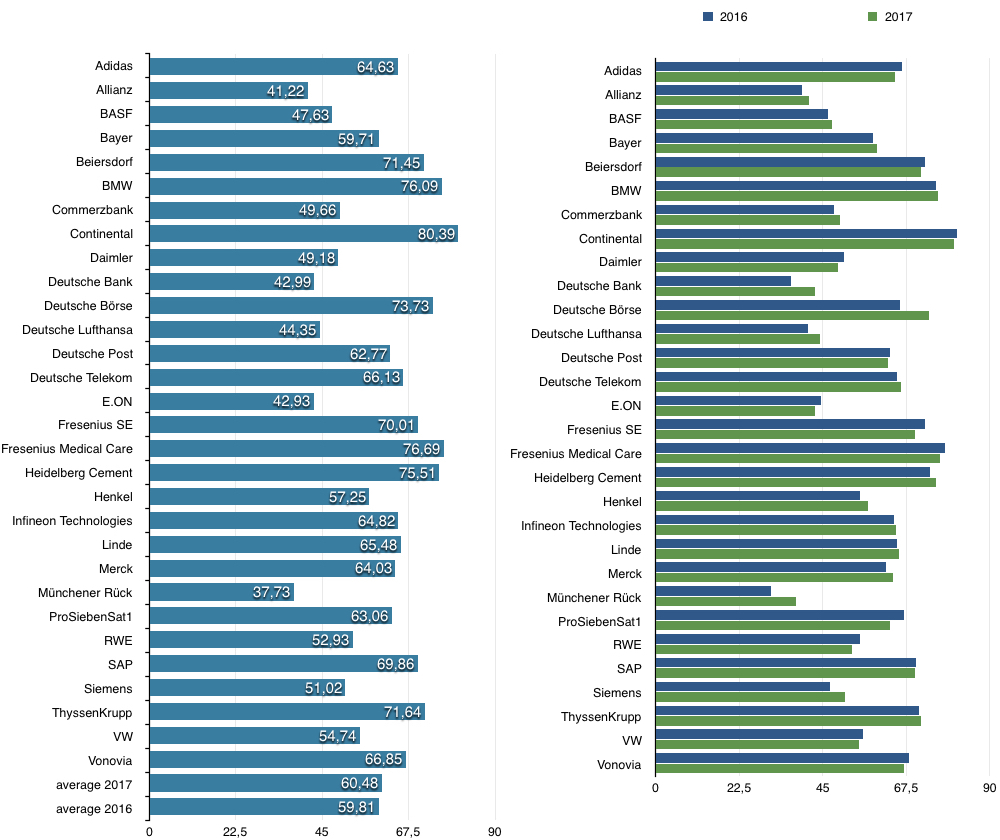

Find here the German AGM quorum 2017 - DAX companies

Bayer AG: Getting ready to integrate and consolidate Monsanto

At the AGM of Bayer AG on April 28th, CEO Werner Baumann presented not only a new record year, he also demonstrated confidence that the takeover of Monsanto will be completed by the end of this year and Monsanto will be fully consolidated for the year, since six of the required approvals by cartel authorities have already been granted.

At the AGM of Bayer AG on April 28th, CEO Werner Baumann presented not only a new record year, he also demonstrated confidence that the takeover of Monsanto will be completed by the end of this year and Monsanto will be fully consolidated for the year, since six of the required approvals by cartel authorities have already been granted.

Several institutional investors criticized that unlike Monsanto´s shareholders, investors in Bayer could not vote on the transaction. However, from Bayer´s perspective the risk of legal proceedings could have threatened the entire transaction. Hence, shareholders had no say on the biggest single transaction in Bayer`s history. Nonetheless, the high consent to the discharge of the managing directors for the year 2016 is a clear indication that most shareholders like the takeover.

KSB AG: Another victim of the KGaA-share-substitutes wave

KSB AG, the leading German manufacturer of pumps, valves and related system, could become the next victim of the trend to dispose of important corporate governance elements. According to the agenda for the AGM to be held on May 10th, 2017, the supervisory board and the managing directors propose to give up the AG status (joint stock corporation) in favor of an association limited by shares (so-called Kommanditgesellschaft auf Aktien). The German word sounds similar to shares, and the basic regulations for this type of legal entity are defined in the Aktiengesetz. However, it is a very different kind of animal, more comparable to a participation certificate than a share. In particular, investors need to give up most of their corporate governance rights when compared to a joint stock corporation in favor of defined people or corporations.

Strange enough, German law does not require the beneficiaries of such a conversion of an AG into a Kommanditgesellschaft auf Aktien to pay a compensation to the shareholders. What is more, many institutional investors are not allowed to invest into share substitutes and therefore are required to sell their investment. Nonetheless, the AGM agenda does not foresee a compensation payment for KSB shareholders who do not want to have their shares converted into KGaA-share substitutes.

Buhlmann's Corner

The council – to safeguard or act boldly?

The shareholders – Opinion or Monopoly?

The AGM of MünchnerRück, a world-renowned re-insurance company was typical of those held in 2017. Decent results for direct insurance business kept far from the glare of the spotlights makes for a dividend that keeps shareholders happy.

The AGM of MünchnerRück, a world-renowned re-insurance company was typical of those held in 2017. Decent results for direct insurance business kept far from the glare of the spotlights makes for a dividend that keeps shareholders happy.

When the time came for the game of boardroom musical chairs, most of those involved got up with good grace and applauded. The majority was very happy.

At the actual vote, however, more than two-thirds of those shareholders voted against management, making a point of leaving it very much out in the cold, isolated and tawdry instead of successful. So much seems the custom of today. Thousands of holders come to the hall to sit at the feet of the management and supervisory boards, wielding a combined clout of between 2 and 2,6 % of capital.

Down the left-hand side, and sometimes on the right side too, there are two or three bag carriers. Low profile people of whom little is known but who, for the duration of the AGM, represent the majorities that are kept in non-strategic holdings or by anchor shareholders.

The bags are full of votes cast, indeed they have been for a week. So, no prizes for guessing that not only can anyone with the right insider contacts find out the results they contain, but also manipulate them. Remember the case four years ago of the candidate for the presidency of a certain Supervisory Board who 24 hours before voting was due to start announced he was withdrawing his candidature, only to throw his hat back into the ring 11 hours later after a panel of 2-3 experts had discovered “irregularies in the instructions to shareholders on casting early votes” in the bagged vote. The Dax Chair won the day with a margin of 63 % of those present.

The reason why attendance is hard put to reach 70% when the major shareholders are taking part is to be sought not only but mostly in the ETF make-up of BlackRock, iShares and others; glib with good corporate governance but when the chips are down they decide in favour of what costs less and forget the vote. This is what the “positive” in “positive trend” means.

“we” on the other hand prefer a more formal, less entrepreneurial approach. It is more tiresome to count the number of times a management board failed to convene despite being summoned than to judge its performance. The issue of how much time ought to pass between presiding the board of management and presiding the Supervisory Board on the other hand is never given the time of day.

A question that time strategists tend to overlook, and so risk setting a wrong date for voting, perhaps by a mere 70 hours. I Linde Manfred Schneider was on the Supervisory Board for 18 days over into the subsequent period in order for everything to dovetail with his successor, former president of the management board. Even more precise were the terms of our re-insurance company. Helmut Perlet held the presidency for 3 days in 2017 in order to pass the sceptre to Michaale Diekmann, who accepted. There is no lack of similarities (Bayer comes to mind) and the list of the Responsibilities gets longer: responsibility by the hour and conflicts of interests scheduled to fit monthly planning.

That’s how things work because that’s the way we like it. It might not be to everyone’s liking but the fact remains that two-thirds of decisions are taken at Rockville and the remaining third in San Francisco, and every so often someone gets up and says their piece in settings less spectacular such as Ethos in the Alps or Proxinvest on the Seine. Thank goodness. That gives us a chance to confer. When the logistics and organisation of both (there are only two AGM organisers left in the world) work according to plan, everything’s cool and we begin at the beginning.

ACTIONS CORNER

Bitter medizin for Basin Capital and Cinvent

Nidda Healthcare Holding AG, the acquiring company of Bain Capital and Cinven, announced today that, as of expiry of the extended acceptance period at midnight (24:00 CEST) on June 22, 2017, only 65.52 percent of the STADA shares outstanding have been tendered under the voluntary public takeover offer. Consequently, the minimum acceptance threshold, which the bidder reduced from the original 75 percent to 67.5 percent on June 7, 2017, has not been reached.

Nidda Healthcare Holding AG, the acquiring company of Bain Capital and Cinven, announced today that, as of expiry of the extended acceptance period at midnight (24:00 CEST) on June 22, 2017, only 65.52 percent of the STADA shares outstanding have been tendered under the voluntary public takeover offer. Consequently, the minimum acceptance threshold, which the bidder reduced from the original 75 percent to 67.5 percent on June 7, 2017, has not been reached.

The company took the vote as a mandate to press ahead with its original strategy. According to STADA, the end of the takeover offer will have no effect on the growth targets for the current fiscal year.

According to market rumors, the shareholder structure of STADA contributed to the reluctant acceptance of the offer by its shareholders. However, what certainly created insecurity with investors is the AGM 2017, which has been adjourned without a proper explanation to shareholders. In light of the small gap between the minimum acceptance threshold and the number of shares tendered, this might have killed the deal.

Marginal result of the tender offer for Drillisch shares is no obstacle for the formation of a new player in the German telecommunications market

United Internet AG reported that as of June 23, 2017, which was the expiry date of the voluntary public tender offer for shares of Drillisch AG, only 839.170 Drillisch shares have been tendered, which equals 1.24 percent of the total number of Drillisch shares in issue. The shares tendered raise the holding of United Internet in Drillisch to 30.9 percent. The marginal outcome of the offer comes a no surprise in light of the higher stock exchange quotation of Drillisch shares.

United Internet AG reported that as of June 23, 2017, which was the expiry date of the voluntary public tender offer for shares of Drillisch AG, only 839.170 Drillisch shares have been tendered, which equals 1.24 percent of the total number of Drillisch shares in issue. The shares tendered raise the holding of United Internet in Drillisch to 30.9 percent. The marginal outcome of the offer comes a no surprise in light of the higher stock exchange quotation of Drillisch shares.

The offer is part of an overall transaction. It is planned to combine the mobile and fixed-net retail business of United Internet with Drillisch. In this context, Drillisch acquires the 1&1 Telecommunications SE from United Internet, which in return receives Drillisch shares from two capital increases. A first capital increase by way of a consideration-in-kind increase became already effective on May 16, 2017. A second increase will be the subject of an extraordinary AGM of Drillisch on July 25, 2017. If things go as planned, United Internet will control 72.89 percent of Drillisch thereafter.

Yesterday`s proxy recommendations for today`s AGMs?

At the 2015 AGM, SAP SE received a lot of criticism for its remuneration policy. Consequently, shareholders showed their dislike of the proposed system of executive board remuneration. Only 54.7 percent of the shares represented at the AGM voted in favor of the board proposal, a record low. After the AGM, the topic turned quite, until it became apparent, that the CEO of SAP received the highest salary among the DAX-CEOs in 2016. Not the absolute amount of remuneration was in the center of the discussion, though, but rather a lack of transparency regarding crucial bonus elements and the calculation process.

At the 2015 AGM, SAP SE received a lot of criticism for its remuneration policy. Consequently, shareholders showed their dislike of the proposed system of executive board remuneration. Only 54.7 percent of the shares represented at the AGM voted in favor of the board proposal, a record low. After the AGM, the topic turned quite, until it became apparent, that the CEO of SAP received the highest salary among the DAX-CEOs in 2016. Not the absolute amount of remuneration was in the center of the discussion, though, but rather a lack of transparency regarding crucial bonus elements and the calculation process.

Nonetheless, up to the AGM it looked like the company did not really care. With his opening remarks at the AGM, though, the chairman of the supervisory board, Prof. Hasso Plattner, surprised the audience with substantial transparency improvements, addressing most of the issues criticized, promising further amendments and announcing a roadshow in Europe and America to discuss the corporate governance of the company with investors.

So, everything´s fine now? Not at all, as is demonstrated by the votes casted on the formal approval of the acts of the supervisory board at the AGM, where a stunning 49.5 percent of voted against a discharge. However, at a second glance it becomes clear what really happened. Many institutions relied on the guidance provided by proxy advisors - not realizing, that proxy advisors are typically not present at AGMS and do not update their recommendations upon new developments. Not really a business model for German AGMs.

Fresenius acquires with a long term perspective

Following the confirmation of talks with the US speciality generic pharmaceutical company Akorn, Inc. on April 7th, 2017, Fresenius, on April 24th announced the intention to strengthen and diversify the product portfolio of Fresenius Kabi via the acquisition of Akorn. The real surprise to the market, however, was the additional information that Fresenius Kabi will also acquire Merck KGaA's biosimilar business.

Following the confirmation of talks with the US speciality generic pharmaceutical company Akorn, Inc. on April 7th, 2017, Fresenius, on April 24th announced the intention to strengthen and diversify the product portfolio of Fresenius Kabi via the acquisition of Akorn. The real surprise to the market, however, was the additional information that Fresenius Kabi will also acquire Merck KGaA's biosimilar business.

The consideration for Akorn amounts to $4.3B., plus approximately $450M of net debt. The transaction is subject to approval by Akorn shareholders.

Merck´s biosimilars business with a product pipeline focused on oncology and autoimmune diseases, will be acquired for a purchase price of up to EUR 670M. While EUR 170M shall be paid in cash upon closing, the remaining amount is subject to milestones tied to development targets. Including expenses related to analytical testing, clinical studies, quality requirements specific to biosimilars, as well as marketing and sales activities, Fresenius expects to invest up to EUR 1.4B until projected EBITDA break even in 2022.

The investment into the biosimilar business will be mainly financed via the cash flow, while the financing of the acquisition of Akorn is planned to be made via debt instruments. Both acquisitions combined are expected to be neutral to group net income and EPS by 2020 and accretive from 2021 onwards.

Supported bid protects the interest of employees, production sites and the corporate strategy of STADA

According to a news release on April 10th, 2017, the executive board and the supervisory board of STADA received two transaction offers for voluntary public tender offers in a structured bidding process. Both offers are subject to the approval of STADA´s executive board.

According to a news release on April 10th, 2017, the executive board and the supervisory board of STADA received two transaction offers for voluntary public tender offers in a structured bidding process. Both offers are subject to the approval of STADA´s executive board.

The release states that the boards decided in the best interest of the company to support the offer by Bain Capital and Cinven, who are offering EUR 65.28 per share plus a dividend of EUR 0.72 per share. This offer corresponds to an approximate 48 percent premium in relation to STADA´s unaffected share price and an approximately 19.6 percent premium in relation to STADA´s volume-weighted average share price over the lasts three months.

STADA, Bain Capital and Cinven have signed an investor agreement with extensive protection provisions for employees and production sites as well as the corporate strategy and later announced the offer. In addition, the release stated that the boards have reached the conclusion that it would also be in the interest of shareholders to support the bid. In particular, the chairman of the supervisory board, Mr. Ferdinand Oetker, stressed the fact that due to the successful negotiation strategy the transaction value could be increased by EUR 7.28 per share.

The offer runs from April 27th through June 8th 2017, while the AGM has been postponed to August 30st, 2017. Anybody surprised?

People

Aftermath effects of a failed offer Just a few days after the failure of the voluntary public takeover offer by Bain Capital and Cinven for shares of STADA AG, the CEO Dr. Matthias Wiedenfels and the CFO Helmut Kraft informed the supervisory board that they will step down with immediate effect for personal reasons. It is probably no surprise to learn from the press release of STADA that the supervisory board was able to bring on board two new excecutives with immediate effect. Engbelbert Coster Tjeenk Willink has been appointed as successor to Dr. Wiedenfels, while Dr. Bernhard Düttmann will follow Helmut Kraft.

Just a few days after the failure of the voluntary public takeover offer by Bain Capital and Cinven for shares of STADA AG, the CEO Dr. Matthias Wiedenfels and the CFO Helmut Kraft informed the supervisory board that they will step down with immediate effect for personal reasons. It is probably no surprise to learn from the press release of STADA that the supervisory board was able to bring on board two new excecutives with immediate effect. Engbelbert Coster Tjeenk Willink has been appointed as successor to Dr. Wiedenfels, while Dr. Bernhard Düttmann will follow Helmut Kraft.

According to the chairman of the supervisory board Ferdinand Oetker, the operational business of the STADA is unaffected by this, and the company will not deviate from its operating and financial targets. STADA also confirms that Bain Capital and Cinven are considering to apply for an exemption from the one-year exclusion period for the submission of a renewed voluntary public takeover offer.

Politics

Greenpeace activists have gatecrashed Credit Suisse’s shareholder meeting in Zurich to protest against the Swiss bank’s alleged funding of firms involved in the controversial Dakota Access oil pipeline project

As CEO Tidjane Thiam was giving a speech, two Greenpeace protestors lowered themselves from a catwalk above the stage in Zurich’s Hallenstadium and unfurled a huge banner “Stop Dirty Pipeline Deals” criticising the bank’s support to the crude oil pipeline.

As CEO Tidjane Thiam was giving a speech, two Greenpeace protestors lowered themselves from a catwalk above the stage in Zurich’s Hallenstadium and unfurled a huge banner “Stop Dirty Pipeline Deals” criticising the bank’s support to the crude oil pipeline.

“I am a democrat and a great believer in freedom of expression,” Thiam said. “I will continue my speech. Everyone has a right to express their views.”

The banner was removed around 15 minutes later.

“When I moved here, I was told this is a quiet, mountainous country. This is more excitement than I expected,” Thiam joked as the two were helped off stage.

Campaigners, including Greenpeace, have repeatedly called for investors like Credit Suisse to stop funding firms involved in the 1,885km (1,172 mile) Dakota Access line (DAPL) running from North Dakota to Illinois. They claim the Swiss bank is a prominent bankroller of the pipeline.

However, Credit Suisse said in April it was not involved in project financing for the pipeline.

“Allegations that Credit Suisse is the biggest lender to DAPL are false and are firmly rejected by the bank,” it said. “Credit Suisse has business relationships with companies undertaking the construction and operation of the pipeline.”

US President Donald Trump supports the project, claiming it would provide better connections between Dakota oil producers and refineries on the Gulf coast. However, opponents criticise the fact it is due to run through traditional grounds of Sioux native Americans, with fears it could pollute the water table in the region.

Stormy meeting

The Greenpeace protest took place on Friday as Credit Suisse holds a stormy shareholder meeting. Switzerland's second biggest bank has faced a revolt from shareholders over compensation and management bonuses for its top managers despite financial losses.

In the afternoon, shareholders narrowly approved the bank's 2016 compensation report in a non-binding vote at the meeting, with 58% accepting the pay policy and 40% opposing. At last year's annual general meeting, 18% of the vote opposed the compensation report.

The Financial Times said this amounted to a 'significant snub' for the leaders of the bank, which is in the midst of a sweeping restructuring programme.

Credit Suisse has run into difficulties after announcing bonuses worth up to CHF78 million ($78.4 million) for executive board members. It also raised its overall bonus pool by 6% to CHF3.09 billion as it battled to stop top bankers defecting to rivals.

Earlier this month senior Credit Suisse managers agreed to take a 40% cut in their bonuses amid unrest over the pay packets following CHF5.6 billion in losses since 2015. The board of directors also offered to freeze their pay.

Capital News

Busch starts a second round for Pfeiffer Vacuum Technology AG

Following an unsuccessful takeover bid by the Busch Group to the shareholders of Pfeiffer Vacuum Technology AG at EUR 96.20 per Pfeiffer share, Pangea GmbH (a company owned by the Busch Group) submitted a new offer on April 12th, 2017, with the intention of acquiring a controlling stake in Pfeiffer, offering EUR 110 per Pfeiffer share. On April 24th, 2017, the management board and the supervisory board of Pfeiffer issued their reasoned statement on the offer according to section 27 of the German Securities Acquisition and Takeover Act (WpÜG). Considering the history of the prior attempt, it came as no surprise that the advice by these bodies was a clear no!

The recommendation based on the findings of the boards – which are based on assessments by UBS Europe and Commerzbank – are such that the offer price is inadequate and the intended takeover of a controlling stake is not in the interest of the company and its shareholders.

Following the publication of the recommendation, Busch made clear that this is by far not the end of the story. Instead, the next round will most likely take place at the AGM. According to press articles, Busch plans to ask for individual discharge of the members of the supervisory board, claiming a conflict of interest of the chairman of the supervisory board based on activities of his law firm. So it is clear that the bid will be the main topic at the AGM on May 23rd, 2017 and a lively exchange of arguments should be expected.

Deutsche Börse plans implementation of a share buyback program

Following the announcement of the decision of the European Commission to prohibit the recommended allshare merger between Deutsche Börse AG und London Stock Exchange Group plc, the executive board of Deutsche Börse announced the plan to implement a share buyback program with a volume of around EUR 200M in the second half of 2017.

Following the announcement of the decision of the European Commission to prohibit the recommended allshare merger between Deutsche Börse AG und London Stock Exchange Group plc, the executive board of Deutsche Börse announced the plan to implement a share buyback program with a volume of around EUR 200M in the second half of 2017.

The program is subject to a resolution of the AGM of Deutsche Börse on May 17th, 2017. The company plans to use a part of the proceeds from the sale of the International Securities Exchange Holdings, Inc., which amounted to approx. EUR 1B, to finance the program.

While the share buyback seems to be in line with the policy of Deutsche Börse prior to the announcement of the intended merger with the LSE, discussions at the AGM are more likely to focus on concerns over the failed merger and a pending investigation into the CEO.