Buhlmann's Corner

About small minds and little effects

In the week after Easter, shareholders this year also practiced revolution beyond the German border.

In the week after Easter, shareholders this year also practiced revolution beyond the German border.

On Tuesday, 62% of ING's shareholders voted against the discharge of the Management Board and Supervisory Board at the Annual General Meeting in the Muziekgebouw in Amsterdam. While the meeting building stands securely on piles above the water, it was apparently up to the neck of the entire board of executive and non-executives.

The Dutch ING Bank, which was rescued in 2009 and ranked 26th worldwide in terms of total assets, decided in the relevant previous year to increase the CEO's salary by 50%. Initially, the Supervisory Board agreed, but later withdrew its decision.

In September 2018, however, a compliance discussion with the public prosecutor's office and the regulator that lasted several years was concluded by the Board of Managing Directors with a settlement of € 775 million. More than just organisational breakdowns were established.

Anyone who first collects royalties from a breach of law and then lets ignorant owners pay the fine - by the way, in this connection the Chief Financial Officer was dismissed by the Supervisory Board with recognition and kind words - cannot actually expect any discharge. That didn't seem to have arrived at the board: until shortly before the Annual General Meeting, people were still playing poker by buying Commerzbank and moving to Frankfurt ...

VIP (only) refused to ratify the actions of the Supervisory Board (and of course refused to re-elect a Supervisory Board member in a mandate), not least because the compliance issue had been addressed since 2016 in a not conspicuous remark in the notes to the annual report. By the way, the aforementioned note 45 appeared immediately after a change of auditor - previously it was EY, now it is KPMG. These company names are interchangeable, but such changes are just as good as the proverbial brooms.

The result was not noticed except by the participants and the local press. For those concerned, the legal and economic impact is as insignificant as the public perception of the matter outside the Netherlands.

The revolutionary storm up the Rhine in the former capital of the Federal Republic of Germany was just as en passant and without consequences. For the third time Bayer invited to Bonn, for the first time with Monsanto and the boundlessly scolded glyphosate. Who cares that competitors all over the world produce and sell their herbicides on the same glyphosate basis - when the pack of American lawyers only hunts Monsanto?

The shareholders decided to hunt the Executive Board voting with a 55% majority against its discharge. Here, too, the glass is half full and half empty - the controversial question about "how expensive will the lawsuit avalanche be" has not yet been determined.

The fact is that 2019 the ethically much more important question:

Is the pesticide dangerous?

And if so, how can it be replaced?

Has not yet become an issue after Easter. And even in a second essential question there is hesitation: are the priced in legal costs sufficient for damages, expenses, negotiation pains and management strategy. Or conversely, is the incorporation of Monsanto damaging Bayer's existing stockholder, just as it happened with the acquisition of Schering. At Bayer, the Executive Board was hastily not discharged, the Supervisory Board received an educational finger with 33% No and ... the much more important motion for a special audit to deal with the factual issues was rejected. Opportunity missed!

Nothing happened, standing comfortably and continuing.

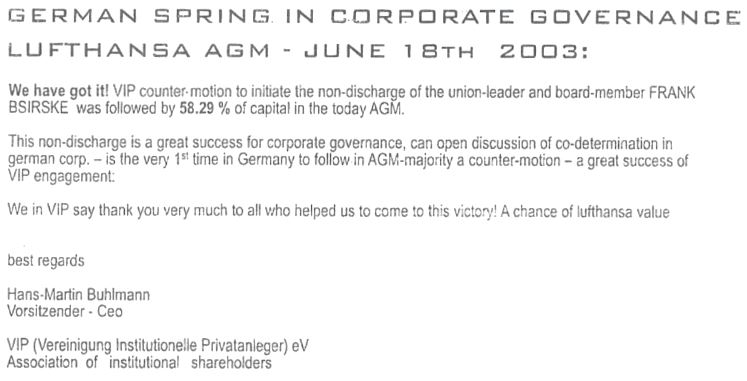

The first non-discharge of a DAX Supervisory Board happened at Lufthansa in 2003, the first one of a DAX Executive Board now in 2019, let's see what happens next in 2035. Without any consequences and unrecognized outside Germany, so much for the diversity of perception and decision-making.

How long will the barriers and border perceptions continue to exist ... even in Europe?

Will there then be effects on the effects?