Campus

IVOX gives marks for Corporate Governance

IVOX assesses Volkswagen as “by far” the poorest firm on the DAX for Corporate Governance standards. The main points of criticism are: the preference shares, supervisory board members are not independent, board members' salaries are too high and individual shareholders like the State of Lower Saxony are granted special rights. The shareholder service provider produced a ranking on corporate governance of German firms for the first time. The so called CG seal of approval, which constitutes a detailed survey of a company on the basis of over a hundred criteria including capital, ownership structure, anti-takeover measures, management structure, remuneration, auditing and much more, gives an overall assessment of this. Initially, the seal of approval covers the 30 DAX firms. The assessment gave the following result:

Good Corporate Governance:

Adidas, BASF, Bayer, Commerzbank, Deutsche Bank, Deutsche Börse, Deutsche Lufthansa, Infineon, Linde, MAN, Munich Re and SAP.

Acceptable Corporate Governance:

Allianz, BMW, Daimler, Deutsche Post, Deutsche Telekom, E.ON, Fresenius Medical Care, Fresenius, Henkel, K+S, RWE, Siemens and Thyssenkrupp.

Gross shortcomings in Corporate Governance:

Metro, Beiersdorf, Merck, Salzgitter and Volkswagen.

At Metro the preference shares, conflicts of interest on the supervisory board and inadequate information on supervisory board candidates and an authorized capital ex rights were seen critically. The supervisory board of Beiersdorf was overrepresented by Maxingvest, thus not guaranteeing independence. Merck did not publish remuneration of its management people, which while legal for a KGaA, deprived investors of important information. Salzgitter did not publish its statutes and allegedly did not provide sufficient information on the supervisory board.

DAX concerns avoid forecasts.

The majority of the DAX firms, even a few weeks before the end of the business year, are still very reticent about publishing specific takeover and outcomes forecasts, says a current study by management consultancy Kirchhoff Consult. Only one in five firms presented specific figures in their quarterly reports on the expected turnover in 2009. Over half of all DAX concerns gave no clear picture in their quarterly reports on the development of results in the present business year, and over 1/3 provided little information on future development in the industry, while 25% of firms gave no picture of the future overall economic position. Around 70% of DAX firms provided no future outlook at all on their liquidity position. Precise predictions regarding turnover and results were supplied particularly by the pharmaceuticals industry, whereas the auto sector kept its cards very close to its chest.

Rise in company bankruptcies

Big names like Arcandor, Escada or Qimonda appeared on the list of bankruptcies in the past year. By the end of 2009, bankruptcies of firms are likely to rise to over 34,000 instances, says an assessment by the German Federal Statistical Office. In the first nine months, the number of insolvent firms was up 11.2% over the previous year. The total of outstanding receivables rose in September to €42.6 billion - fourteen times the previous year's figure, when the number was still €2.8 billion. The outlook remains clouded: business information firm Creditreform assumes that it will be over 38,000 bankruptcies in the coming year. The negative record was in 2003, when 39,740 insolvencies were declared.

No market manipulation on bonds

The federal panel for financial services oversight (BaFin) has not been able to find any manipulation of prices at the end of the year in 2008 for company bonds on the Frankfurt securities exchange (FWB). This was stated by the authority, which has audited procedures since April, on 21 December. The FWB stock-exchange panel has nonetheless drawn consequences from the several hundred suspicious cases for manipulation of bond prices, appearing by the end of the year 2008/09. Deutsche Börse confirmed in mid December that there would be changes in regulations for leading suspects in share and bond trading. The changes in the stock-exchange regulations have already come into force, in an attempt to avert possible manipulations at the end of the year. They apply to current trading on the FWB and also to electronic trading on the Xetra, and are connected with the assessment prices disregarding turnover. The new aspect here is that price raises for bonds greater than 5% and for shares greater than 10% can in future be found not just by exchange leaders and their trading partners. For bonds whose prices have fallen sharply and shares up to a price of €5, higher margins apply. The exchange leaders are obliged to explain to the FWB trading monitoring office how these prices have been arrived at. Reference markets and documentary reference prices have to be adduced.

Insider trading defined more strictly

The European Court of Justice in a recent judgment formulated stricter provisions for the prosecution of insider trading. According to these, it is already sufficient for someone with inside knowledge to buy or sell shares. Whether the intervention was deliberately used need not be proved, any more than any profit obtained thereby. In th specific case, a Belgian firm had bought back shares before publication of its positive business results. The newspaper FAZ cites here professor of criminal law Christian Schröder: “Joint-stock companies must in future freeze such programmes if during the course of them new business figures arise, until they have disseminated them as an ad hoc disclosure.”

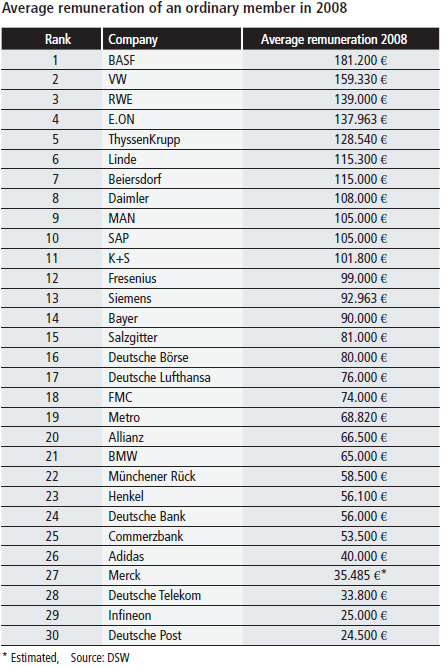

DSW criticizes supervisory board remuneration

Supervisory board remuneration in German firms is according to the view of shareholder association Deutsche Schutzvereinigung für Wertpapierbesitz (DSW) determined too strongly by short-term profits. At the same time, the DSW criticizes the use of dividend as an index, since supervisory board members themselves decide about dividend proposals. The remuneration of supervisory board members fell in the previous year a little, however. Among the 205 people occupying 262 seats on supervisory boards, 23 DAX directors are listed, this being interpreted as a move towards professional supervisory board members and an end to “Deutschland AG”. The most important supervisory board member is Manfred Schneider, who holds supervisory posts at a total of four DAX companies, with annual remuneration of just over 1 million euros.

Private investors mistrust shares

Germany’s private investors, while optimistic and looking forward to continually rising share prices, nonetheless have not laid aside their risk aversion, and tend to avoid investment in shares. According to the latest findings of the investment indicator surveyed quarterly by TNS Infratest on a commission from the DZ BANK, currently almost half of the 1,026 private investors surveyed (46%) expect the German share index to continue to rise in the next six months, while only 14% expect quotations to fall. Nonetheless, only a small part of investors are prepared to invest money in shares or share funds. The representative survey further confirms that investors continue to behave very cautiously, building up reserves on the share market. A striking point is that currently ¾three quarters of all respondents are not at all prepared to engage in risks in investing their money. Of the remaining respondents, some 2/3 tend to invest their money in daily or fixed-money accounts, a quarter in share funds and only a fifth directly in shares.

Code for independent remuneration consultancy

Management consultancy Towers Perrin has developed a “Code for independent remuneration consultancy”. The set of regulations should serve supervisory board members and remuneration advisers as a basis for assessing the independence of external experts in consultancy projects on the remuneration of directors and top management. The basis for the code is a legal report by renowned company lawyer and member of the government commission for the German Corporate Governance Code Professor Theodor Baums. Towers Perrin consultants are committed to rigid implementation of the Code rules. The remuneration consultants in consultancy projects have accordingly to act on the basis of appropriate information and with the necessary technical expertise. Consultancy should be done free of any personal or economic interest of the remuneration consultant liable to influence the outcome of the remuneration consultancy.

The concept of independence relates to the individual commissioned to do the consultancy. Their independence is to be denied where

-

the remuneration consultant personally is simultaneously, on a mandate from the board, advising the company, a board member or a firm associated with the company without the assent of the Supervisory Board – irrespective of the topic,

-

the remuneration consultant is an officer or employee of the company to be advised or a firm dependent on it,

-

a financial or capital connection exists between the company to be advised, a firm dependent on it or a board member and the remuneration consultant/consultancy company of such an extent as to make uninfluenced consultancy unlikely,

-

either the remuneration consultant or the consultancy company where he is a partner or employee has in the last five years derived more than 15 percent of total income from the company or a firm associated with it.

In consultancy projects remuneration consultants must without request and in writing declare their independence to the chair of the Supervisory Board or of the remuneration committee before conclusion of the consultancy contract. Changes regarding their independence are to be notified to the aforesaid forthwith. A further important aspect concerns data utilization. A remuneration consultant must inform the chair of the Supervisory Board or of the remuneration committee if use is to be made in the consultancy of information provided by the board or employees of the company or a firm associated with it. Finally, the consultancy fee must not be oriented to the remuneration of board members or employees of the company to be advised. The “Code for independent remuneration consultancy” can be got free of charge from the Towers Perrin web page www.towersperrin.de.