VIPsight - February 2010

COMPANIES

First HV-AGM vote on executive remuneration

Steel group ThyssenKrupp is the first German DAX group, following the entry iinto force of the new Act on Executive Remuneration in autumn 2009, to let its shareholders vote on the level of its board members’ remuneration, at the AGM on 21 January. With 99.55% in favour, shareholders voted for a salary cut for the board for the completed business year 2008–9 from €19.8 million to €6.5 million. Bonuses were deleted. The proposed dividend of €0.30 met with criticisms. In view of the enormous loses for the year this amount of €140 million was not justified, and would, said the critics, be paid in favour of the major shareholder, the Krupp von Bohlen und Halbach-Stiftung, out of assets. However, the distribution was resolved on by a majority.

Steel group ThyssenKrupp is the first German DAX group, following the entry iinto force of the new Act on Executive Remuneration in autumn 2009, to let its shareholders vote on the level of its board members’ remuneration, at the AGM on 21 January. With 99.55% in favour, shareholders voted for a salary cut for the board for the completed business year 2008–9 from €19.8 million to €6.5 million. Bonuses were deleted. The proposed dividend of €0.30 met with criticisms. In view of the enormous loses for the year this amount of €140 million was not justified, and would, said the critics, be paid in favour of the major shareholder, the Krupp von Bohlen und Halbach-Stiftung, out of assets. However, the distribution was resolved on by a majority.

While there was massive criticism at the AGM of the cost explosion in the construction of the two new plants in Brazil and the US, Der Spiegel reported that the group would get rid of its last involvement in merchant shipbuilding.bThe report stated that the traditional Hamburg dockyard Blohm + Voss, specialized inbbuilding luxury yachts and the repair and maintenance of merchant vessels, would have 80% of it sold to the Arab group of companies Abu Dhabi MAR. ThyssenKrupp would keep the remaining shares. Naval shipbuilding, with frigates and submarines, would however remain a core business.

Siemens too holds a vote on pay

At the Siemens AGM on 26 January too, the shareholders’ meeting was for the first time able to vote on management remuneration. Management was praised for this, but shareholder associations like the Deutsche Schutzvereinigung für Wertpapierbesitz (DSW) criticized the pay level of Siemens CEO Peter Löscher, which in 2009 was €7.1 million. There were also demands to extend the holding period for options granted from three years to four. Hans-Christian Hirt of the British pension fund Hermes noted that Supervisory Board remuneration was wrong because the variable part exceeded the fixed part and was linked to the result per share. In response to the critical voices, Supervisory Board chair Gerhard Cromme announced he would have the pay system reviewed once again to see whether it was in line with the new Act on Appropriateness of Executive Remuneration (VorstAG). The Supervisory Board meeting in April could then already decide on necessary changes, said its chair.

Hope for E.ON and RWE

The nuclear shut-down act passed by the red-green government in 2002 provided for the seventeen German nuclear power stations to be taken off the grid by 2022. The CDU is now talking openly about extending the lifetimes of the nuclear power stations. In mid-January the minister for the chancellery, Ronald Pofalla (CDU), invited the boards of the four big German energy suppliers and the secretaries of state from the ministries for the economy and the environment to come to him and discuss the future of nuclear power, reported Der Spiegel. The option being negotiated is to extend the lifetimes of the reactors and hand over at least half of the company’s additional gains from that to the federal government. The coalition could then use these to finance the transition to the green-power age. Landesbank Baden-Württemberg has calculated that if the nuclear power stations had their lifetimes extended by 25 years, at an electricity price of €80 per megawatt-hour the four electricity groups could earn up to €233 billion.

By the summer break the lifetimes and conditions for extending them should be clarified. This also includes the question of the additional nuclear waste that would then be produced. The matter will however be definitively settled only in autumn, when the government presents its announced overall energy-policy concept. The topic is a pressing one because the two reactors in Biblis and Neckarwestheim are soon to be taken off the grid. There are, however, also speculations now that the remaining power quantities established could be transferred from new reactors to old ones. That would affect the two utilities, RWE and E.ON.

Power struggle over Infineon

At the Infineon AGM, for the first time in the history of the Federal Republic of Germany minority shareholders want to replace the Supervisory Board chair candidate proposed by the Supervisory Board. Klaus Wucherer, ex board member of Siemens, was proposed by the departing Supervisory Board chair Max Dietrich Kley as his successor. Wucherer has been on the Supervisory Board for several years now. That meant he shared the responsibility for the bankruptcy of memory-chip subsidiary Qimonda and thus did not stand for the necessary new start, said Hermes fund manager Hans-Christoph Hirt in his criticism. The British pension fund put forward Willi Berchtold, present CFO of automotive supplier ZF Friedrichshafen, as a counter-candidate. The VorstAG act, in force since autumn 2009, allows direct election of individual Supervisory Board members. Hermes has in the meantime managed to win over proxy agent VIP (Vereinigung Institutioneller Privatanleger), voting consultancy Ivox, Riskmetrics and other institutional investors to his side. Wucherer suggested holding his post as Supervisory Board chair for one year only, so as then to make room for a “distinguished successor candidate” from outside.

Müller wants to overturn the remuneration limit

The government has saved Germany’s second biggest bank, Commerzbank, from a grave position, for altogether €18.2 billion. Rescue fund SoFFin alone supplied 16.4 billion as a silent contribution. As soon as the bank is out of the red, it must according to EU provisions pay interest of 9% on this contribution. However, losses are expected for 2010, too, so that the interest is not likely to become due until 2011. As long as the loss position continues, the salaries of top managers are limited to €500,000 a year. The ex CEO, now Supervisory Board chair, Klaus-Peter Müller, in January called on the federal government to lift this pay limit. In September 2009 Müller had still managed to come to agreement with the Soffin steering committee that the pay ceiling would be time-limited till 2009. However, the federal government has now rejected an appeal of the provision. Müller, who as head of the government commission is also responsible for working out new pay structures, based his demand on the ground that otherwise top bank personnel would move away.

Drugstore chain Müller moves into Douglas

At a little over 3%, entrepreneur Erwin Müller in November came into retail group Douglas, and has been buying up more since. At the same time, Swiss bank Sarasin also took a holding of some 10% in Douglas. Says Müller: “For myself I see the investment in the Douglas shares as already a second leg to stand on.” Particularly in procurement and logistics, the drugstore-chain owner hopes to secure synergies between the two companies. In particular, he could in future supply the perfume stores in the Douglas group, were his plans. Douglas is sceptical about his entry. Through Sarasin, Müller might possibly have access to a further 14%, admitted Douglas CEO Henning Kreke. While Douglas owners Oetker and Kreke were seeking defences against a hostile takeover, they nonetheless fear that Müller could, together with the credit institution, secure a blocking minority at the AGM. The hostile entry brought the Federal Financial Services Oversight Panel (BaFin) into play.

Porsche threatened by a special audit

At the Porsche AGM there was no vote on discharge to board members Wendelin Wiedeking and Holger Härter, in office until July. The company wants to await the outcome of investigations by public prosecutors who are looking back at the capitalmarket transactions that took place in connection with speculation in VW options. Christian Strenger, member of the German Corporate Governance Commission, in vain called as a private person for a special audit to clarify the conduct of the board and Supervisory Board. If Strenger subsequently manages to get 1% of the capital on his side, he can legally enforce this special audit. That would, according to the FAZ, block the integration of Porsche into the VW group for a year.

Subsidies to solar electricity to be cut

Federal environment minister Norbert Röttgen (CDU) presented a bill in January whereby the subsidies to solar and the “over-promotion” of the solar industry would be cut still more in 2010 than originally planned. Currently, the substitute to small solar installations on house roofs is 39 cents per kilowatt-hour, down from 43 cents the previous year. By 2011 subsidies to solar electricity are to be cut to up to 34%. That would mean a reduction by 13 cents to 26 cents per kilowatt-hour fed in. The cuts would particularly affect installations on agricultural set-aside land and old military and industrial sites. Particular promotion is however planned for solar cells on roofs used for home consumption and thus not fed expensively into the power grid. The industry association Bundesverband Solarwirtschaft expects job losses at companies like Solarworld, Phoenix Solar or Conergy, and is even talking about bankruptcies. The stock exchange reacted by bringing prices down by up to 25%. Röttgen by contrast sees a price fall for solar systems of 30%, and expects new installations in any case to be offered by 2013 at market prices, and therefore with no subsidies.

Pause for breath at Continental

The merger of the two automotive suppliers Continental and Schaeffler has been postponed for the moment, reports Handelsblatt. The stock-exchange prospectus for the recent capital increase at MDAX group Continental definitively rules out the merger of the two in the next twelve months. Both firms will initially cooperate in the power-train sector, it is now said. This means that financial rehabilitation of the two struggling companies is being given priority over a merger. The capital increase of a billion Euros and 31 million shares needed to cut indebtedness was placed overwhelmingly with institutional investors. It was also announced that Continental shareholders could not expect any dividend until 2012. The capital increase is to be followed by a high-interest bond to cut indebtedness, at latest in the second quarter.

The merger of the two automotive suppliers Continental and Schaeffler has been postponed for the moment, reports Handelsblatt. The stock-exchange prospectus for the recent capital increase at MDAX group Continental definitively rules out the merger of the two in the next twelve months. Both firms will initially cooperate in the power-train sector, it is now said. This means that financial rehabilitation of the two struggling companies is being given priority over a merger. The capital increase of a billion Euros and 31 million shares needed to cut indebtedness was placed overwhelmingly with institutional investors. It was also announced that Continental shareholders could not expect any dividend until 2012. The capital increase is to be followed by a high-interest bond to cut indebtedness, at latest in the second quarter.

Schaeffler, itself €12 billion in debt because of taking over 90% of the Continental shares, agreed a restructuring of its debts in August 2009 with its creditor banks. The interest on the credit package will now be paid by the family firm from operative business. If possible by the third quarter of 2010, Schaeffler wants to transform itself into a joint-stock company. It is not clear whether its form will be as an AG or an GmbH. This step was a requirement for the merger of the two automotive suppliers. In the course of the latest Conti capital increase, the family firm’s share of the Hanover group was down from 90% of the shares to 75.1%.

E.ON hives off its grid

Earlier than planned, energy company E.ON will hive off its some 11,000km long power grid, retroactively to the beginning of the year. According to Financial Times Deutschland, the group is expecting the permits from the authorities by the end of January. Initially, the transaction had been announced for the first quarter of 2010, but it could now be earlier. The transaction will bring E.ON some 1 billion euros. With the sale to Dutch grid operator Tennet, the electricity company is meeting a requirement from the European Commission, which had demanded in order to promote competition that E.ON should get rid of its high-voltage grid. In the course of restructuring, the French EDF group and E.ON competitor ENBW also gave up capacity, or acquired new capacity. Altogether, once the exchange is completed E.ON will, as well as its power grid, have transferred 5,000 MW of power-station capacity.

Earlier than planned, energy company E.ON will hive off its some 11,000km long power grid, retroactively to the beginning of the year. According to Financial Times Deutschland, the group is expecting the permits from the authorities by the end of January. Initially, the transaction had been announced for the first quarter of 2010, but it could now be earlier. The transaction will bring E.ON some 1 billion euros. With the sale to Dutch grid operator Tennet, the electricity company is meeting a requirement from the European Commission, which had demanded in order to promote competition that E.ON should get rid of its high-voltage grid. In the course of restructuring, the French EDF group and E.ON competitor ENBW also gave up capacity, or acquired new capacity. Altogether, once the exchange is completed E.ON will, as well as its power grid, have transferred 5,000 MW of power-station capacity.

Permira hives off Freenet

Investment company Permira has got rid of the bulk of its holding in Freenet. For its 12.9 million shares Permira got some 115 million euros. The holding of Permira subsidiary Telco in Freenet fell from 24.99% to 10.1%. Placement of the 19.1 million Freenet shares was carried through by Goldman Sachs and UBS in an accelerated bookbuilding procedure. After the sale of Debitel to Freenet and the change at the top, it was the right time to get out, stated Permira. The financial investor had come into Freenet last year when then Freenet CEO Eckhard Spoerr bought its competitor Debitel. United Internet and financial investor Cyrte had also recently sold shares in Freenet.

Frenzel blocks Fredriksen

The TUI board will after the AGM on 17 February be cut by one member, to four. CFO Rainer Feuerhake is retiring and will not be replaced. The composition of the TUI Supervisory Board continues to be controversial. Since his entry to the Hanover group, Norwegian shipowner John Frederiksen has been fighting to have two seats on the oversight body. Frenzel had offered Frederiksen one seat on the Supervisory Board, but linked to a condition that neither Frederiksen nor his confidant Tor Olav Troim would join it. Since Troim had thought aloud about founding a cheap container line, the regional court in Hanover found that a possible conflict of interests would threaten if Troim held a post on the TUI Supervisory Board, so that his application to join it was rejected. Thanks to the latterly evident improvement in business, shipowners Hapag-Lloyd are hoping not to have to use the State guarantee of 1.2 billion euros they negotiated in autumn. European transport commissioner Antonio Tajani had approved the State aid to the former TUI subsidiary.

However, new competition commissioner-designate Joaquin Almunia might now call the aid in question, “since it is not exactly minor aid”. Only €500,000 can be given to a company by an EU country – on condition that the company given the aid must have been sound before the crisis. Additionally, the aid must not exceed the staff costs of the firm receiving it. In the case of Hapag- Lloyd the aid was ten times these costs, so that the shipowners had to pay the State almost as much interest as on the free market for the guarantee. On the ownership side too there are changes to be seen. Majority owner TUI will in the long term move entirely out of the shipowning business and get rid of its Hapag holdings of 43%. As from 2012 the tour operator has arranged a purchase option for them with the owner syndicate around shipper Klaus-Michael Kühne and Albert Ballin. Kühne has now said that TUI might even gradually withdraw earlier from its involvement. It would then be conceivable for private-equity houses to come on board as new investors.

Rheinmetall and MAN to co-operate

Technology group Rheinmetal and utilityvehicle maker MAN have decided in an agreement to cooperate in the area of wheeled military vehicles. The two groups are – assuming antitrust authorities accept – founding Rheinmetall Man Military Vehicles GmbH (RMMV), with its headquarters

in Munich, in which Rheinmetal will hold 51% and MAN 49% of the shares. It is intended to move forward to become an important complete supplier of wheeled military vehicles. The range will include armoured and nonarmoured transport and staff and functional vehicles. In a first stage, development and distribution operations of both companies in the area of wheeled military vehicles will be brought together under the umbrella of the new company. In a second stage, by 2011, production capacity at the Kassel and Vienna works is to be integrated into the joint venture. RMMV will employ 1,300 workers and have an estimated turnover over 1 billion euros.

Is Metro threatened with an antitrust fine?

In the German food-retail trade there have been price agreements among suppliers and producers, is the suspicion the German antitrust watchdog Kartellamt is now following up. In mid-January a hundred investigators and police had made raids on 15 suspect firms and manufacturers, including wholesaler Metro. Branded-article producers are said to have agreed prices for sweets, coffee and animal feed with the retailers. If the accusations of an illegal cartel should prove true, the companies involved are threatened with fines that might amount to up to 10% of annual turnover. In late 2009 the Kartellamt imposed a fine of €159.5 billion on the three biggest German coffee-roasters for anticompetitive price agreements.

Buhlmann’s Corner

Movement in Corporate Governance

Scarcely has the German year begun when it gets stuck in the snow. At least in Corporate Governance there is some movement. Here a pleasant novelty comes along from Infineon. Wasn’t the board, headed by Peter Bauer, saying only two weeks ago that he found the kind of candidate chosen by the old Supervisory Board for the post of new Supervisory Board chairman better than the shareholders’ proposal? Now he’s got it: it is not he (the board) who decides the Supervisory Board, but we (the shareholders). The year’s off to a good start after all.

Scarcely has the German year begun when it gets stuck in the snow. At least in Corporate Governance there is some movement. Here a pleasant novelty comes along from Infineon. Wasn’t the board, headed by Peter Bauer, saying only two weeks ago that he found the kind of candidate chosen by the old Supervisory Board for the post of new Supervisory Board chairman better than the shareholders’ proposal? Now he’s got it: it is not he (the board) who decides the Supervisory Board, but we (the shareholders). The year’s off to a good start after all.

Then the old – new – candidate is sent on an introductory trip round shareholders – that’s pretty definitely progress too. The countermotion was logical and necessary. How does an old Supervisory Board have to be structured in order to think that by its own decisions it can perpetuate cooptation, when since its existence on the exchange it has never produced dividends, and last year was given only a 50.0 percent discharge? From the viewpoint of self-glorification, their only success is not to have actually gone bankrupt.

However the general meeting may have voted, one thing is evident: following Lufthansa (Bsirske), ThyssenKrupp (secondment right) and Infineon (Supervisory Board chair), the shareholders are winning. They are no longer just murmuring, but having a say. Those who do not listen, they need to feel that. The important thing is that a clear outcome, not some marginal bluff, should give back clarity to firms – but that clarity has to come from the shareholders.

ACTIONS CORNER

Conergy and MEMC have settled their lawsuit about the validity of the Wafer Supply Agreements out of court and agreed to further amendment of this agreement. The supply contract for silicon wafers originally for eight billion Euros had been adjusted, stated the struggling solar firm on 24 January in Hamburg. The new arrangement removes all the disputed bars on competition. On the old terms, profitable operations would not have been possible for the TecDax listed company. At the time silicon was still a scarce and expensive article, but the price has since fallen considerably.

In America, on 11 January Daimler’s appeal proceedings against South African plaintiffs, who accuse the car firm and Rheinmetall of aiding and abetting human rights infringements through racial segregation during Apartheid in the 70’s and 80’s began. The two companies are threatened with high compensation payments. The first point before a New York court will be the admissibility of the action. The plaintiffs are appealing to the „Alien Tort Claims Act“ of 1798, allowing foreigners to bring suit in the US if the tortfeasors operate commercially there. “Admitting the action would be a precedent with considerable consequences,” said a Daimler spokesman. Bush always rejected such court actions against non-American companies, in the light of sovereignty rights under international law. The Obama administration favours the continuation of such actions, and in particular the US State Department under Hilary Clinton wishes in future through the change of course to stress humanrights aspects.

Deutsche Bank and the Österreichische Bundesbahn (ÖBB) have settled out of court. their longrunning law suit about a package of credit default derivatives worth €613 million In a joint declaration, the companies stated that ÖBB would pay the bank €295 million. In return, the securitized debt certificates will lose their validity. Additionally, the State railway company will drop a pending action. A bank spokesman confirmed the agreement. ÖBB had accused Deutsche Bank of having given it incomplete and misleading information about the risks.

Several competitors of Deutsche Post have won their action against the Post minimum wage regulation on final appeal. Because of a formal error by the Federal Ministry of Labour, the Federal Administrative Tribunal in Leipzig on 28 January overturned the regulation enacted by the former federal government in 2008 on a minimum wage for letter carriers, distributors and drivers of €9.80 or €8.40 per hour respectively. The court granted the post firms’ suit because they had not been heard, as required. Accordingly, the regulation is not legally valid for them.

An appeals court in Paris has reduced the antitrust fine for illegal price agreements imposed on a Klöckner & Co subsidiary by €145.5 million. The fine of €169 million imposed on French subsidiary KDI was thus reduced to €23.5 million, stated the Duisburg steel trader. Of this, €17.5 million had already been paid. In late 2008 French antitrust authorities had fined eleven steel traders and steelmakers almost €600 million (see ICGG 2009/01).

On 25 January Siemens filed its still pending suit against the two ex-directors Heinz-Joachim Neubürger and Thomas Ganswindt with Munich Regional Court. In this civil action, the company is demanding €15 million from its ex CFO, stated Siemens. From Ganswindt, who was in charge of the Telecommunications division, it wants €5 million. Siemens had already announced this step in September 2009, after the Supervisory Board chaired by Gerhard Cromme had agreed settlements with nine former directors or Supervisory Board members.

Sedika Weingärtner (45) has sued Siemens for mobbing because as purchasing strategist she had been systematically obstructed by her superiors for seven years, and felt herself discriminated against as a woman and a foreigner. This was the Afghanorigin businesswoman’s response to her dismissal. After she complained of her sufferings, most recently in several e-mails to Siemens CEO Peter Löscher comparing them to those of the Jews under the Nazi dictatorship, the firm dismissed her for allegedly trivializing the Holocaust. Weingärtner is now asking for €1.2 million in damages. On 17 March the Nuremberg Labour Tribunal will decide whether Siemens was entitled to dismiss its former manager because of her behaviour or whether she was really discriminated against.

The Federal Court of Justice (BGH) in a judgment of 21 September 2009 quashed the discharge to board and Supervisory Board given by the AGM of Springer AG. At the time one Supervisory Board member was also on the Supervisory Board of Premiere (today Sky) and a board member of one of the companies’ shareholders. When the resolutions on the takeover of Premiere were being discussed, this Supervisory Board member abstained from voting. The Supervisory Board report to the AGM did not mention this conflict of interest. The BGH thus confirmed the ruling already given in the Kirch/Deutsche Bank case.

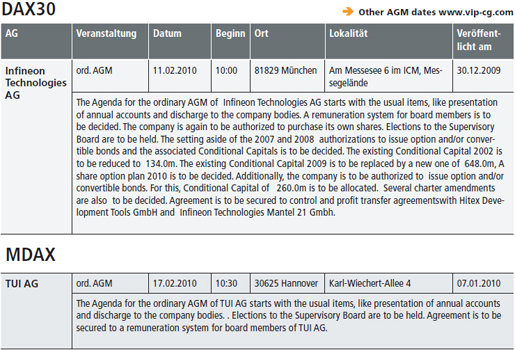

AGM Dates

in February

Politics

Tighter antitrust law

The minister for the economy, Rainer Brüderle (FDP) will, as the coalition agreement states, rework the Act on Restraint of Competition and allow the possibility of breaking up market-dominating firms. According to his draft presented in January, the Kartellamt will also be able to act pre-emptively, even where a company does not abuse its monopoly position. To date, the antitrust watchdogs could only prohibit or allow mergers, and break up companies only where there was a merger despite a ban. According to the new bill, the Kartellamt is to be able to force firms to sell or hive off parts of their assets, where they have achieved a market-controlling position. There are, however, massive rule-of-law objections to pre-emptive action, which the CDU also shared. Thus, it is unclear what sector the Act is aiming at. While among those mentioned were Deutsche Post, energy companies, the food sector and the health sector with hospital companies and health-insurance companies, creating a possibility of pre-emptive break up was nonsense, stated the CDU rapporteur Georg Nüßlein. German energy companies, headed by RWE, have even had a study done, according to which the Brüderle Act is not needed in the energy sector. The bill is to be discussed in cabinet on 24 March.

Boom in D&O insurers

The financial crisis and big corruption cases like the one at Siemens could mean that so-called D&O insurance will become considerably dearer, says a study by consultancy firm Simon-Kucher. According to it, German insurance managers stated in a survey that 70% of customers were willing to pay more for directors’ and officers’ liability insurance. Price increases of around 20 to 30% were realistic, said the study. In general, the sector was growing, since small businesses too were increasingly seeking insurance against management errors. The market volume could double from its current 300 to 500 million Euros. Some 75% of insurers had announced growth rates of up to 20%, said Simon-Kucher. In the course of the crisis, particularly liability insurance in the banking, investment-companies and financial-firms sectors had drastically risen. However, in the round of contract renewals on 1 January 2010 there had been a slight easing, said US insurer Chubb. Meantime, the own-risk excess for managers in the event of damages has been readjusted. With the entry into force of the Act on the Appropriateness of Executive Remuneration, managers must bear 10% of the amount of damages themselves, though with a ceiling of 150% of their annual fixed salary.

New insolvency law for banks

German finance minister Wolfgang Schäuble (CDU) wants an act on rehabilitation of ailing banks, to create the possibility for banks to reorganize themselves through insolvency proceedings. The healthy part of an insolvent bank would be detached and transferred to another bank or a new vehicle. On this model, the institution’s equity-capital providers might lose all or part of their capital.

Financial-markets oversight goes to the Bundesbank

As agreed in the coalition agreement, the German government wishes to bring financial oversight, including oversight of banks, insurance companies and securities, fully under the umbrella of the Bundesbank. The parallel operation of the Federal Financial Services Oversight Panel (BaFin) and Bundesbank had not proved efficient, runs the justification. Combining them under the umbrella of the Bundesbank would also integrate German banking oversight better into the European oversight system. Additionally, the Bundesbank was organizationally independent of politics, and thus able to take unpopular decisions. At present Ba- Fin still comes under the Federal Ministry of Finance. In the meantime Axel Weber, the head of the Bundesbank, has called on credit institutions to take advantage of the favourable capital-market environment to strengthen their equity capital. Otherwise, Weber threatened regulatory intervention. Federal finance minister Wolfgang Schäuble (CDU), however, announced he wished to make the financial sector share in the cost of the financial crisis, and was working on a German act limiting bank managers. According to it, in future bankers would receive neither guaranteed bonuses nor bonus payments linked to short-term successes. Institutions themselves receiving State aid would, moreover, be able to pay only limited remuneration to their board members. Also under discussion was a rescue fund to which banks would pay in according to their systemic importance.

As agreed in the coalition agreement, the German government wishes to bring financial oversight, including oversight of banks, insurance companies and securities, fully under the umbrella of the Bundesbank. The parallel operation of the Federal Financial Services Oversight Panel (BaFin) and Bundesbank had not proved efficient, runs the justification. Combining them under the umbrella of the Bundesbank would also integrate German banking oversight better into the European oversight system. Additionally, the Bundesbank was organizationally independent of politics, and thus able to take unpopular decisions. At present Ba- Fin still comes under the Federal Ministry of Finance. In the meantime Axel Weber, the head of the Bundesbank, has called on credit institutions to take advantage of the favourable capital-market environment to strengthen their equity capital. Otherwise, Weber threatened regulatory intervention. Federal finance minister Wolfgang Schäuble (CDU), however, announced he wished to make the financial sector share in the cost of the financial crisis, and was working on a German act limiting bank managers. According to it, in future bankers would receive neither guaranteed bonuses nor bonus payments linked to short-term successes. Institutions themselves receiving State aid would, moreover, be able to pay only limited remuneration to their board members. Also under discussion was a rescue fund to which banks would pay in according to their systemic importance.

Two bad banks hived off

So far only two credit institutions have taken advantage of the option allowed by the government of hiving off toxic securities and non-strategic business sectors to a so-called bad bank: Landesbank WestLB and the nationalized Hypo Real Estate (HRE). As part of the consolidation model under the bad-bank arrangement WestLB had hived off some 85 million Euros worth of possibly defaulting securities and business areas that no longer fit its strategy, out of its total budget of some €258 billion. The remaining bank would receive a silent contribution from the government of three to four billion Euros. By 2011 this rump bank is supposed to be sold. HRE also applied in January for the setting up of a Bad Bank. Problematic and non-strategic government bonds and realestate credits with a volume of up to €210 billion were to be hived off. By contrast with the farther-reaching consolidation model, the time limit for applying for a special-purpose company to which only toxic securitiesbwould be hived off expired at the end of January.

BaFin warns life assurers

Jochen Sanio, head of the Federal Financial Services Oversight Panel, warned life assurers at the institution’s New Year reception that they should no longer promise their customers such high yields. To date the assurers’ business has been based on betting on capital investments with enough yield to cover their interest promises. However, current interest levels raised doubts about this model. Sanio said he saw it generally as a danger to insurers, who should in the first place cut their surplus participation to insured people.

Is a stock-exchange turnover tax coming?

In order to load part of the costs of the financial crisis onto the banks, willingness is growing in the CDU to levy a stock-exchange turnover tax. Among its advocates are chancellor Angela Merkel (CDU), who hopes the levy will bring the institutions to a greater responsibility and awareness of risk: “The banks must do justice to their responsibility for the damage they have caused.” If a transaction tax of 0.05% were levied at EU level, the tax proceeds would on initial calculations amount to €160 billion. The biggest opponent of the stock-exchange turnover tax is the FDP, fearing that it would particularly hit small investors and those saving for retirement. Up to 1991 there was already such a tax in Germany, which was then overturned by the black-yellow (CDU-FDP) coalition governing at the time.

In order to load part of the costs of the financial crisis onto the banks, willingness is growing in the CDU to levy a stock-exchange turnover tax. Among its advocates are chancellor Angela Merkel (CDU), who hopes the levy will bring the institutions to a greater responsibility and awareness of risk: “The banks must do justice to their responsibility for the damage they have caused.” If a transaction tax of 0.05% were levied at EU level, the tax proceeds would on initial calculations amount to €160 billion. The biggest opponent of the stock-exchange turnover tax is the FDP, fearing that it would particularly hit small investors and those saving for retirement. Up to 1991 there was already such a tax in Germany, which was then overturned by the black-yellow (CDU-FDP) coalition governing at the time.

Michael Proft

Supervisory Board Chairs criticize VorstAG*

The “Act on the Appropriateness of Executive Remuneration” (VorstAG) of August 2009 for the first time brought in specific statutory provisions that considerably tightened both the professional and the personal liability of Supervisory Board members for the performance of their oversight function in German joint-stock companies.

To enrich the ongoing debate on the role and responsibility of Supervisory Board members with an objective picture of the opinions of the relevant office holders, international personnel consultancy Odgers Berndtson, together with law firm Nieding + Barth, has done a study amongst 650 Supervisory Board chairs of listed companies in Germany, for the first time asking the supervisors about the expediency and the consequences of the new provisions for their oversight activity.

The main finding is that the tighter liability provisions of the VorstAG, especially the personal liability, are overwhelmed only critically by German Supervisory Board members. Thus, ensuring against the personal risk is the top priority for the Supervisory Board chairs surveyed: over 90% of respondents would take out or adjust (D&O) liability insurance. The Supervisory Board people also want to protect themselves by improving reporting (42%), random checks (32%) and the production of expert reports (23%). At the same time, the majority of Supervisory Board chairs expect their oversight activity to become less attractive in the future.

A surprising finding is that better knowledge of the rules also leads to greater rejection of them. Thus, Supervisory Board chairs of DAX companies are better informed than their colleagues from smaller companies, but are also markedly more critical about the new set of provisions, while Supervisory Board chairs from smaller companies tend more to regard the new rules as helpful. The urgency is however something all respondents are aware of: almost all Supervisory Board people wish to take steps within a year to meet the requirements of the Act; 75% have already taken measures or will have done so by the second quarter of 2010.

Given the sharply intensified oversight duties, it is entirely comprehensible that insurance against liability risks is to the fore. It is, however, important for this first step to be followed by a second one, the taking of measures to further professionalize Supervisory Board work. There has been much discussion of this point too. The verdict of the Supervisory Board chairs is that in order to do the oversight job better, 65% of respondents call for more professional skills among Supervisory Board members. Three qualifications in particular will in their view be requisites for Supervisory Board positions: knowledge of the sector, experience in managing companies and sound financial education. Despite the tighter requirements, however, only one in five considered it is advisable to establish a profession of Supervisory Board member.

Professional Supervisory Board members are in principle an alternative, since this would guarantee a qualified basis for Supervisory Board work. Oversight as a fulltime job by former board members or managers has of course existed for decades. The new thing, though, is for managers to deliberately decide in favour of moving to the Supervisory Board even before they reach retirement age. Thus, in our consultancy practice, we meet with candidates who are already leaving operational business at 50 and becoming professional Supervisory Board members. However, in order for this professionalization to become better established, Supervisory Board work has also to be properly paid. Our study shows that 86% of Supervisory Board chairs are in favour of higher remuneration for Supervisory Board members.

What can Supervisory Board chairs do in practice in order to raise the professional skill level of their Supervisory Board and thus at the same time reduce their technical and organizational risk? One important thing is to work out clear profiles of requirements on Supervisory Board members, in order to do justice to the contents of the new requirements. These should be harmonized with available skill profiles of the Supervisory Board members, with the aim of consciously closing skills gaps. In order to find new qualified Supervisory Board members, two thirds of Supervisory Board chairs surveyed would use their own network, and similarly two thirds would approach a professional personnel consultant. Very few wish to include board members in the search.

The work of Supervisory Board members will change fundamentally in coming years. The commitment, time and personal risk of a Supervisory Board member are all going to go up. The times when oversight over a company was a secondary job are definitely past. If the Act on Appropriateness of Executive Remuneration now sets off a change and accelerates the professionalization of the bodies, that would be a highly desirable development.

Michael Proft, Odgers Berndtson, Partner and Global Head of Industry Practice Business & Professional Services, as well as Telecoms, Media & Technology

* The full study “New Regulations for Supervisory Board members – Supervisory Board chairmen’s view” can be got from www.odgersberndtson.de.

People

Board and Supervisory Board changes in DAX30, MDAX and TECDAX30

After a year and a half’s work chairing the board of Carl Zeiss Meditec, Michael Kaschke is going back to the Supervisory Board of the Carl-Zeiss subsidiary. After the AGM on 4 March he is to be replaced at the top by board member Ludwin Monz, stated the medical technology firm on 18 January. Kaschke, head of Controlling, took the top spot in July 2008 and prescribed a programme of savings for the firm.

Wulf Bernotat and Ulrich Middelmann joined the Supervisory Board of Deutsche Telekom at the turn of the year, stated Telekom on 5 January in Bonn. This was decided at the last meeting of the Telekom Supervisory Board in mid-December. E.ON CEO Bernotat and ThyssenKrupp board member Middelmann are replacing Linde CEO Wolfgang Reitzle and the Post Supervisory Board chair Wulf von Schimmelmann, who resigned their posts on the Supervisory Board at the end of 2009.

Eduard Schleicher and Gerhard Hirth resigned their posts at HeidelbergCement at the end of 2009 in the light of the changed shareholder structure. Mannheim regional court, on application by the construction group, renewed the Supervisory Board and appointed Herbert Lütkestratkötter and Alan Murray as shareholder representatives on it. The appointment is time limited until re-election by the next AGM on 6 May. Their departure marks the end of the period when the company’s destiny was determined by the Merckle and Schwenk/Schleicher families. Schleicher is a personally liable partner in the Schwenk group of companies, and Hirth is general manager. The cement dynasty from Ulm had sold their holdings in HeidelbergCement off the exchange.

The HUGO BOSS supervisory board appointed Mark Langer as board member and CFO with effect from 15 January. The 41-year-old manager of the fashion producer succeeds Norbert Unterharnscheidt, who according to the firm’s indications left on 15 January “for personal reasons, in the best of agreement with the Supervisory Board”. He had come to Metzingen only in December 2008.

Andreas Barth, since 2007 a board member of IVG Immobilien, left the board at the end of the year, but will still be available to the Bonn firm for a further year on a consultancy basis. According to the firm’s statement, both sides came to agreement on this. The background to the departure is the withdrawal of IVG from the business area of project development, of which Barth was in charge.

Campus

DAX-insiders are reticent

Board and Supervisory Board members of the 30 DAX groups invested in their own firms’ shares only very restrainedly in 2009. This emerges from an analysis by the Börsen-Zeitung. In over 50% of the DAX groups, no board member made an investment, and the figure for Supervisory Board members was even around 2/3. At nine DAX companies, neither board nor Supervisory Board members bought or sold shares. On the Supervisory Board side, sale orders were given in only five companies. Board members were active almost exclusively on the buying side, with their financial investments mostly dictated by the rhythm of their share option plans. Deutsche Lufthansa, Fresenius Medical Care, K+S, RWE and Siemens were to the fore here.

DAX majority for sustainability

The theme of sustainability is so important to 54% of DAX companies that it has been brought as a responsibility directly under the board, says a study by Asset Managers Union Investment. Particularly in family firms (Beiersdorf, BMW, Henkel and Merck) the theme of sustainability has a high value. Sustainability is defined here as a threedimensional concept, made up of ecology but also of economic, ethical and social criteria, which lastingly guarantees the future viability of development of companies and national economies. The study used a questionnaire to ask about the areas of environment, social matters and corporate governance. Alongside annual energy consumption, CO2 emissions, product safety and labour standards were just as important as social commitment. 86% of DAX companies were certified under DIN standard ISO 14001. Only 11% of them make the sustainability report a part of the business report.

Boom in capital increases

In 2009 only Vtion Wireless Technology from China came on to the stock market floor in the area of the Prime Standard. This meant that, according to a study by consultancy firm Kirchhoff Consult, the IPO emission volume was only around €55.6 million. In a year, 25 companies ran up a total issue volume of around 400 million Euros. Despite the sluggishness on the IPO market, the capital market was open to accept big capital increases in 2009. Banks in particular issued new shares, but companies from other sectors too placed sizeable capital increases on the market. Without banks, the issue volume in Germany amounted to €8,187 billion. Kirchhoff expect up to 20 Prime Standard IPOs in 2010.

More compliance in the DAX

More corruption cases like the one at Siemens have sensitized the public and companies themselves to the need for monitoring (compliance) systems, say the authors of an investigation by Financial Times Deutschland (FTD). According to it, in the past five years the 30 DAX groups have strongly expanded their compliance structure. Here Siemens is in the lead, with man power of 600, while Salzgitter still gets by totally without a compliance division. Siemens, Deutsche Telekom, Fresenius and Fresenius Medical Care each have a Chief Compliance Officer (CCO) on the board. Some compliance heads do it as a full-time job, while others combine it with heading auditing. At Metro the CCO reports directly to the CEO, while seven other CCOs are directly under the CFO. 26 of 29 CCOs are lawyers by training; only one CCO is a woman. Salaries range from €250,000 to €600,000. Deutsche Post and BMW have set up Compliance Committees instead of a CCO. A total of 14 DAX companies had not put their compliance systems together into a division, says the FTD.

Economic crime up

According to a new KPMG study, in the last three years 37% of German companies were victims of fraud, theft, embezzlement or criminal breach of trust. In 2006 was only 26%. The auditing and consultancy firm commissioned the Emnid Institute to survey 300 companies - from small and medium sized businesses up to DAX groups. Internet crime in particular has risen by leaps and bounds, as transactions and processing increasingly move there. By far the biggest damage is according to the study caused by breaches of anti-trust law, which, however, occur relatively rarely.

DSW extends cooperation

Shareholder association Deutsche Schutzvereinigung für Wertpapierbesitz (DSW) has embarked on two pieces of cooperation. First, it will, from now on be working with Swiss financial research firm Obermatt in the area of the appropriateness of bonuses paid. The bonus index worked out for this is a ranking of recommended bonus levels for HDax companies: the higher the companies’ ranking, the higher the bonus deserved. The indicator is thus intended to offer as strong a basis as possible for the appropriateness of bonuses. Second, DSW is cooperating with the American firm Broadridge, which gives institutional investors worldwide voting analyses and recommendations through its electronic voting-rights platform ProxyEdge. From now on, clients can call up DSW recommendations on this platform for all DAX companies. Plans to extend the offering to Prime Standard have been announced.

Thomas Lünendonk

Fees on the consultancy market

For a craftsman or his assistant, the basis for the title and qualification is regulated more or less uniformly throughout Germany. Correspondingly, different hourly rates are charged for the two skill grades. The situation is rather more multi-layered on the consultancy market. While there are skill grades here too, they are, however, filled differently from one firm to another. What may be a Senior Consultant in one consultancy will be called Partner in another. And whether both senior levels have the same training, qualifications and experience is not attested uniformly by the title. Things are correspondingly harder and less transparent with setting prices in the fee rates for management consultancy. Whereas some clients pay comparatively high daily rates for consultancy, others pay much more favourable ones.

This is the finding of the “Price /Skill Level Matrix Management Consultancy” by Lünendonk GmbH, Kaufbeuren, assessing and analysing the daily fees actually collected by management consultants in thirteen big firms and groups in Germany. All the client firms looked at pay fees in the double or triple digits of millions for outside management consultancy. Additionally, they have largely centralized and professionalized their consultancy procurement. The daily fees analysed by Lünendonk refer exclusively to the consultancy areas of “strategy consultancy” and “organizational and process consultancy”.

Since the client firms studied have differently structured procurement processes and volumes, the daily fees negotiated are in part considerably divergent. The daily fees actually paid result from the list price or offer price less negotiated rebates. Thus, there are clients who on a statistical average pay €1,300 per day for consultancy by a senior consultant, while other clients pay an average of €3,820 per day’s consultancy for the same seniority. Already at 30 commissioned consultancy days by a senior consultant, there are resulting opportunity costs amounting to €75,600 for a project. This of course also makes clear the differing meanings underline this kind of skill designation.

Thomas Lünendonk, Lünendonk GmbH*

*The detailed Lünendonk® Benchmark “Price / Skill Level Matrix Management Consultancy”, covering 13 big firms and groups, is obtainable from Lünendonk GmbH at a price of €950 (plus VAT, including delivery as a PDF file).

Capital News

Capital Measures in Januay

Continental’s capital increase by 31 million shares has met with great interest from both institutional investors and shareholders in general. 99.4% of the 3.4 million new shares involved were taken up after the subscription time limit. In the capital increase the new shares were placed on an accelerated Bookbuilding basis up to 11 January. Alongside 24.55 million new shares at the fixed subscription price of €35 per share, the other 6.45 million of them were placed at a price of €40 per share. The result was gross proceeds from the issue of some 1.11 billion Euros. Major Conti shareholder Schaeffler waived their subscription right. The automotive supplier finally allocated the new shares on which the subscription right had not been exercised, already on 6 and 12 January placed with investors under a reservation as to allocation, on 28 January. This brought the direct Schaeffler holding down from 49.9% to 42.17%, and the “parking banks” Metzler and M. M. Warburg from 19.5% to 16.48%.

Deutsche EuroShop has decided to raise its registered capital by up to 6,302,082.00 1€ registered shares, corresponding to 16.7% of the present registered capital, against cash contributions. The Hamburg firm wants thus to secure fresh money to finance its purchase of the A10 shopping centre in Wildau (Brandenburg) near Berlin. The subscription price is €19.50. The real-estate investor, specialized in shopping centres, expects proceeds of €123 million from the issue. The total investment volume, including modernization and new construction, amounts to around €265 billion.

K+S wants to buy 200,000 of its own shares by 31 March this year. The repurchased shares will according to indications be offered for purchase to employees of the Kassel salt and fertilizer maker or associated companies.

Linde has stated that a Sponsored Level 1 American Depositary Receipt (ADR) Program has been set up in the US. As the Munich gas and plantconstruction group announced on 11 January, the ADRs will be traded in the US on the over-thecounter (OTC) market. Ten ADRs will correspond to one Linde share. Deutsche Bank was acting as deposit bank for this ADR program. ADRs are deposit certificates traded in the US as substitutes for the underlying shares.

Pfleiderer has decided to sell up to 2,643,458 of its own shares that it holds, i.e. up to 4.96% of the registered capital, on the stock exchange. The shares were worth 7 Euros each at their date of sale on the market. Pfleiderer is in the red with its lenders for a good 820 million Euros.

Sky Deutschland has carried out a €49,014,714 capital increase, by issuing the same number of new registered shares. The Munich pay-TV provider took in proceeds of €110, to be used on projects to promote sustainable subscriber growth. News Adelaide Holdings, a 100% indirect subsidiary of News Corporation, subscribed the shares and has since then held 45.42% of Sky. The new shares were included in trading on the Frankfurt stock exchange on 22 January. Their entry in the commercial register raises the total number of Sky Deutschland registered shares from 490,147,144 to 539,161,858. The capital increase is already the third in a short period. Only few months ago, Sky raised its capital, in two stages.

United Internet has withdrawn 11,625,656 shares, corresponding to 4.62% of the registered capital, from its own holdings, lowering its registered capital to 240 million shares. The reduction was done in order to optimize the budget and capital structure. After the capital reduction it still held 10,272,291 of its own shares, some 4.28% of the registered capital. The withdrawal and capital reduction came on 21 December 2009. On 14 January the board of the internet company decided to buy back up to 5 million shares, corresponding to some 2.08% of the registered capital, on the exchange.

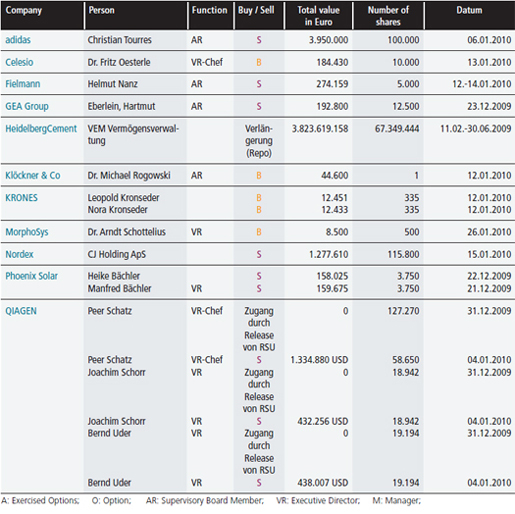

Director's Dealings

im Januar

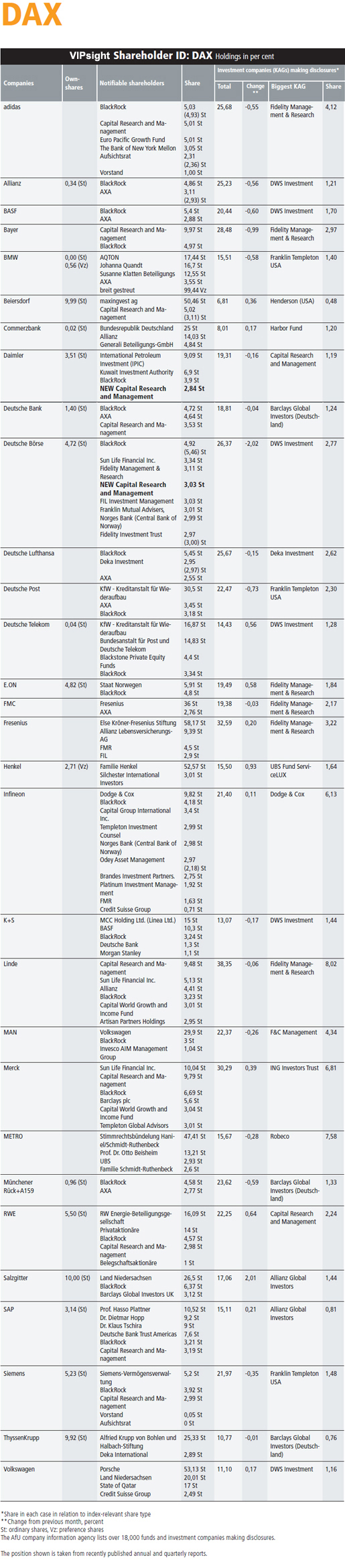

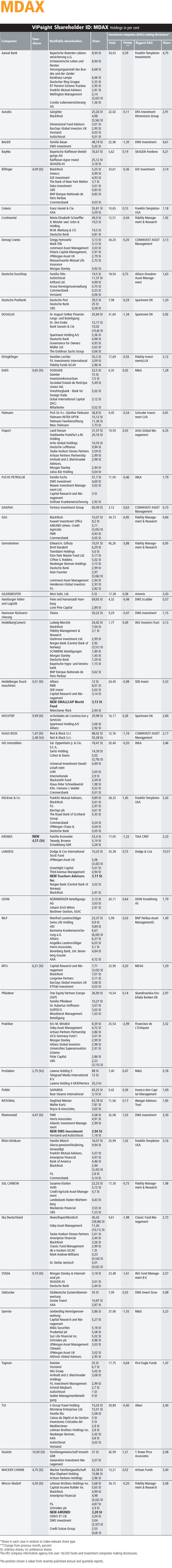

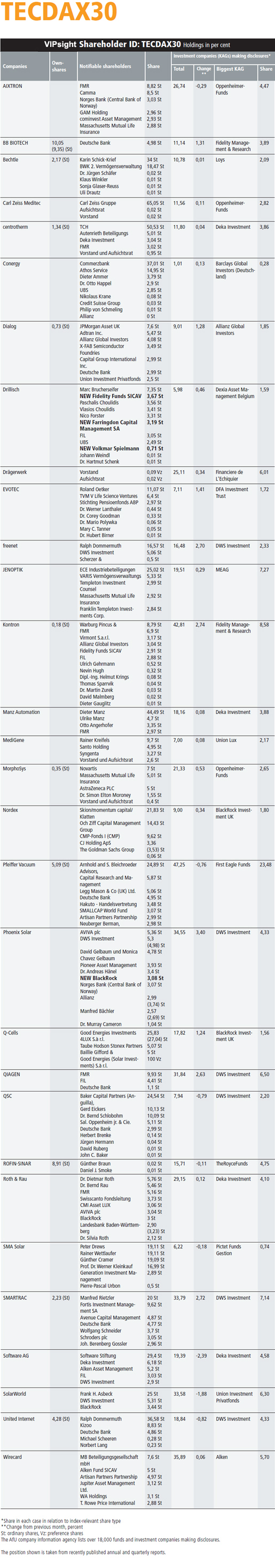

VIPsight Shareholder ID

Januar 2010

Events Diary

February

24. February 2010 Eigenkapital und Mittelstand organizer: Deutsches Aktien-Institut; place: IHK, Frankfurt am Main; cost: €900 (non-members); info: 069 929 15-0

24. February 2010 Internationale Listings an der Deutschen Börse organizer: Deutsche Börse; place: Neue Börse; info: 069-211-17205

Reading suggestions

Grieser, Simon G., Heemann, Manfred (Hrsg.), Bankaufsichtsrecht – Entwicklungen und Perspektiven Frankfurt School Verlag, 1,132 pp, €98.00, ISBN 978-3-937519-97-5

Last year saw far-reaching reforms of banking oversight brought in. On the authors’ assessment, they were “only a foretaste of what we still have to face.“ This new standard work edited by two lawyers who are partners in international law firm Mayer Brown LLP in Frankfurt comprehensively documents the new range of regulations.

Levermann, Susanne, Der entspannte Weg zum Reichtum Hanser Verlag, 250 pp, €24.90, ISBN 3-446-42252-0

A book for newbies who no longer want to rely on others but run their portfolios themselves. A former fund manager shows where the necessary information can be found, mostly free, on the Internet and how to select the most suitable shares using a points system.

Löhndorf, Nils, Naumann, Stefan (eds.), Zertifikate Reloaded – Transparenz, Vertrauen, Rendite – eine Anlageklasse positioniert sich neu Gabler Verlag, 273 pp, €39.95, ISBN 978-3-8349-1652-5

Since the outbreak of the financial crisis certificates have been regarded as the archetype of the risky financial investment. The reason for this verdict is not least the issuers’ inadequate product and communications policies. Yet certificates can in fact be very sensible parts of a portfolio for all investors – particularly from security viewpoints. This book explains how product transparency creates trust in volatile markets. Making use of the complexity available in derivative financial instruments, coupled with client-oriented features like product and price transparency, in the long term creates higher yields for issuers and banks. The attractiveness of the products thrives on innovation: for instance the development processes of innovative certificates should be described. The book shows the “certificate makers” in banks approaches for innovative and sustainably successful product distribution structures.

Nils Löhndorf and Dr. Stefan Nauman are management consultants in the areas of banking/ capital markets and risk management at Steria Mummert.

INDEXES OF COMPANIES AND PERSONS